Aprovechar la IA: Perspectivas Estratégicas de Datos en JPMorgan Chase

Aprovechar la IA: Perspectivas Estratégicas de Datos en JPMorgan Chase

AI

18 dic 2025

Not sure what to do next with AI?

Assess readiness, risk, and priorities in under an hour.

Not sure what to do next with AI?

Assess readiness, risk, and priorities in under an hour.

➔ Reserva una Consulta

Por qué esto importa ahora

Los bancos con bases de datos sólidas están convirtiendo la IA de proyectos piloto en valor medible. JPMorgan Chase ilustra cómo escalar de manera responsable: construir productos de datos gobernados, operacionalizar controles de riesgo de modelos y aplicar IA donde realmente hace la diferencia: servicio al cliente, riesgo y productividad en ingeniería. El resultado son decisiones más rápidas, mejores controles y una ejecución más precisa.

Liderazgo y modelo operativo

CDO global de la empresa: Bajo el mando del Director Global de Datos, JPMorgan estructura la gobernanza de datos, estándares de calidad y patrones de acceso que permiten a la IA operar de manera segura. La función de CDO alinea las plataformas de datos con la gestión de riesgo de modelos (MRM), legal y seguridad. Este mandato de arriba hacia abajo ayuda a los equipos de producto a implementar características de IA dentro de marcos claros de control.

Liderazgo tecnológico: El banco financia la IA como parte de una agenda de modernización de varios años, priorizando las inversiones en plataformas (fábrica de datos, catálogos, almacenes de características) y habilitación de IA (plataformas LLM, asistentes de codificación). Este modelo operativo equilibra estándares centrales con ejecución federada.

Qué hay de nuevo: de plataformas a resultados

LLM internos y copilotos: Los empleados utilizan herramientas internas de modelo de lenguaje extenso para la investigación, resumir y acelerar flujos de trabajo, reduciendo el esfuerzo manual en asesoría, operaciones e ingeniería.

Más de 450 casos de uso de GenAI en movimiento: La mayoría de los primeros éxitos se ven en eficiencia de back-office y trabajos de conocimiento, con despliegue específico para equipos de primera línea.

Productividad en ingeniería: Un asistente de codificación acelera la generación de código repetitivo y pruebas, liberando a los ingenieros para trabajos de mayor valor y mejorando la velocidad de entrega.

Impacto comercial: La IA apoya al servicio al cliente durante la volatilidad y contribuye al crecimiento de ventas en los canales de riqueza y asesoría.

Bases de datos que hacen confiable a la IA

1) Productos de datos gobernados. Productos de datos curados y descubribles—expuestos a través de catálogos y políticas de acceso—permiten que los servicios de IA confíen en definiciones y linajes consistentes.

2) Análisis en tiempo real y casi en tiempo real. Las canalizaciones de flujo traen datos de pagos, transacciones e interacciones a los modelos más rápido, impulsando alertas oportunas (por ejemplo, fraude) y un servicio más receptivo.

