Los flujos de trabajo de inteligencia artificial están transformando la economía de los centros de datos

Los flujos de trabajo de inteligencia artificial están transformando la economía de los centros de datos

AI

17 dic 2025

Not sure what to do next with AI?

Assess readiness, risk, and priorities in under an hour.

Not sure what to do next with AI?

Assess readiness, risk, and priorities in under an hour.

➔ Reserva una Consulta

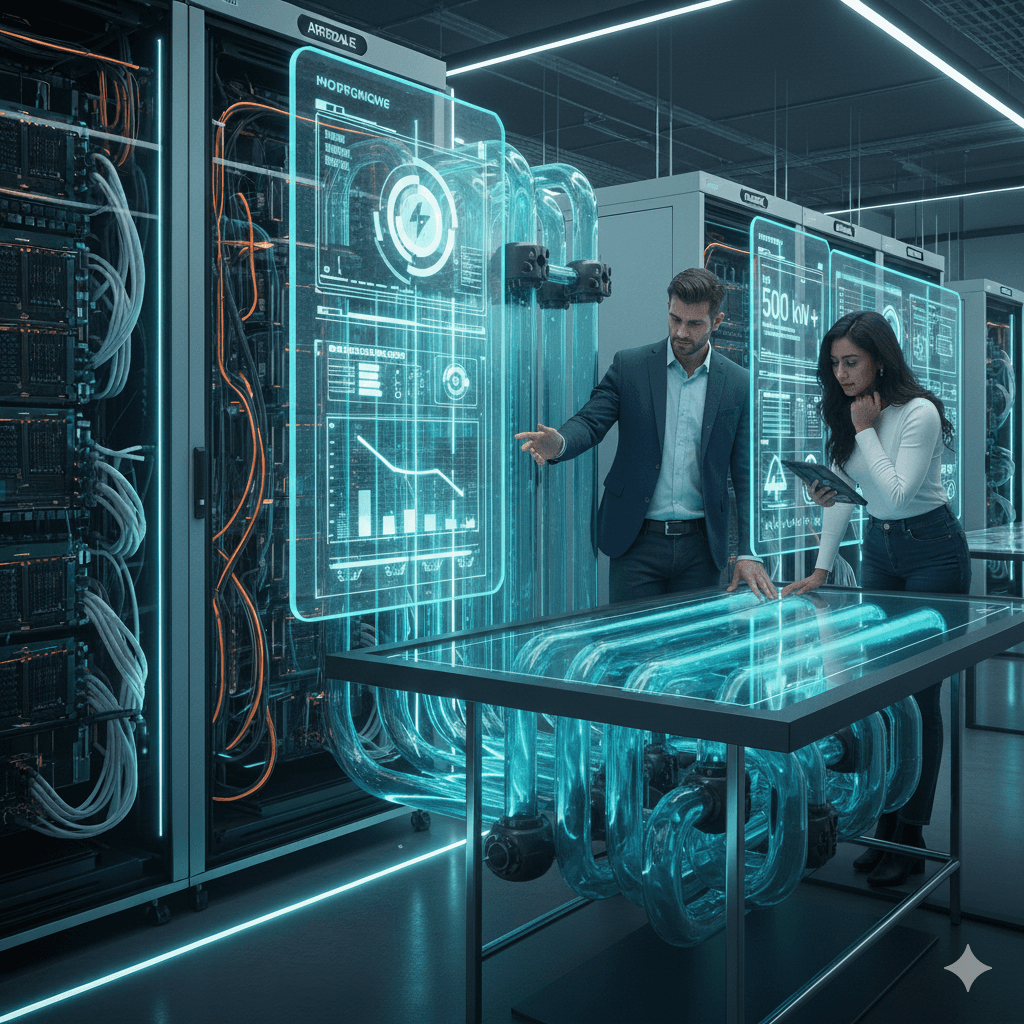

Las cargas de trabajo de IA están cambiando la economía de los centros de datos rápidamente. La potencia, no el espacio, es la restricción principal, impulsando el arrendamiento centrado en la potencia, densidades más altas de racks y la rápida adopción de enfriamiento por líquido. La absorción récord, la baja vacancia y los retrasos de la red significan que los operadores deben planificar para tener energía resiliente, enfriamiento más inteligente y financiamiento flexible para asegurar los nuevos desarrollos.

Puntos clave

Estrategia centrada en la potencia: El arrendamiento y la valoración ahora dependen de los megavatios asegurados, no solo de los metros cuadrados. Los mercados muestran demanda récord y baja vacancia a medida que los arrendatarios de IA pre-alquilan capacidad.

