OpenAI lanza una RFP para fortalecer la cadena de suministro de IA en Estados Unidos mediante la fabricación nacional

OpenAI lanza una RFP para fortalecer la cadena de suministro de IA en Estados Unidos mediante la fabricación nacional

OpenAI

Inteligencia Artificial

15 ene 2026

¿No sabes por dónde empezar con la IA?

Evalúa preparación, riesgos y prioridades en menos de una hora.

¿No sabes por dónde empezar con la IA?

Evalúa preparación, riesgos y prioridades en menos de una hora.

➔ Descarga nuestro paquete gratuito de preparación para IA

OpenAI ha hecho un llamado a fabricantes y socios de EE. UU. capaces de construir componentes críticos para AI a escala. El programa está dirigido a acortar los tiempos de construcción, fortalecer la resiliencia de la cadena de suministro y ampliar el liderazgo tecnológico a medida que la demanda de computación y AI incorporada aumenta.

La RFP agrupa las necesidades en tres áreas:

Insumos de centros de datos — computación, energía, enfriamiento, racks y redes.

Electrónicos de consumo — módulos, componentes y herramientas utilizadas en dispositivos habilitados para AI.

Robótica avanzada — incluyendo cajas de engranajes, motores y electrónica de potencia.

Por qué esto es significativo

Resiliencia: Trae pasos clave de producción a nivel local para reducir la exposición a cuellos de botella globales.

Velocidad: Cadenas logísticas más cortas e iteración más rápida para los sistemas de AI de próxima generación.

Empleos e inversión: Apoya roles de alto valor en fabricación, empaque avanzado, sistemas electromecánicos e infraestructura de centros de datos.

Contexto: la carrera de AI — por qué OpenAI necesita esto

Explosión de demanda de computación: El entrenamiento y el servicio de modelos avanzados requieren volúmenes crecientes de aceleradores, memoria (HBM) y empaques avanzados. Asegurar proveedores locales ayuda a garantizar un acceso predecible a estos insumos.

Cuellos de botella en la infraestructura: Desde sustratos avanzados y empaques tipo CoWoS hasta energía, enfriamiento, racks y óptica, los puntos de estrangulamiento retrasan los despliegues. Construir capacidad en EE. UU. a través de estos vínculos reduce los puntos únicos de falla.

Restricciones de potencia y térmicas: Los clústeres de AI densos intensifican las necesidades de suministro de energía y eliminación de calor. La fabricación local de PDUs, barras colectoras, enfriadores, placas frías y recintos de alta eficiencia acelera el despliegue.

Transición de laboratorios a productos: A medida que AI se mueve a dispositivos de consumo y robótica incorporada, OpenAI necesita fuentes locales confiables para mecánica de precisión (cajas de engranajes, motores), electrónica de control y módulos de CE.

Geopolítica y riesgo comercial: Los controles de exportación, aranceles y choques logísticos pueden prolongar los tiempos de entrega. La fabricación nacional mitiga el riesgo de suministro para programas críticos en el tiempo.

Velocidad para aprender: Ciclos de construcción más rápidos y localizados significan experimentación e iteración más rápidas en la infraestructura de entrenamiento e inferencia de modelos, una ventaja en una carrera de rápida evolución.

Señalización del ecosistema: Comprometerse con proveedores de EE. UU. fomenta la inversión en materiales primarios, herramientas y mano de obra, ampliando la capacidad con el tiempo.

Quiénes deben aplicar

Fabricantes y consorcios de EE. UU. con capacidad existente o a corto plazo en cualquiera de las tres áreas de enfoque.

Proveedores de tecnologías habilitadoras como empaque avanzado, gestión térmica, óptica, movimiento preciso y herramientas relacionadas.

Socios capaces de demostrar instalaciones escalables, sistemas de calidad y valor agregado local.

Qué incluir en su propuesta

Alineación del alcance: Indique el área de enfoque que abordan y los cuellos de botella que resuelven.

Capacidad y cronograma: Instalaciones, plan de equipamiento, objetivos de rendimiento, calendario de aumento.

