IA Agente para CEOs: Estrategia de Crecimiento y Plan a 2 Años

IA Agente para CEOs: Estrategia de Crecimiento y Plan a 2 Años

Inteligencia Artificial

18 dic 2025

¿No sabes por dónde empezar con la IA?

Evalúa preparación, riesgos y prioridades en menos de una hora.

¿No sabes por dónde empezar con la IA?

Evalúa preparación, riesgos y prioridades en menos de una hora.

➔ Descarga nuestro paquete gratuito de preparación para IA

¿Qué es la IA agéntica y por qué importa ahora?

La IA agéntica va más allá de los chatbots y copilotos: encadena razonamientos, herramientas y acciones para ofrecer resultados (p. ej., generar opciones ➝ analizar datos ➝ activar flujos de trabajo). Los analistas colocan la IA agéntica entre las principales tendencias de 2025, pero también advierten que muchas iniciativas se estancan sin disciplina en el ROI y controles fuertes.

La tesis de valor. La IA generativa/agéntica ya está vinculada a grupos de valor multimillonarios; solo la banca podría ver cientos de miles de millones anualmente a medida que los agentes automatizan el servicio y las operaciones. Tu trabajo es localizar ese valor en tu P&L: ingresos, márgenes, capital de trabajo y riesgo.

