Mistral AI targets €1B revenue in 2026: what it means

Mistral AI targets €1B revenue in 2026: what it means

Mistral

28 ene 2026

Not sure what to do next with AI?

Assess readiness, risk, and priorities in under an hour.

Not sure what to do next with AI?

Assess readiness, risk, and priorities in under an hour.

➔ Reserva una Consulta

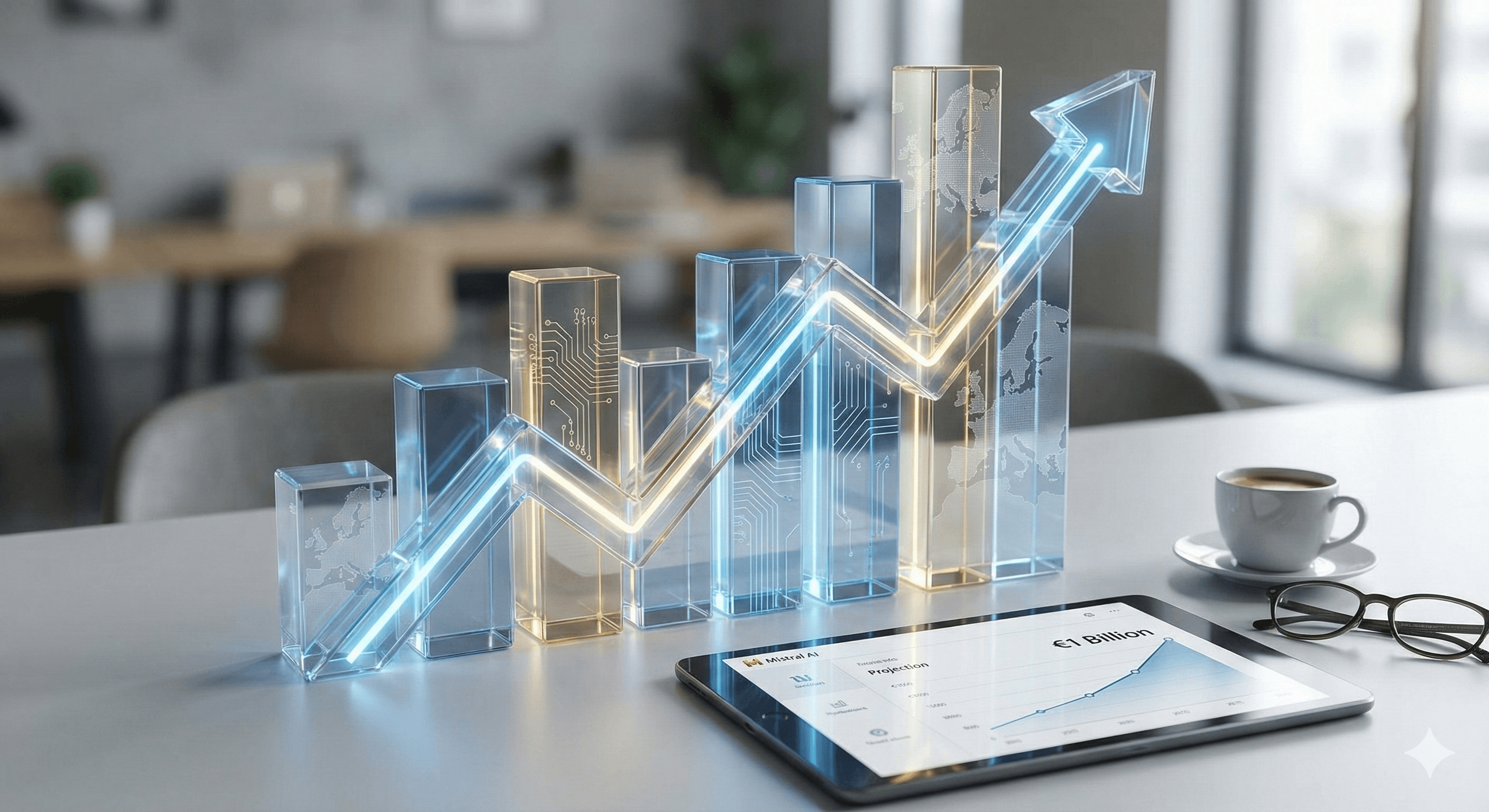

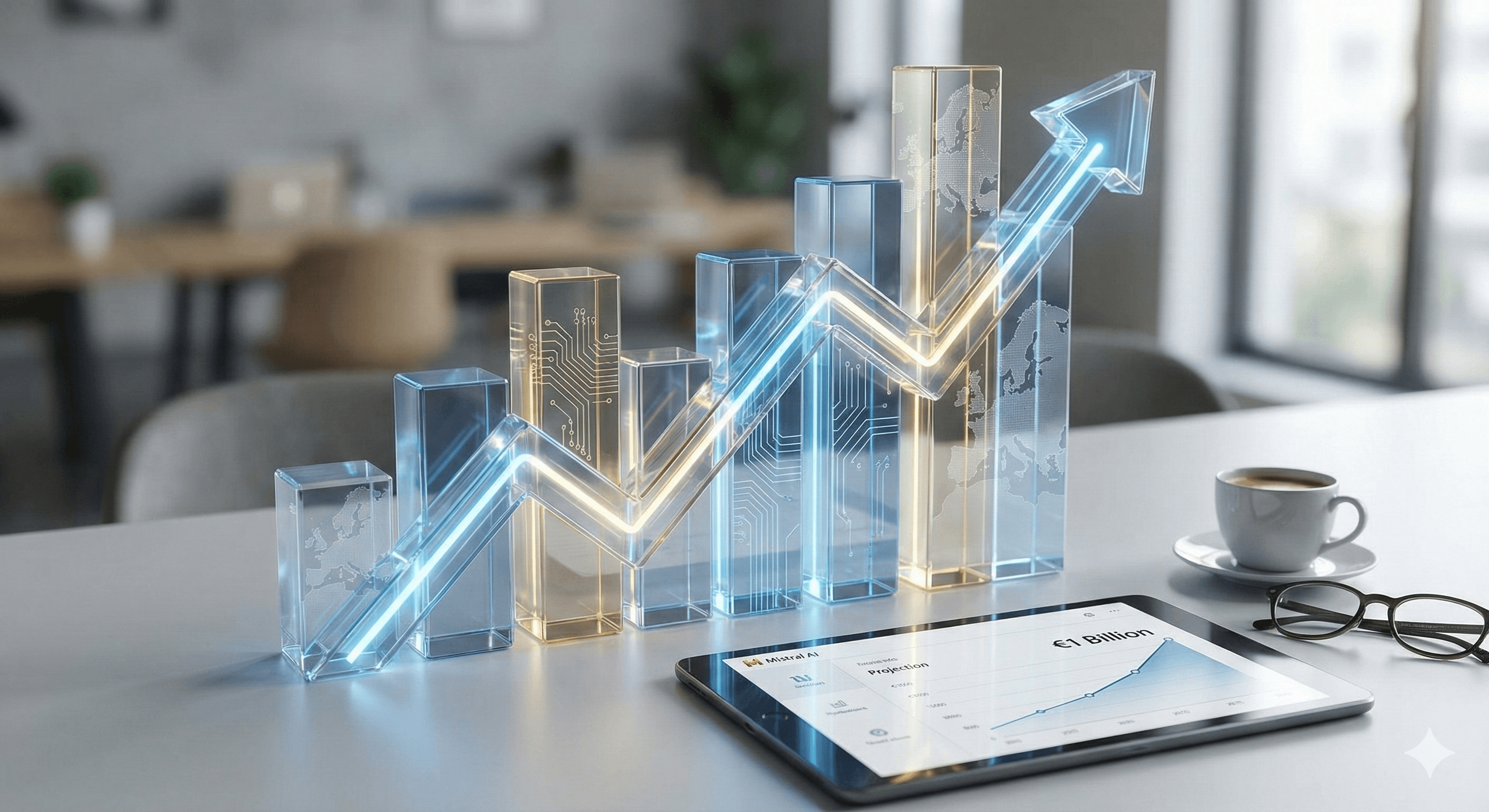

Mistral AI says it’s on track to generate €1 billion in revenue in 2026, signalling rapid enterprise adoption and strong product momentum. Backed by a major 2025 funding round led by ASML, the French model company aims to scale sales while expanding products and potential acquisitions across Europe’s AI market.

The news in context

According to Maddyness UK, CEO Arthur Mensch indicated at Davos that Mistral expects to reach €1B in revenue this year (2026) and is exploring acquisitions to accelerate growth.

French daily Le Monde likewise reported the forecast, placing the €1B target within the company’s broader European strategy and rapid commercial ramp.

This ambition follows Mistral’s €1.7B Series C in Sept 2025, led by ASML, valuing the company at €11.7B—capital that underwrites compute, go-to-market, and product expansion.

What’s driving the target?

Enterprise demand & product breadth. Mistral has expanded from models and APIs into agentic tooling (e.g., Vibe 2.0) and enterprise offerings, supporting more use cases (code, productivity, knowledge work). Independent coverage highlights paid plans and team features that strengthen monetisation.

European “sovereign AI” momentum. Policy and procurement interest in European AI stacks—and partnerships with major EU enterprises—create favourable conditions for regional adoption.

Capital for scale. The ASML-led round brought deep pockets and strategic alignment with Europe’s semiconductor ecosystem—key when GPU/TPU capacity and inference costs define margins.

Signals to watch in 2026

Sales mix & gross margins: How quickly high-margin platform/API revenue outpaces lower-margin services. (Inference cost discipline will be pivotal.)

Acquisitions: Mensch flagged potential M&A; watch for teams or products that extend enterprise workflows (search, agents, compliance).

Customer concentration: Whether growth is broad-based across sectors vs. a few flagship deals.

Competitive benchmarks: Revenue cadence vs. US peers will shape valuation and hiring capacity through 2026.

Quick timeline

Sept 2025: €1.7B Series C led by ASML; post-money €11.7B.

Jan 2026 (Davos): CEO projects €1B 2026 revenue; media pickup across Europe/Asia tech press.