Plan de resiliencia: Segundo abastecimiento, trazabilidad y localización de proveedores en EE. UU.

Fuerza laboral y cumplimiento: Contratación, capacitación, seguridad y controles relevantes.

Impacto: Cuantifique la reducción del tiempo de entrega, los objetivos de rendimiento y el valor agregado local.

Fechas clave

Fecha de publicación: 15 de enero de 2026

Revisiones: En curso, continuas

Fecha límite final: junio de 2026

Cómo puede ayudar Generation Digital

Preparación para licitación: Rápida exploración de elegibilidad, evidencia y hitos.

Soporte para propuestas: Estructura, narrativa y diseño de KPI.

Herramientas de entrega: Asana para control de programas, Miro para revisiones y diseño, Notion para documentación y pista de auditoría.

Contáctenos para evaluar la idoneidad y acelerar su presentación.

Preguntas frecuentes

¿Cuál es la fecha límite?

Junio de 2026; las propuestas se revisan de manera continua.

¿Quién es elegible?

Fabricantes y socios con sede en EE. UU. que puedan escalar la capacidad en insumos para centros de datos, electrónicos de consumo o robótica avanzada.

¿Cuál es el objetivo?

Acortar los tiempos, fortalecer la resiliencia y ampliar el liderazgo tecnológico de EE. UU. en la infraestructura de hardware de AI.

OpenAI ha hecho un llamado a fabricantes y socios de EE. UU. capaces de construir componentes críticos para AI a escala. El programa está dirigido a acortar los tiempos de construcción, fortalecer la resiliencia de la cadena de suministro y ampliar el liderazgo tecnológico a medida que la demanda de computación y AI incorporada aumenta.

La RFP agrupa las necesidades en tres áreas:

Insumos de centros de datos — computación, energía, enfriamiento, racks y redes.

Electrónicos de consumo — módulos, componentes y herramientas utilizadas en dispositivos habilitados para AI.

Robótica avanzada — incluyendo cajas de engranajes, motores y electrónica de potencia.

Por qué esto es significativo

Resiliencia: Trae pasos clave de producción a nivel local para reducir la exposición a cuellos de botella globales.

Velocidad: Cadenas logísticas más cortas e iteración más rápida para los sistemas de AI de próxima generación.

Empleos e inversión: Apoya roles de alto valor en fabricación, empaque avanzado, sistemas electromecánicos e infraestructura de centros de datos.

Contexto: la carrera de AI — por qué OpenAI necesita esto

Explosión de demanda de computación: El entrenamiento y el servicio de modelos avanzados requieren volúmenes crecientes de aceleradores, memoria (HBM) y empaques avanzados. Asegurar proveedores locales ayuda a garantizar un acceso predecible a estos insumos.

Cuellos de botella en la infraestructura: Desde sustratos avanzados y empaques tipo CoWoS hasta energía, enfriamiento, racks y óptica, los puntos de estrangulamiento retrasan los despliegues. Construir capacidad en EE. UU. a través de estos vínculos reduce los puntos únicos de falla.

Restricciones de potencia y térmicas: Los clústeres de AI densos intensifican las necesidades de suministro de energía y eliminación de calor. La fabricación local de PDUs, barras colectoras, enfriadores, placas frías y recintos de alta eficiencia acelera el despliegue.

Transición de laboratorios a productos: A medida que AI se mueve a dispositivos de consumo y robótica incorporada, OpenAI necesita fuentes locales confiables para mecánica de precisión (cajas de engranajes, motores), electrónica de control y módulos de CE.

Geopolítica y riesgo comercial: Los controles de exportación, aranceles y choques logísticos pueden prolongar los tiempos de entrega. La fabricación nacional mitiga el riesgo de suministro para programas críticos en el tiempo.

Velocidad para aprender: Ciclos de construcción más rápidos y localizados significan experimentación e iteración más rápidas en la infraestructura de entrenamiento e inferencia de modelos, una ventaja en una carrera de rápida evolución.