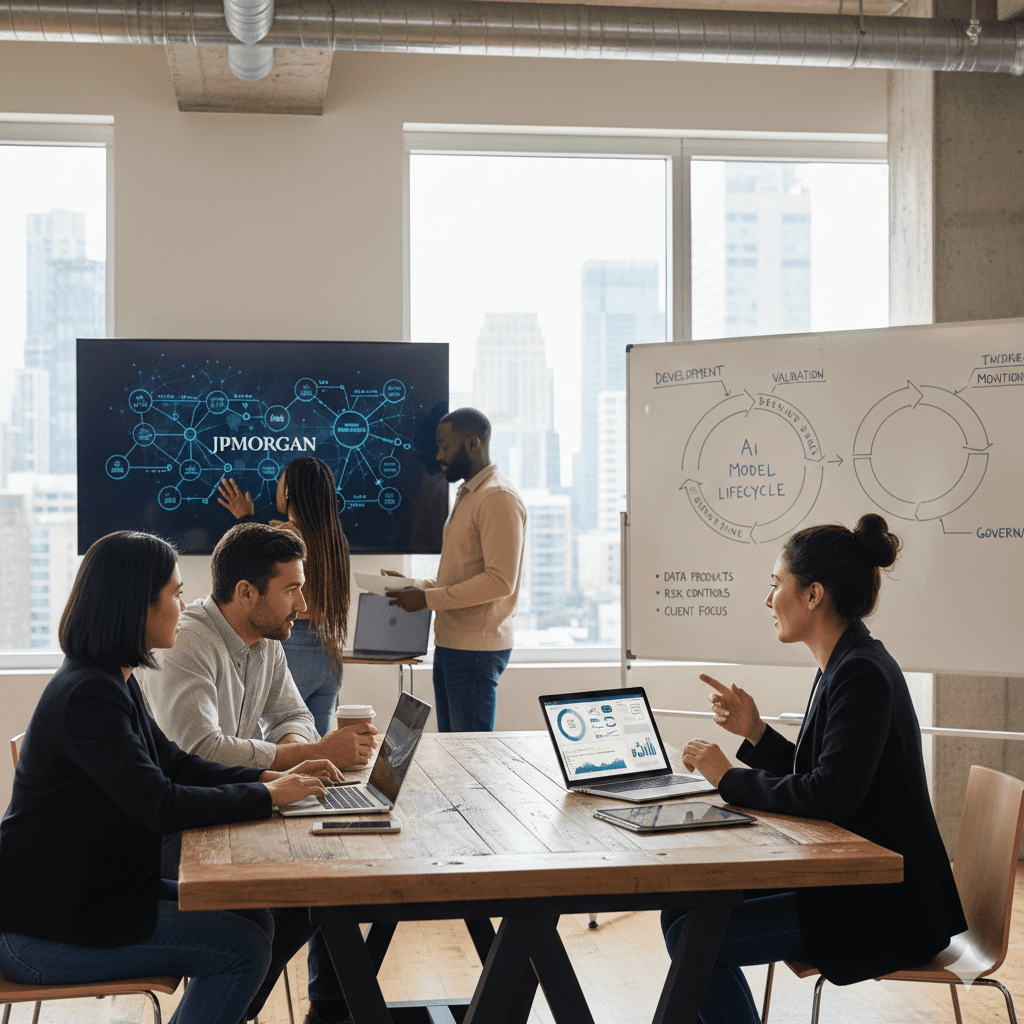

3) Ciclo de vida del modelo y controles de riesgo. Los modelos de IA pasan por etapas documentadas del ciclo de vida (desarrollo, validación, monitoreo). Los controles cubren sesgo, deriva, rendimiento y explicabilidad, con trazas listas para auditoría.

4) Humano en el bucle. Las decisiones sensibles (crédito, comercio, KYC) retienen la supervisión de expertos. La IA complementa, no reemplaza, los juicios regulados.

Aplicaciones prácticas

Fraude y delito financiero: Los modelos de aprendizaje automático detectan comportamientos anómalos en distintos canales, reduciendo falsos positivos y acelerando el manejo de casos genuinos.

Riesgo y tesorería: La IA ayuda con escenarios de estrés, indicadores tempranos de alerta y señales de liquidez al unificar datos de mercado, crédito y operaciones.

Flujos de trabajo de clientes y asesores: Asistentes internos resumen carteras, destacan productos comparables y preparan resúmenes de reuniones, acelerando los tiempos de respuesta y mejorando la consistencia.

Centros de contacto y operaciones: GenAI ayuda a redactar respuestas, clasificar solicitudes y actualizar notas de casos, permitiendo a los agentes dedicar más tiempo a problemas complejos.

Ingeniería de software: La generación de código, creación de pruebas y sugerencias de refactorización acortan los tiempos de ciclo y mejoran la experiencia del desarrollador.