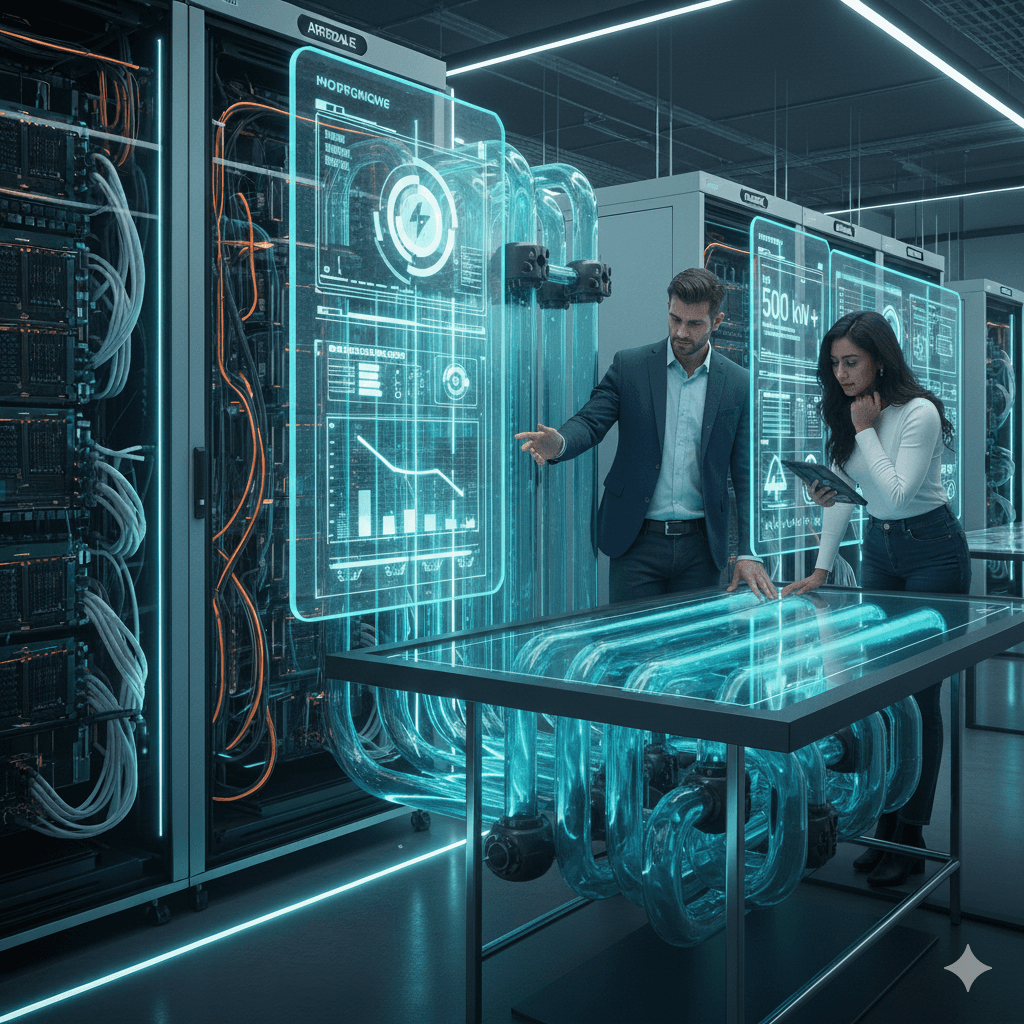

Densidades de racks más altas: El entrenamiento/inferencia de IA impulsa densidades de racks mucho más allá de las normas históricas; el enfriamiento por líquido está en aumento para manejar racks de IA de 50–300 kW o más.

Eficiencia operativa: Nuevos perfiles de potencia y diseños de enfriamiento mejoran el rendimiento donde la energía de la red es escasa.

Cómo funciona

La economía del arrendamiento está liderada por la potencia. América del Norte y EMEA reportan absorción récord y rentas crecientes a medida que la demanda de IA supera la potencia disponible; Londres lideró la absorción de EMEA en el primer semestre de 2025 en medio de la conversión de pre-alquileres de 2024 a demanda en vivo.

Las restricciones de la red remodelan la secuencia de construcción. Los desarrolladores del Reino Unido y EMEA enfrentan retrasos en la conexión, impulsando aplicaciones de red especulativas, selección de sitios "centrados en la potencia" y estrategias de energía puente mientras esperan conexiones permanentes.

Desplazamiento en el diseño térmico/energético. Los racks promedio de empresas (5–10 kW) ya no representan las salas de IA; el enfriamiento por líquido (directo al chip/inmersión) junto con un flujo de aire optimizado y la reutilización del calor reducen los costos de infraestructura incluso cuando la carga total de TI aumenta.