Mentalidades de CEO que separan a los ganadores de los pilotos

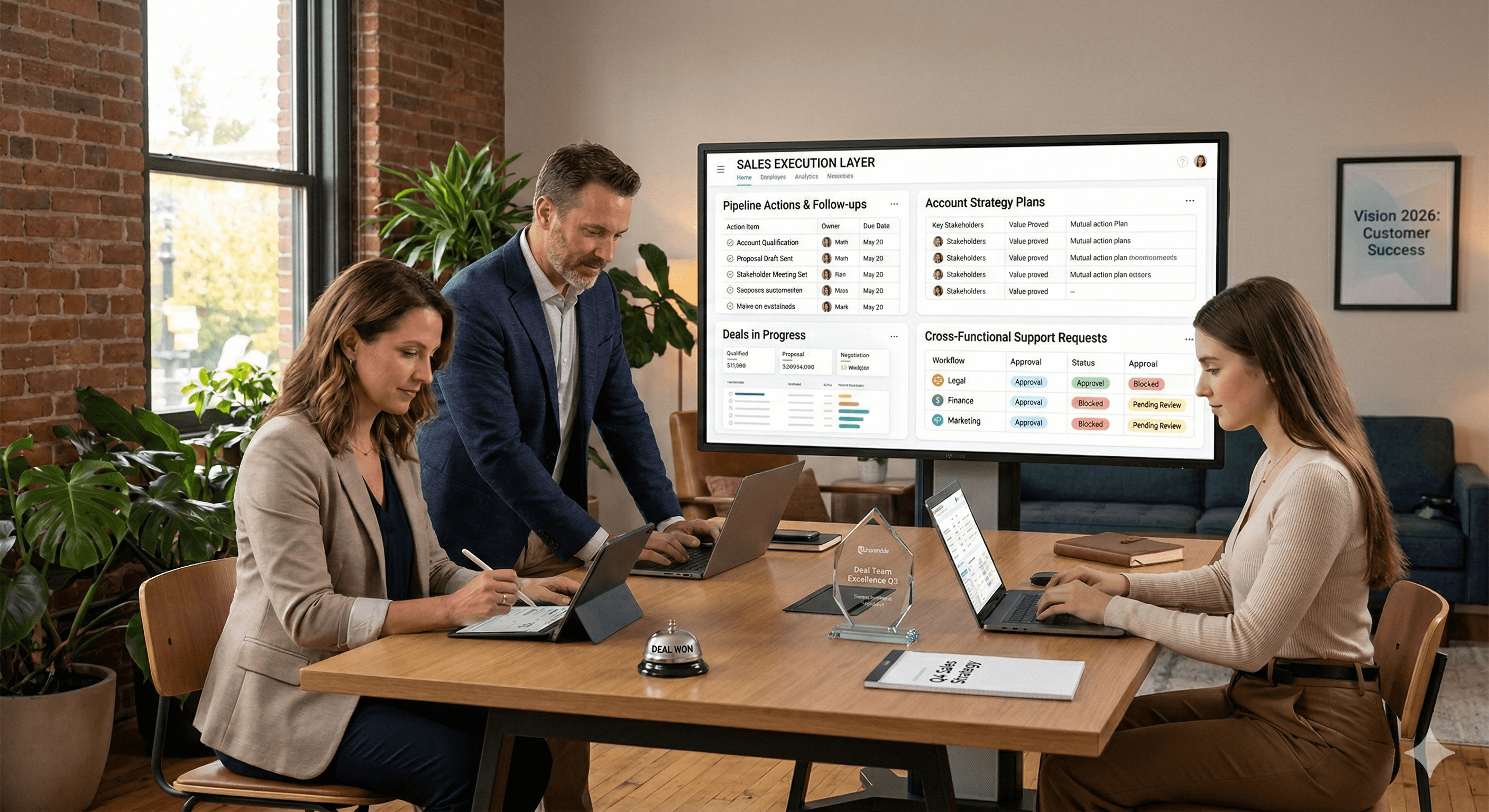

Resultados > demostraciones. Financia casos de uso con objetivos visibles en P&L (p. ej., +2–3 pts de servicio NPS; −20% tiempo de manejo; +5% conversión). Ancla cada agente a un KPI y al tiempo de materialización del valor. (McKinsey: el valor se materializa donde se rediseñan los procesos, no solo donde se añaden herramientas.)