Jan 2026: Product momentum continues (e.g., Vibe 2.0 tiers for pros/teams).

Frequently asked questions

Is the €1B target confirmed revenue or guidance?

It’s management guidance shared publicly; precise audited results are not yet reported. Treat it as a projection to be validated by 2026 actuals.

Why does the ASML round matter for revenue?

Compute access and strategic alignment reduce bottlenecks that slow enterprise AI roll-outs, helping Mistral scale paid usage and services.

Will Mistral buy companies to hit the goal?

The CEO indicated acquisitions are under consideration to accelerate capability and market access; targets weren’t named.

How does this compare with rivals?

Press comparisons note Mistral still trails the largest US AI players by revenue, but the €1B milestone would mark Europe’s strongest independent challenger to date.

Mistral AI says it’s on track to generate €1 billion in revenue in 2026, signalling rapid enterprise adoption and strong product momentum. Backed by a major 2025 funding round led by ASML, the French model company aims to scale sales while expanding products and potential acquisitions across Europe’s AI market.

The news in context

According to Maddyness UK, CEO Arthur Mensch indicated at Davos that Mistral expects to reach €1B in revenue this year (2026) and is exploring acquisitions to accelerate growth.

French daily Le Monde likewise reported the forecast, placing the €1B target within the company’s broader European strategy and rapid commercial ramp.

This ambition follows Mistral’s €1.7B Series C in Sept 2025, led by ASML, valuing the company at €11.7B—capital that underwrites compute, go-to-market, and product expansion.

What’s driving the target?

Enterprise demand & product breadth. Mistral has expanded from models and APIs into agentic tooling (e.g., Vibe 2.0) and enterprise offerings, supporting more use cases (code, productivity, knowledge work). Independent coverage highlights paid plans and team features that strengthen monetisation.

European “sovereign AI” momentum. Policy and procurement interest in European AI stacks—and partnerships with major EU enterprises—create favourable conditions for regional adoption.

Capital for scale. The ASML-led round brought deep pockets and strategic alignment with Europe’s semiconductor ecosystem—key when GPU/TPU capacity and inference costs define margins.

Signals to watch in 2026

Sales mix & gross margins: How quickly high-margin platform/API revenue outpaces lower-margin services. (Inference cost discipline will be pivotal.)

Acquisitions: Mensch flagged potential M&A; watch for teams or products that extend enterprise workflows (search, agents, compliance).

Customer concentration: Whether growth is broad-based across sectors vs. a few flagship deals.

Competitive benchmarks: Revenue cadence vs. US peers will shape valuation and hiring capacity through 2026.

Quick timeline

Sept 2025: €1.7B Series C led by ASML; post-money €11.7B.

Jan 2026 (Davos): CEO projects €1B 2026 revenue; media pickup across Europe/Asia tech press.

Jan 2026: Product momentum continues (e.g., Vibe 2.0 tiers for pros/teams).

Frequently asked questions

Is the €1B target confirmed revenue or guidance?

It’s management guidance shared publicly; precise audited results are not yet reported. Treat it as a projection to be validated by 2026 actuals.

Why does the ASML round matter for revenue?

Compute access and strategic alignment reduce bottlenecks that slow enterprise AI roll-outs, helping Mistral scale paid usage and services.

Will Mistral buy companies to hit the goal?

The CEO indicated acquisitions are under consideration to accelerate capability and market access; targets weren’t named.

How does this compare with rivals?

Press comparisons note Mistral still trails the largest US AI players by revenue, but the €1B milestone would mark Europe’s strongest independent challenger to date.

Recibe consejos prácticos directamente en tu bandeja de entrada

Al suscribirte, das tu consentimiento para que Generation Digital almacene y procese tus datos de acuerdo con nuestra política de privacidad. Puedes leer la política completa en gend.co/privacy.

Generación

Digital

Oficina en el Reino Unido

33 Queen St,

Londres

EC4R 1AP

Reino Unido

Oficina en Canadá

1 University Ave,

Toronto,

ON M5J 1T1,

Canadá

Oficina NAMER

77 Sands St,

Brooklyn,

NY 11201,

Estados Unidos

Oficina EMEA

Calle Charlemont, Saint Kevin's, Dublín,

D02 VN88,

Irlanda

Oficina en Medio Oriente

6994 Alsharq 3890,

An Narjis,

Riyadh 13343,

Arabia Saudita

Número de la empresa: 256 9431 77 | Derechos de autor 2026 | Términos y Condiciones | Política de Privacidad

Generación

Digital

Oficina en el Reino Unido

33 Queen St,

Londres

EC4R 1AP

Reino Unido

Oficina en Canadá

1 University Ave,

Toronto,

ON M5J 1T1,

Canadá

Oficina NAMER

77 Sands St,

Brooklyn,

NY 11201,

Estados Unidos

Oficina EMEA

Calle Charlemont, Saint Kevin's, Dublín,

D02 VN88,

Irlanda

Oficina en Medio Oriente

6994 Alsharq 3890,

An Narjis,

Riyadh 13343,

Arabia Saudita