Las arquitecturas de potencia evolucionan. Los proveedores están probando la distribución de CC de mayor voltaje y perfiles de potencia ajustables para maximizar el rendimiento por vatio en "fábricas de IA" con limitaciones de potencia.

Pasos prácticos o ejemplos

Garanticen la potencia desde el principio. Prioricen sitios con capacidad de red firme o potencia puente creíble; alineen contratos de compraventa de energía/renovables para cubrir la volatilidad y cumplir con ESG.

Diseñen para la densidad. Planifiquen corredores y espacio para racks de IA de 50–300 kW y adaptaciones de enfriamiento por líquido, incluso si la Fase 1 se lanza a una densidad más baja.

Ingeniería para la eficiencia, no solo para el PUE. Utilicen modelos de energía actualizados y telemetría; a medida que la participación de la carga de TI crece, la eficiencia de la infraestructura (y el uso del agua) todavía tiene un impacto significativo en los OPEX.

Arrendar con flexibilidad. Estructuren horarios de entrega obligatoria o escalonados que alineen la entrega de MW con la llegada de clústeres de GPU para reducir la capacidad inactiva. Los datos del mercado muestran que los arrendatarios de IA están impulsando la absorción y los aumentos de renta.

Preguntas frecuentes

P1: ¿Cómo influencian las cargas de trabajo de IA las operaciones de los centros de datos?

Dan prioridad a la disponibilidad de potencia y densidad sobre el espacio bruto, acelerando el enfriamiento por líquido y las operaciones optimizadas para la energía para mantener alimentados a los clústeres de GPU. tomshardware.com

P2: ¿Cuáles son los impactos económicos en las decisiones de arrendamiento y construcción?

La absorción récord, el aumento de las rentas y los retrasos en la conexión impulsan el arrendamiento centrado en la potencia y los aumentos escalonados de MW; los sitios con capacidad firme tienen ventaja. CBRE

P3: ¿Cómo se adaptan técnicamente los centros de datos?

Diseñando para racks de 50–300 kW o más, adoptando el enfriamiento por líquido, optimizando el flujo de aire/la reutilización del calor y explorando la distribución de potencia de voltaje más alto y las soluciones de energía puente. Aon | tomshardware.com | Airedale

P4: ¿Está aumentando el impacto ambiental?

Sí, las huellas de energía y agua están bajo escrutinio; los operadores contrarrestan con estrategias de eficiencia, renovables y recuperación de calor, mientras que los estudios prevén un crecimiento continuo de las cargas de IA. The Verge

Resumen

La IA es ahora el centro de gravedad para la economía de los centros de datos. Para mantenerse competitivos, prioricen sitios con MW asegurados, diseños preparados para la densidad y arrendamientos flexibles, respaldados por planes claros de eficiencia y sostenibilidad. Así es como los operadores ofrecen capacidad de IA rápidamente sin gastar de más en potencia inactiva o adaptaciones prematuras.

Las cargas de trabajo de IA están cambiando la economía de los centros de datos rápidamente. La potencia, no el espacio, es la restricción principal, impulsando el arrendamiento centrado en la potencia, densidades más altas de racks y la rápida adopción de enfriamiento por líquido. La absorción récord, la baja vacancia y los retrasos de la red significan que los operadores deben planificar para tener energía resiliente, enfriamiento más inteligente y financiamiento flexible para asegurar los nuevos desarrollos.

Puntos clave

Estrategia centrada en la potencia: El arrendamiento y la valoración ahora dependen de los megavatios asegurados, no solo de los metros cuadrados. Los mercados muestran demanda récord y baja vacancia a medida que los arrendatarios de IA pre-alquilan capacidad.

Densidades de racks más altas: El entrenamiento/inferencia de IA impulsa densidades de racks mucho más allá de las normas históricas; el enfriamiento por líquido está en aumento para manejar racks de IA de 50–300 kW o más.

Eficiencia operativa: Nuevos perfiles de potencia y diseños de enfriamiento mejoran el rendimiento donde la energía de la red es escasa.

Cómo funciona

La economía del arrendamiento está liderada por la potencia. América del Norte y EMEA reportan absorción récord y rentas crecientes a medida que la demanda de IA supera la potencia disponible; Londres lideró la absorción de EMEA en el primer semestre de 2025 en medio de la conversión de pre-alquileres de 2024 a demanda en vivo.

Las restricciones de la red remodelan la secuencia de construcción. Los desarrolladores del Reino Unido y EMEA enfrentan retrasos en la conexión, impulsando aplicaciones de red especulativas, selección de sitios "centrados en la potencia" y estrategias de energía puente mientras esperan conexiones permanentes.