Señalización del ecosistema: Comprometerse con proveedores de EE. UU. fomenta la inversión en materiales primarios, herramientas y mano de obra, ampliando la capacidad con el tiempo.

Quiénes deben aplicar

Fabricantes y consorcios de EE. UU. con capacidad existente o a corto plazo en cualquiera de las tres áreas de enfoque.

Proveedores de tecnologías habilitadoras como empaque avanzado, gestión térmica, óptica, movimiento preciso y herramientas relacionadas.

Socios capaces de demostrar instalaciones escalables, sistemas de calidad y valor agregado local.

Qué incluir en su propuesta

Alineación del alcance: Indique el área de enfoque que abordan y los cuellos de botella que resuelven.

Capacidad y cronograma: Instalaciones, plan de equipamiento, objetivos de rendimiento, calendario de aumento.

Plan de resiliencia: Segundo abastecimiento, trazabilidad y localización de proveedores en EE. UU.

Fuerza laboral y cumplimiento: Contratación, capacitación, seguridad y controles relevantes.

Impacto: Cuantifique la reducción del tiempo de entrega, los objetivos de rendimiento y el valor agregado local.

Fechas clave

Fecha de publicación: 15 de enero de 2026

Revisiones: En curso, continuas

Fecha límite final: junio de 2026

Cómo puede ayudar Generation Digital

Preparación para licitación: Rápida exploración de elegibilidad, evidencia y hitos.

Soporte para propuestas: Estructura, narrativa y diseño de KPI.