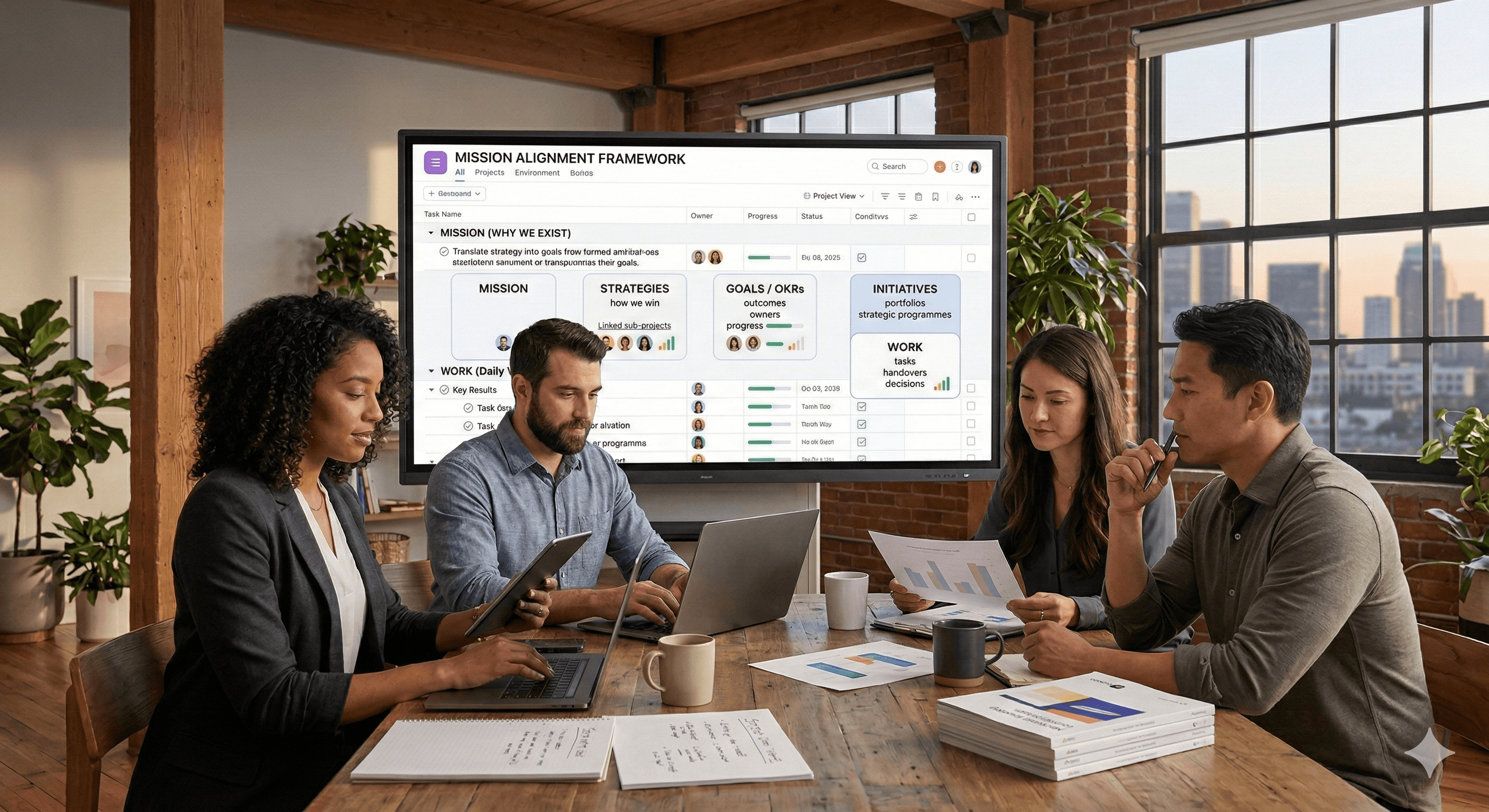

Opera como una empresa de productos. Trata a los agentes como productos con hojas de ruta, acuerdos de nivel de servicio y propietarios; evita pruebas de concepto dispersas que nunca escalan. (La advertencia de cancelación de Gartner en gran parte es una falla del modelo operativo.)

Gobernar por diseño. Construye confianza, seguridad y capacidad de auditoría desde el primer día: adopta la norma ISO/IEC 42001 para un sistema de gestión de IA; alinea riesgos con NIST AI RMF; y sigue la aplicabilidad y fechas del Acta de la UE sobre IA.

Humano en el circuito donde importa. Usa puertas de aprobación para acciones de alto impacto (transferencias financieras, precios, remediación de clientes) y registra todo para revisión.

Un plan de dos años (a nivel de junta)

Fase 1: 0–6 meses — Demostrar valor de forma segura

Selecciona 3 casos de uso agénticos con rápido retorno y riesgo limitado (p. ej., propuestas de ventas, cobros, orquestación de incorporación de proveedores).

Establece el modelo operativo: patrocinador ejecutivo; propietarios de productos de IA; comité de riesgos de modelos; gobernanza de datos; revisiones de seguridad.

Línea base de controles: adopta ISO/IEC 42001 (política, registro de riesgos, manuales de gestión de incidentes), mapea riesgos a NIST AI RMF, y confirma exposición al Acta de la UE sobre IA (GPAI vs alto riesgo).

Métricas objetivo: tiempo de ciclo ↓30–50%; costo por transacción ↓10–20%; NPS/CSAT ↑; rendimiento en el primer intento ↑.

Fase 2: 6–12 meses — Industrializar

Elección de plataformas: estandariza en un marco de agentes y un patrón de uso de herramientas (acciones, memoria, recuperación, orquestación).

Fiabilidad del servicio: observabilidad, reversión, acciones en entornos de prueba, cuotas de API.

Capacitación de la fuerza laboral: redefine roles (supervisor de agentes, diseñador de solicitudes/flujo) con rutas de capacitación.