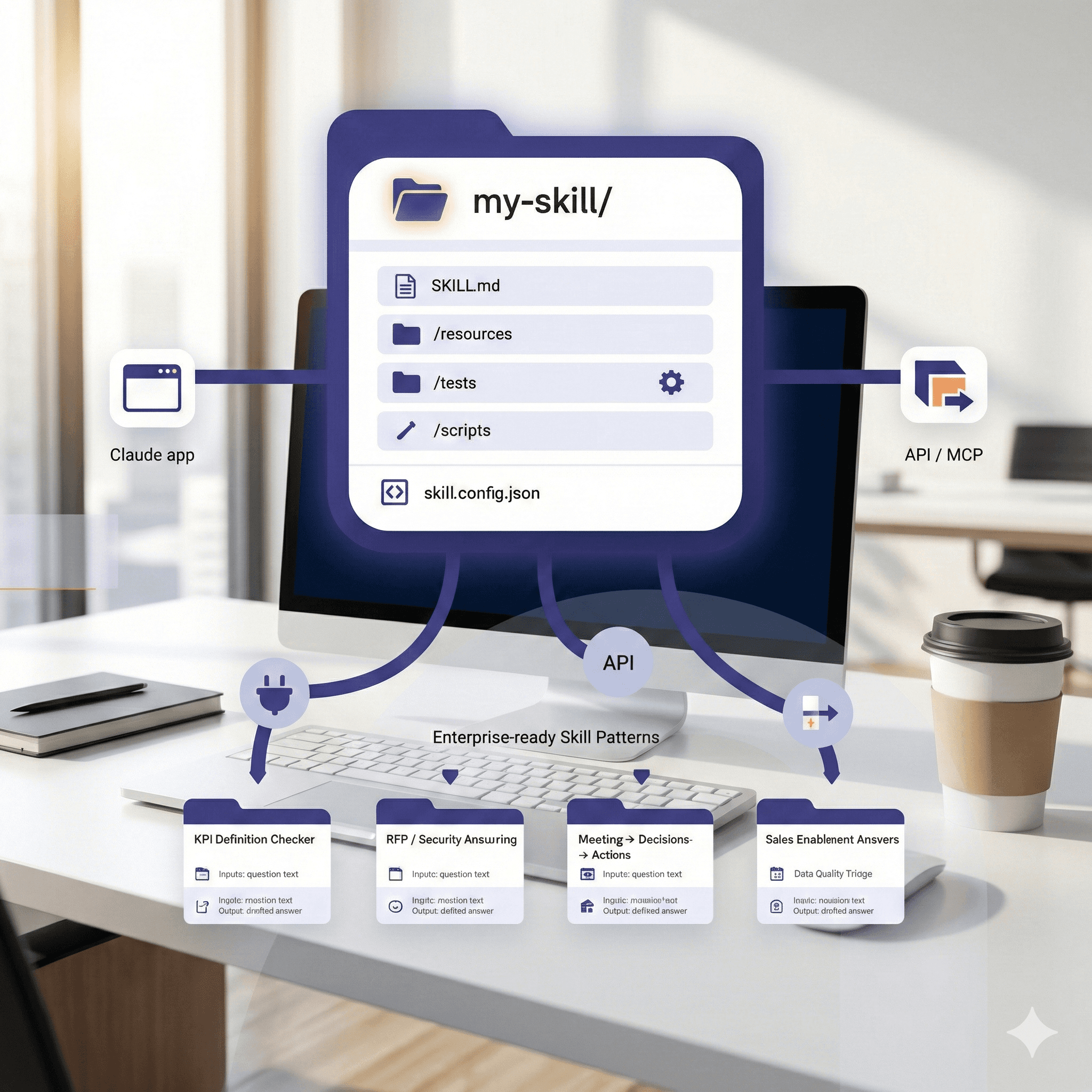

Cómo funciona: arquitectura de referencia (nivel alto)

Ingesta y calidad: Las canalizaciones por lotes y streaming llevan datos crudos a zonas seguras con comprobaciones automáticas de calidad, validación de esquemas y controles de PII.

Curaduría y gobernanza: Productos de datos alineados con el negocio, con linaje, metadatos y políticas de acceso; los patrones de catálogos y mallas hacen que los datos sean descubribles.

Capa de características y modelos: Características reutilizables, seguimiento de experimentos y MLOps orquestan el entrenamiento, despliegue y monitoreo.

Habilitación de LLM: Los patrones de generación aumentada por recuperación (RAG) conectan modelos a fuentes gobernadas. Las barreras de seguridad gestionan la inyección de prompts, la fuga de datos y los filtros de salida.