Desplazamiento en el diseño térmico/energético. Los racks promedio de empresas (5–10 kW) ya no representan las salas de IA; el enfriamiento por líquido (directo al chip/inmersión) junto con un flujo de aire optimizado y la reutilización del calor reducen los costos de infraestructura incluso cuando la carga total de TI aumenta.

Las arquitecturas de potencia evolucionan. Los proveedores están probando la distribución de CC de mayor voltaje y perfiles de potencia ajustables para maximizar el rendimiento por vatio en "fábricas de IA" con limitaciones de potencia.

Pasos prácticos o ejemplos

Garanticen la potencia desde el principio. Prioricen sitios con capacidad de red firme o potencia puente creíble; alineen contratos de compraventa de energía/renovables para cubrir la volatilidad y cumplir con ESG.

Diseñen para la densidad. Planifiquen corredores y espacio para racks de IA de 50–300 kW y adaptaciones de enfriamiento por líquido, incluso si la Fase 1 se lanza a una densidad más baja.

Ingeniería para la eficiencia, no solo para el PUE. Utilicen modelos de energía actualizados y telemetría; a medida que la participación de la carga de TI crece, la eficiencia de la infraestructura (y el uso del agua) todavía tiene un impacto significativo en los OPEX.

Arrendar con flexibilidad. Estructuren horarios de entrega obligatoria o escalonados que alineen la entrega de MW con la llegada de clústeres de GPU para reducir la capacidad inactiva. Los datos del mercado muestran que los arrendatarios de IA están impulsando la absorción y los aumentos de renta.

Preguntas frecuentes

P1: ¿Cómo influencian las cargas de trabajo de IA las operaciones de los centros de datos?

Dan prioridad a la disponibilidad de potencia y densidad sobre el espacio bruto, acelerando el enfriamiento por líquido y las operaciones optimizadas para la energía para mantener alimentados a los clústeres de GPU. tomshardware.com

P2: ¿Cuáles son los impactos económicos en las decisiones de arrendamiento y construcción?

La absorción récord, el aumento de las rentas y los retrasos en la conexión impulsan el arrendamiento centrado en la potencia y los aumentos escalonados de MW; los sitios con capacidad firme tienen ventaja. CBRE

P3: ¿Cómo se adaptan técnicamente los centros de datos?

Diseñando para racks de 50–300 kW o más, adoptando el enfriamiento por líquido, optimizando el flujo de aire/la reutilización del calor y explorando la distribución de potencia de voltaje más alto y las soluciones de energía puente. Aon | tomshardware.com | Airedale

P4: ¿Está aumentando el impacto ambiental?

Sí, las huellas de energía y agua están bajo escrutinio; los operadores contrarrestan con estrategias de eficiencia, renovables y recuperación de calor, mientras que los estudios prevén un crecimiento continuo de las cargas de IA. The Verge

Resumen

La IA es ahora el centro de gravedad para la economía de los centros de datos. Para mantenerse competitivos, prioricen sitios con MW asegurados, diseños preparados para la densidad y arrendamientos flexibles, respaldados por planes claros de eficiencia y sostenibilidad. Así es como los operadores ofrecen capacidad de IA rápidamente sin gastar de más en potencia inactiva o adaptaciones prematuras.

Recibe consejos prácticos directamente en tu bandeja de entrada

Al suscribirte, das tu consentimiento para que Generation Digital almacene y procese tus datos de acuerdo con nuestra política de privacidad. Puedes leer la política completa en gend.co/privacy.

Generación

Digital

Oficina en el Reino Unido

33 Queen St,

Londres

EC4R 1AP

Reino Unido

Oficina en Canadá

1 University Ave,

Toronto,

ON M5J 1T1,

Canadá

Oficina NAMER

77 Sands St,

Brooklyn,

NY 11201,

Estados Unidos

Oficina EMEA

Calle Charlemont, Saint Kevin's, Dublín,

D02 VN88,

Irlanda

Oficina en Medio Oriente

6994 Alsharq 3890,

An Narjis,

Riyadh 13343,

Arabia Saudita

Número de la empresa: 256 9431 77 | Derechos de autor 2026 | Términos y Condiciones | Política de Privacidad

Generación

Digital

Oficina en el Reino Unido

33 Queen St,

Londres

EC4R 1AP

Reino Unido

Oficina en Canadá

1 University Ave,

Toronto,

ON M5J 1T1,

Canadá

Oficina NAMER

77 Sands St,

Brooklyn,

NY 11201,

Estados Unidos

Oficina EMEA

Calle Charlemont, Saint Kevin's, Dublín,

D02 VN88,

Irlanda

Oficina en Medio Oriente

6994 Alsharq 3890,

An Narjis,

Riyadh 13343,

Arabia Saudita