Ruta de cumplimiento: Fechas del Acta sobre IA en la UE: las prohibiciones y obligaciones de alfabetización aplican desde el 2 de febrero de 2025; las reglas de gobernanza y GPAI aplican desde el 2 de agosto de 2025; aplicación total para el 2 de agosto de 2026 con una extensión más prolongada para sistemas integrados de alto riesgo hasta el 2 de agosto de 2027.

Fase 3: 12–24 meses — Escalar y nuevos negocios

Expansión de portafolio: 10–20 agentes en funciones (operaciones de precios, adjudicación de reclamaciones, programación de servicios de campo, cierre financiero).

Nuevos ingresos: convierte a los agentes en funciones (asesoría autónoma, servicio proactivo).

M&A y asociaciones: decisiones de comprar vs construir vs asociarse basadas en el tiempo de materialización de valor y deuda de cumplimiento.

Aseguramiento externo: considera la certificación ISO/IEC 42001 para mostrar madurez a clientes y reguladores.

Modelo operativo: cómo gestionarás esto

Liderazgo y financiación. Un ejecutivo responsable (CPO/CTO/CIO) con un sobre de capital vinculado al aumento de KPI, no a la actividad. Puertas de etapa trimestrales.

Escuadrones de producto. Cada agente tiene un propietario de producto, líder técnico, líder de datos y líder de riesgos; ellos son dueños de métricas, casos de seguridad y guías operativas.

Riesgo y cumplimiento.

ISO/IEC 42001: política de IA, controles de ciclo de vida, supervisión de proveedores y gestión de incidentes.

NIST AI RMF: mapea riesgos en gobernar, mapear, medir, gestionar.

Acta de la UE sobre IA: rastrea categoría (prohibido / GPAI / alto riesgo), documentación técnica, transparencia y obligaciones de alfabetización en IA según el cronograma publicado.

Dónde ya se está mostrando el valor

Servicios financieros. Los pilotos iniciales del Reino Unido/UE señalan una gestión autónoma del dinero y automatización de servicios; los reguladores están observando de cerca: la gobernanza y la responsabilidad de los gerentes senior son importantes.

Operaciones empresariales. Los analistas notan grandes mejoras de eficiencia cuando los agentes automatizan flujos de trabajo complejos, entre sistemas, más allá de RPA/IVR tradicional.

Preguntas frecuentes

P1. ¿Qué es la IA agéntica?

IA que puede planificar, decidir y actuar (con restricciones) para lograr objetivos—automatizando trabajo de múltiples pasos e integrándose con tus sistemas. Los analistas la clasifican como una tendencia estratégica para 2025. PagerDuty

P2. ¿Por dónde deberían comenzar los CEO?

Elige unos pocos flujos de trabajo de alto valor y bajo riesgo; asigna propietarios de productos; establece objetivos de KPI; y organiza la gobernanza alineada con ISO/IEC 42001 / NIST AI RMF mientras mapeas obligaciones del Acta de la UE sobre IA. ISO | NIST

P3. ¿Cuáles son los mayores escollos a evitar?

Pilotos no definidos sin KPIs, modelos operativos débiles y cumplimiento descuidado—causas detrás de la previsión de Gartner de que más del 40% de las iniciativas agénticas podrían cancelarse. Gartner

¿Qué es la IA agéntica y por qué importa ahora?

La IA agéntica va más allá de los chatbots y copilotos: encadena razonamientos, herramientas y acciones para ofrecer resultados (p. ej., generar opciones ➝ analizar datos ➝ activar flujos de trabajo). Los analistas colocan la IA agéntica entre las principales tendencias de 2025, pero también advierten que muchas iniciativas se estancan sin disciplina en el ROI y controles fuertes.

La tesis de valor. La IA generativa/agéntica ya está vinculada a grupos de valor multimillonarios; solo la banca podría ver cientos de miles de millones anualmente a medida que los agentes automatizan el servicio y las operaciones. Tu trabajo es localizar ese valor en tu P&L: ingresos, márgenes, capital de trabajo y riesgo.