Controles y auditoría: Los controles de riesgo del modelo, cumplimiento y seguridad instrumentan cada etapa—produciendo artefactos para validación y revisión regulatoria.

Lista de verificación de implementación para bancos

Comience con productos de datos para sus diez principales casos de uso de IA; defina propietarios, SLA y métricas de calidad.

Establezca gobernanza de modelos alineada con MRM desde el primer día (documentación, validación, monitoreo, explicabilidad).

Construya seguridad en LLM: gobernanza de recuperación, acceso basado en roles y pruebas de equipos rojos.

Habilite productividad del desarrollador con un asistente de codificación y rutas preferentes para MLOps.

Demuestre valor comercial: comprométase con un conjunto pequeño de KPIs (tiempo de ciclo, aumento de ventas, reducción de tasa de pérdida) y publique resultados trimestrales.

Errores comunes a evitar

Expansión de datos sin propiedad. Una malla solo es útil cuando los productos tienen propietarios responsables y SLA de calidad.

Proliferación de modelos. Consolide características y modelos; estandarice el monitoreo y la reversión.

LLM sin gobernanza de recuperación. El acceso descontrolado arriesga filtraciones y alucinaciones.

Purgatorio de pilotos. Vincule cada desarrollo a un KPI propiedad del negocio y deseche lo que no lo avance.

Qué sigue

Espere flujos de trabajo más autónomos, integración más estrecha de señales en tiempo real y mayor amplitud de barreras de seguridad para la autonomía. El diferenciador sigue siendo el mismo: datos confiables más gobernanza disciplinada, no solo modelos más grandes.

Resumen

JPMorgan muestra cómo convertir los datos en una ventaja duradera: fundamentos gobernados, controles de riesgo disciplinados y IA dirigida que mejora los resultados del cliente y la productividad. Si está configurando un plan de IA a nivel de banco, Generación Digital puede ayudar a definir casos de uso, productos de datos y controles que envíen valor rápidamente. Modernicemos su infraestructura de datos e IA, de manera segura y pragmática.

Preguntas frecuentes

¿Cómo mejora la IA la gestión de datos en JPMorgan Chase?

Al reforzar la gobernanza, el linaje y los controles de acceso, los productos de datos se convierten en fuentes fiables para el análisis y la IA. Esto sustenta mejores perspectivas, modelos más seguros y una mejor capacidad de auditoría.

¿Cuáles son los beneficios de la IA en los servicios financieros?

Detección de riesgos más precisa, mejor servicio al cliente y mayor productividad en ingeniería y operaciones, todo dentro de marcos regulatorios.

¿Puede la IA predecir tendencias del mercado?

La IA puede identificar patrones e indicadores líderes, pero los bancos implementan supervisión humana para decisiones de alto impacto.

¿Cómo maneja JPMorgan el riesgo de la IA?

A través de controles del ciclo de vida del modelo (validación, monitoreo, explicabilidad), alineación con MRM y gobernanza documentada en todo el flujo de datos y modelos.

Por qué esto importa ahora

Los bancos con bases de datos sólidas están convirtiendo la IA de proyectos piloto en valor medible. JPMorgan Chase ilustra cómo escalar de manera responsable: construir productos de datos gobernados, operacionalizar controles de riesgo de modelos y aplicar IA donde realmente hace la diferencia: servicio al cliente, riesgo y productividad en ingeniería. El resultado son decisiones más rápidas, mejores controles y una ejecución más precisa.

Liderazgo y modelo operativo

CDO global de la empresa: Bajo el mando del Director Global de Datos, JPMorgan estructura la gobernanza de datos, estándares de calidad y patrones de acceso que permiten a la IA operar de manera segura. La función de CDO alinea las plataformas de datos con la gestión de riesgo de modelos (MRM), legal y seguridad. Este mandato de arriba hacia abajo ayuda a los equipos de producto a implementar características de IA dentro de marcos claros de control.