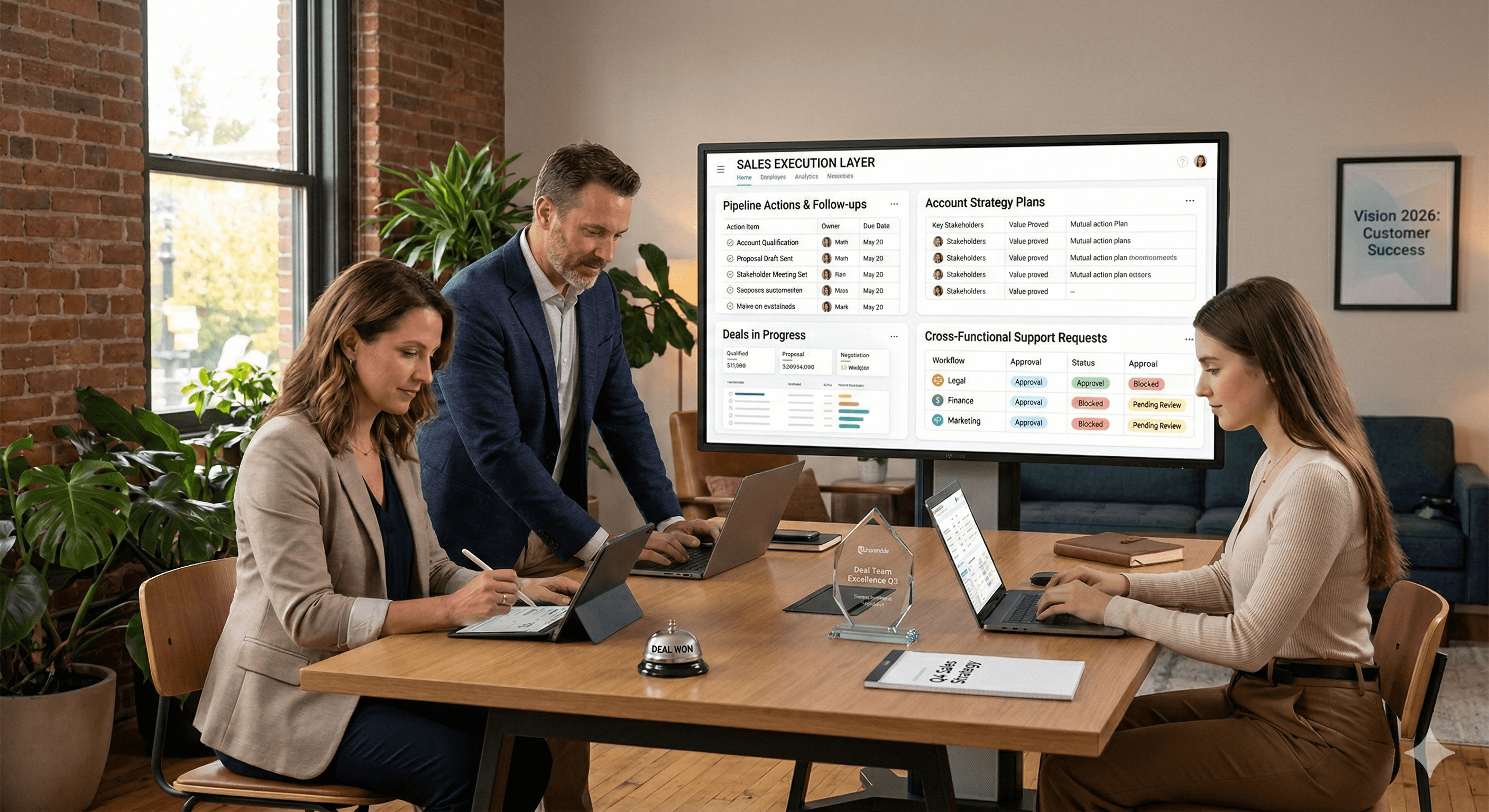

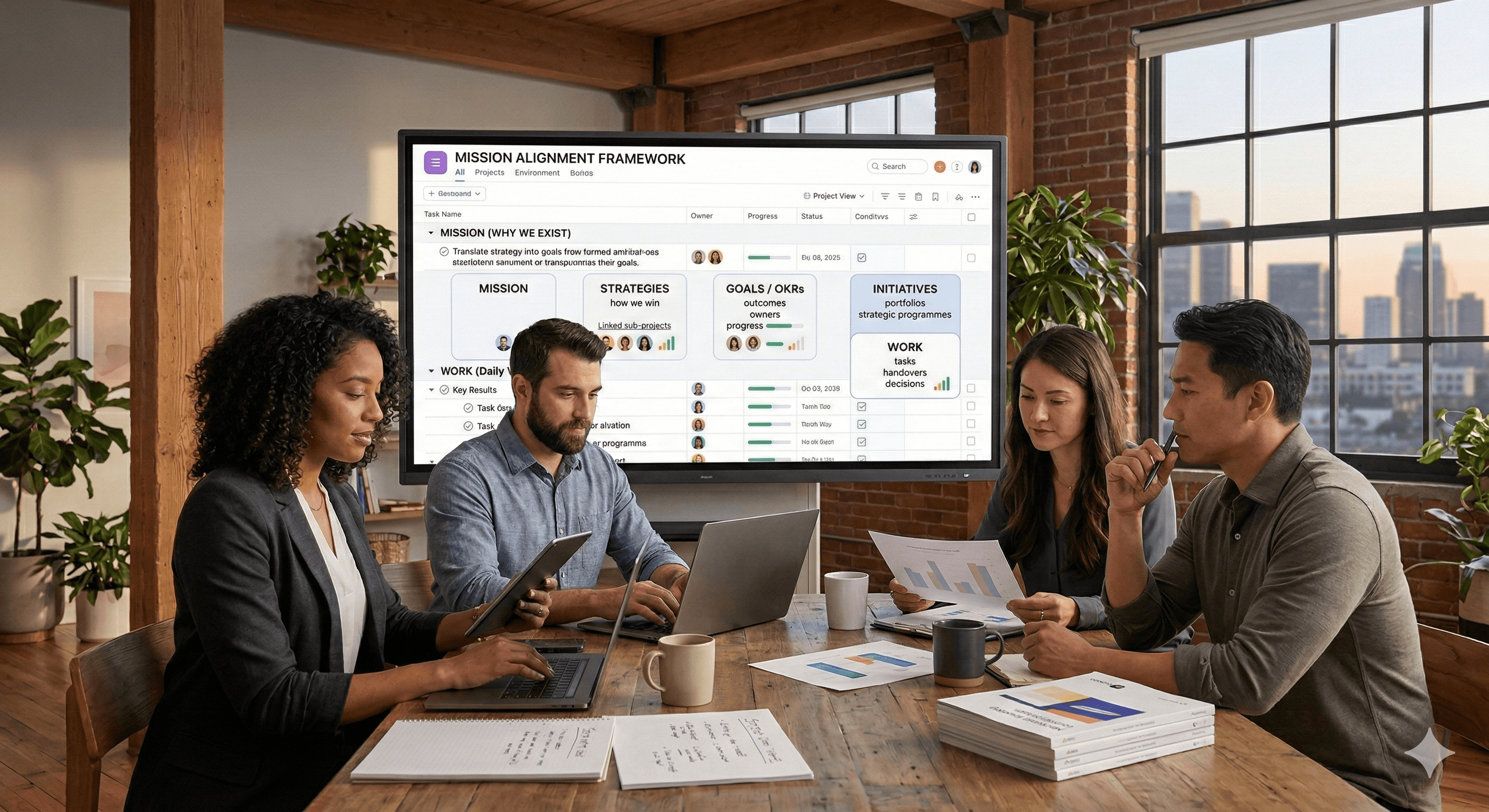

Herramientas de entrega: Asana para control de programas, Miro para revisiones y diseño, Notion para documentación y pista de auditoría.

Contáctenos para evaluar la idoneidad y acelerar su presentación.

Preguntas frecuentes

¿Cuál es la fecha límite?

Junio de 2026; las propuestas se revisan de manera continua.

¿Quién es elegible?

Fabricantes y socios con sede en EE. UU. que puedan escalar la capacidad en insumos para centros de datos, electrónicos de consumo o robótica avanzada.

¿Cuál es el objetivo?

Acortar los tiempos, fortalecer la resiliencia y ampliar el liderazgo tecnológico de EE. UU. en la infraestructura de hardware de AI.

Recibe noticias y consejos sobre IA cada semana en tu bandeja de entrada

Al suscribirte, das tu consentimiento para que Generation Digital almacene y procese tus datos de acuerdo con nuestra política de privacidad. Puedes leer la política completa en gend.co/privacy.

Próximos talleres y seminarios web

Claridad Operacional a Gran Escala - Asana

Webinar Virtual

Miércoles 25 de febrero de 2026

En línea

Trabaja con compañeros de equipo de IA - Asana

Taller Presencial

Jueves 26 de febrero de 2026