Mentalidades de CEO que separan a los ganadores de los pilotos

Resultados > demostraciones. Financia casos de uso con objetivos visibles en P&L (p. ej., +2–3 pts de servicio NPS; −20% tiempo de manejo; +5% conversión). Ancla cada agente a un KPI y al tiempo de materialización del valor. (McKinsey: el valor se materializa donde se rediseñan los procesos, no solo donde se añaden herramientas.)

Opera como una empresa de productos. Trata a los agentes como productos con hojas de ruta, acuerdos de nivel de servicio y propietarios; evita pruebas de concepto dispersas que nunca escalan. (La advertencia de cancelación de Gartner en gran parte es una falla del modelo operativo.)

Gobernar por diseño. Construye confianza, seguridad y capacidad de auditoría desde el primer día: adopta la norma ISO/IEC 42001 para un sistema de gestión de IA; alinea riesgos con NIST AI RMF; y sigue la aplicabilidad y fechas del Acta de la UE sobre IA.

Humano en el circuito donde importa. Usa puertas de aprobación para acciones de alto impacto (transferencias financieras, precios, remediación de clientes) y registra todo para revisión.

Un plan de dos años (a nivel de junta)

Fase 1: 0–6 meses — Demostrar valor de forma segura

Selecciona 3 casos de uso agénticos con rápido retorno y riesgo limitado (p. ej., propuestas de ventas, cobros, orquestación de incorporación de proveedores).

Establece el modelo operativo: patrocinador ejecutivo; propietarios de productos de IA; comité de riesgos de modelos; gobernanza de datos; revisiones de seguridad.

Línea base de controles: adopta ISO/IEC 42001 (política, registro de riesgos, manuales de gestión de incidentes), mapea riesgos a NIST AI RMF, y confirma exposición al Acta de la UE sobre IA (GPAI vs alto riesgo).

Métricas objetivo: tiempo de ciclo ↓30–50%; costo por transacción ↓10–20%; NPS/CSAT ↑; rendimiento en el primer intento ↑.

Fase 2: 6–12 meses — Industrializar

Elección de plataformas: estandariza en un marco de agentes y un patrón de uso de herramientas (acciones, memoria, recuperación, orquestación).

Fiabilidad del servicio: observabilidad, reversión, acciones en entornos de prueba, cuotas de API.

Capacitación de la fuerza laboral: redefine roles (supervisor de agentes, diseñador de solicitudes/flujo) con rutas de capacitación.

Ruta de cumplimiento: Fechas del Acta sobre IA en la UE: las prohibiciones y obligaciones de alfabetización aplican desde el 2 de febrero de 2025; las reglas de gobernanza y GPAI aplican desde el 2 de agosto de 2025; aplicación total para el 2 de agosto de 2026 con una extensión más prolongada para sistemas integrados de alto riesgo hasta el 2 de agosto de 2027.

Fase 3: 12–24 meses — Escalar y nuevos negocios

Expansión de portafolio: 10–20 agentes en funciones (operaciones de precios, adjudicación de reclamaciones, programación de servicios de campo, cierre financiero).

Nuevos ingresos: convierte a los agentes en funciones (asesoría autónoma, servicio proactivo).

M&A y asociaciones: decisiones de comprar vs construir vs asociarse basadas en el tiempo de materialización de valor y deuda de cumplimiento.

Aseguramiento externo: considera la certificación ISO/IEC 42001 para mostrar madurez a clientes y reguladores.

Modelo operativo: cómo gestionarás esto

Liderazgo y financiación. Un ejecutivo responsable (CPO/CTO/CIO) con un sobre de capital vinculado al aumento de KPI, no a la actividad. Puertas de etapa trimestrales.

Escuadrones de producto. Cada agente tiene un propietario de producto, líder técnico, líder de datos y líder de riesgos; ellos son dueños de métricas, casos de seguridad y guías operativas.

Riesgo y cumplimiento.