Liderazgo tecnológico: El banco financia la IA como parte de una agenda de modernización de varios años, priorizando las inversiones en plataformas (fábrica de datos, catálogos, almacenes de características) y habilitación de IA (plataformas LLM, asistentes de codificación). Este modelo operativo equilibra estándares centrales con ejecución federada.

Qué hay de nuevo: de plataformas a resultados

LLM internos y copilotos: Los empleados utilizan herramientas internas de modelo de lenguaje extenso para la investigación, resumir y acelerar flujos de trabajo, reduciendo el esfuerzo manual en asesoría, operaciones e ingeniería.

Más de 450 casos de uso de GenAI en movimiento: La mayoría de los primeros éxitos se ven en eficiencia de back-office y trabajos de conocimiento, con despliegue específico para equipos de primera línea.

Productividad en ingeniería: Un asistente de codificación acelera la generación de código repetitivo y pruebas, liberando a los ingenieros para trabajos de mayor valor y mejorando la velocidad de entrega.

Impacto comercial: La IA apoya al servicio al cliente durante la volatilidad y contribuye al crecimiento de ventas en los canales de riqueza y asesoría.

Bases de datos que hacen confiable a la IA

1) Productos de datos gobernados. Productos de datos curados y descubribles—expuestos a través de catálogos y políticas de acceso—permiten que los servicios de IA confíen en definiciones y linajes consistentes.

2) Análisis en tiempo real y casi en tiempo real. Las canalizaciones de flujo traen datos de pagos, transacciones e interacciones a los modelos más rápido, impulsando alertas oportunas (por ejemplo, fraude) y un servicio más receptivo.

3) Ciclo de vida del modelo y controles de riesgo. Los modelos de IA pasan por etapas documentadas del ciclo de vida (desarrollo, validación, monitoreo). Los controles cubren sesgo, deriva, rendimiento y explicabilidad, con trazas listas para auditoría.

4) Humano en el bucle. Las decisiones sensibles (crédito, comercio, KYC) retienen la supervisión de expertos. La IA complementa, no reemplaza, los juicios regulados.

Aplicaciones prácticas

Fraude y delito financiero: Los modelos de aprendizaje automático detectan comportamientos anómalos en distintos canales, reduciendo falsos positivos y acelerando el manejo de casos genuinos.

Riesgo y tesorería: La IA ayuda con escenarios de estrés, indicadores tempranos de alerta y señales de liquidez al unificar datos de mercado, crédito y operaciones.

Flujos de trabajo de clientes y asesores: Asistentes internos resumen carteras, destacan productos comparables y preparan resúmenes de reuniones, acelerando los tiempos de respuesta y mejorando la consistencia.

Centros de contacto y operaciones: GenAI ayuda a redactar respuestas, clasificar solicitudes y actualizar notas de casos, permitiendo a los agentes dedicar más tiempo a problemas complejos.

Ingeniería de software: La generación de código, creación de pruebas y sugerencias de refactorización acortan los tiempos de ciclo y mejoran la experiencia del desarrollador.

Cómo funciona: arquitectura de referencia (nivel alto)

Ingesta y calidad: Las canalizaciones por lotes y streaming llevan datos crudos a zonas seguras con comprobaciones automáticas de calidad, validación de esquemas y controles de PII.

Curaduría y gobernanza: Productos de datos alineados con el negocio, con linaje, metadatos y políticas de acceso; los patrones de catálogos y mallas hacen que los datos sean descubribles.

Capa de características y modelos: Características reutilizables, seguimiento de experimentos y MLOps orquestan el entrenamiento, despliegue y monitoreo.

Habilitación de LLM: Los patrones de generación aumentada por recuperación (RAG) conectan modelos a fuentes gobernadas. Las barreras de seguridad gestionan la inyección de prompts, la fuga de datos y los filtros de salida.

Controles y auditoría: Los controles de riesgo del modelo, cumplimiento y seguridad instrumentan cada etapa—produciendo artefactos para validación y revisión regulatoria.

Lista de verificación de implementación para bancos

Comience con productos de datos para sus diez principales casos de uso de IA; defina propietarios, SLA y métricas de calidad.

Establezca gobernanza de modelos alineada con MRM desde el primer día (documentación, validación, monitoreo, explicabilidad).