Londres, Reino Unido

De Idea a Prototipo: IA en Miro

Seminario Web Virtual

Miércoles 18 de febrero de 2026

En línea

Generación

Digital

Oficina en Reino Unido

Generation Digital Ltd

33 Queen St,

Londres

EC4R 1AP

Reino Unido

Oficina en Canadá

Generation Digital Americas Inc

181 Bay St., Suite 1800

Toronto, ON, M5J 2T9

Canadá

Oficina en EE. UU.

Generation Digital Américas Inc

77 Sands St,

Brooklyn, NY 11201,

Estados Unidos

Oficina de la UE

Software Generación Digital

Edificio Elgee

Dundalk

A91 X2R3

Irlanda

Oficina en Medio Oriente

6994 Alsharq 3890,

An Narjis,

Riad 13343,

Arabia Saudita

Número de la empresa: 256 9431 77 | Derechos de autor 2026 | Términos y Condiciones | Política de Privacidad

Generación

Digital

Oficina en Reino Unido

Generation Digital Ltd

33 Queen St,

Londres

EC4R 1AP

Reino Unido

Oficina en Canadá

Generation Digital Americas Inc

181 Bay St., Suite 1800

Toronto, ON, M5J 2T9

Canadá

Oficina en EE. UU.

Generation Digital Américas Inc

77 Sands St,

Brooklyn, NY 11201,

Estados Unidos

Oficina de la UE

Software Generación Digital

Edificio Elgee

Dundalk

A91 X2R3

Irlanda

Oficina en Medio Oriente

6994 Alsharq 3890,

An Narjis,

Riad 13343,

Arabia Saudita