ISO/IEC 42001: política de IA, controles de ciclo de vida, supervisión de proveedores y gestión de incidentes.

NIST AI RMF: mapea riesgos en gobernar, mapear, medir, gestionar.

Acta de la UE sobre IA: rastrea categoría (prohibido / GPAI / alto riesgo), documentación técnica, transparencia y obligaciones de alfabetización en IA según el cronograma publicado.

Dónde ya se está mostrando el valor

Servicios financieros. Los pilotos iniciales del Reino Unido/UE señalan una gestión autónoma del dinero y automatización de servicios; los reguladores están observando de cerca: la gobernanza y la responsabilidad de los gerentes senior son importantes.

Operaciones empresariales. Los analistas notan grandes mejoras de eficiencia cuando los agentes automatizan flujos de trabajo complejos, entre sistemas, más allá de RPA/IVR tradicional.

Preguntas frecuentes

P1. ¿Qué es la IA agéntica?

IA que puede planificar, decidir y actuar (con restricciones) para lograr objetivos—automatizando trabajo de múltiples pasos e integrándose con tus sistemas. Los analistas la clasifican como una tendencia estratégica para 2025. PagerDuty

P2. ¿Por dónde deberían comenzar los CEO?

Elige unos pocos flujos de trabajo de alto valor y bajo riesgo; asigna propietarios de productos; establece objetivos de KPI; y organiza la gobernanza alineada con ISO/IEC 42001 / NIST AI RMF mientras mapeas obligaciones del Acta de la UE sobre IA. ISO | NIST

P3. ¿Cuáles son los mayores escollos a evitar?

Pilotos no definidos sin KPIs, modelos operativos débiles y cumplimiento descuidado—causas detrás de la previsión de Gartner de que más del 40% de las iniciativas agénticas podrían cancelarse. Gartner

Recibe noticias y consejos sobre IA cada semana en tu bandeja de entrada

Al suscribirte, das tu consentimiento para que Generation Digital almacene y procese tus datos de acuerdo con nuestra política de privacidad. Puedes leer la política completa en gend.co/privacy.

Próximos talleres y seminarios web

Claridad Operacional a Gran Escala - Asana

Webinar Virtual

Miércoles 25 de febrero de 2026

En línea

Trabaja con compañeros de equipo de IA - Asana

Taller Presencial

Jueves 26 de febrero de 2026

Londres, Reino Unido

De Idea a Prototipo: IA en Miro

Seminario Web Virtual

Miércoles 18 de febrero de 2026

En línea

Generación

Digital

Oficina en Reino Unido

Generation Digital Ltd

33 Queen St,

Londres

EC4R 1AP

Reino Unido

Oficina en Canadá

Generation Digital Americas Inc

181 Bay St., Suite 1800

Toronto, ON, M5J 2T9

Canadá

Oficina en EE. UU.

Generation Digital Américas Inc

77 Sands St,

Brooklyn, NY 11201,

Estados Unidos

Oficina de la UE

Software Generación Digital

Edificio Elgee

Dundalk

A91 X2R3

Irlanda

Oficina en Medio Oriente

6994 Alsharq 3890,

An Narjis,

Riad 13343,

Arabia Saudita

Número de la empresa: 256 9431 77 | Derechos de autor 2026 | Términos y Condiciones | Política de Privacidad

Generación

Digital

Oficina en Reino Unido

Generation Digital Ltd

33 Queen St,

Londres

EC4R 1AP

Reino Unido

Oficina en Canadá

Generation Digital Americas Inc

181 Bay St., Suite 1800

Toronto, ON, M5J 2T9

Canadá

Oficina en EE. UU.

Generation Digital Américas Inc

77 Sands St,

Brooklyn, NY 11201,

Estados Unidos

Oficina de la UE

Software Generación Digital

Edificio Elgee

Dundalk

A91 X2R3

Irlanda

Oficina en Medio Oriente

6994 Alsharq 3890,

An Narjis,

Riad 13343,

Arabia Saudita