Construya seguridad en LLM: gobernanza de recuperación, acceso basado en roles y pruebas de equipos rojos.

Habilite productividad del desarrollador con un asistente de codificación y rutas preferentes para MLOps.

Demuestre valor comercial: comprométase con un conjunto pequeño de KPIs (tiempo de ciclo, aumento de ventas, reducción de tasa de pérdida) y publique resultados trimestrales.

Errores comunes a evitar

Expansión de datos sin propiedad. Una malla solo es útil cuando los productos tienen propietarios responsables y SLA de calidad.

Proliferación de modelos. Consolide características y modelos; estandarice el monitoreo y la reversión.

LLM sin gobernanza de recuperación. El acceso descontrolado arriesga filtraciones y alucinaciones.

Purgatorio de pilotos. Vincule cada desarrollo a un KPI propiedad del negocio y deseche lo que no lo avance.

Qué sigue

Espere flujos de trabajo más autónomos, integración más estrecha de señales en tiempo real y mayor amplitud de barreras de seguridad para la autonomía. El diferenciador sigue siendo el mismo: datos confiables más gobernanza disciplinada, no solo modelos más grandes.

Resumen

JPMorgan muestra cómo convertir los datos en una ventaja duradera: fundamentos gobernados, controles de riesgo disciplinados y IA dirigida que mejora los resultados del cliente y la productividad. Si está configurando un plan de IA a nivel de banco, Generación Digital puede ayudar a definir casos de uso, productos de datos y controles que envíen valor rápidamente. Modernicemos su infraestructura de datos e IA, de manera segura y pragmática.

Preguntas frecuentes

¿Cómo mejora la IA la gestión de datos en JPMorgan Chase?

Al reforzar la gobernanza, el linaje y los controles de acceso, los productos de datos se convierten en fuentes fiables para el análisis y la IA. Esto sustenta mejores perspectivas, modelos más seguros y una mejor capacidad de auditoría.

¿Cuáles son los beneficios de la IA en los servicios financieros?

Detección de riesgos más precisa, mejor servicio al cliente y mayor productividad en ingeniería y operaciones, todo dentro de marcos regulatorios.

¿Puede la IA predecir tendencias del mercado?

La IA puede identificar patrones e indicadores líderes, pero los bancos implementan supervisión humana para decisiones de alto impacto.

¿Cómo maneja JPMorgan el riesgo de la IA?

A través de controles del ciclo de vida del modelo (validación, monitoreo, explicabilidad), alineación con MRM y gobernanza documentada en todo el flujo de datos y modelos.

Recibe consejos prácticos directamente en tu bandeja de entrada

Al suscribirte, das tu consentimiento para que Generation Digital almacene y procese tus datos de acuerdo con nuestra política de privacidad. Puedes leer la política completa en gend.co/privacy.

Generación

Digital

Oficina en el Reino Unido

33 Queen St,

Londres

EC4R 1AP

Reino Unido

Oficina en Canadá

1 University Ave,

Toronto,

ON M5J 1T1,

Canadá

Oficina NAMER

77 Sands St,

Brooklyn,

NY 11201,

Estados Unidos

Oficina EMEA

Calle Charlemont, Saint Kevin's, Dublín,

D02 VN88,

Irlanda

Oficina en Medio Oriente

6994 Alsharq 3890,

An Narjis,

Riyadh 13343,

Arabia Saudita

Número de la empresa: 256 9431 77 | Derechos de autor 2026 | Términos y Condiciones | Política de Privacidad

Generación

Digital

Oficina en el Reino Unido

33 Queen St,

Londres

EC4R 1AP

Reino Unido

Oficina en Canadá

1 University Ave,

Toronto,

ON M5J 1T1,

Canadá

Oficina NAMER

77 Sands St,

Brooklyn,

NY 11201,

Estados Unidos

Oficina EMEA

Calle Charlemont, Saint Kevin's, Dublín,

D02 VN88,

Irlanda

Oficina en Medio Oriente

6994 Alsharq 3890,

An Narjis,

Riyadh 13343,

Arabia Saudita