La Computación Cuántica Mejora el Rendimiento y la Seguridad Bancaria

La Computación Cuántica Mejora el Rendimiento y la Seguridad Bancaria

17 dic 2025

Not sure what to do next with AI?

Assess readiness, risk, and priorities in under an hour.

Not sure what to do next with AI?

Assess readiness, risk, and priorities in under an hour.

➔ Reserva una Consulta

Los bancos están utilizando análisis híbridos cuántico-clásicos para mejorar el comercio y el riesgo mientras migran al PQC estándar de NIST para defenderse contra amenazas cuánticas, logrando ganancias de rendimiento y seguridad a largo plazo en paralelo.

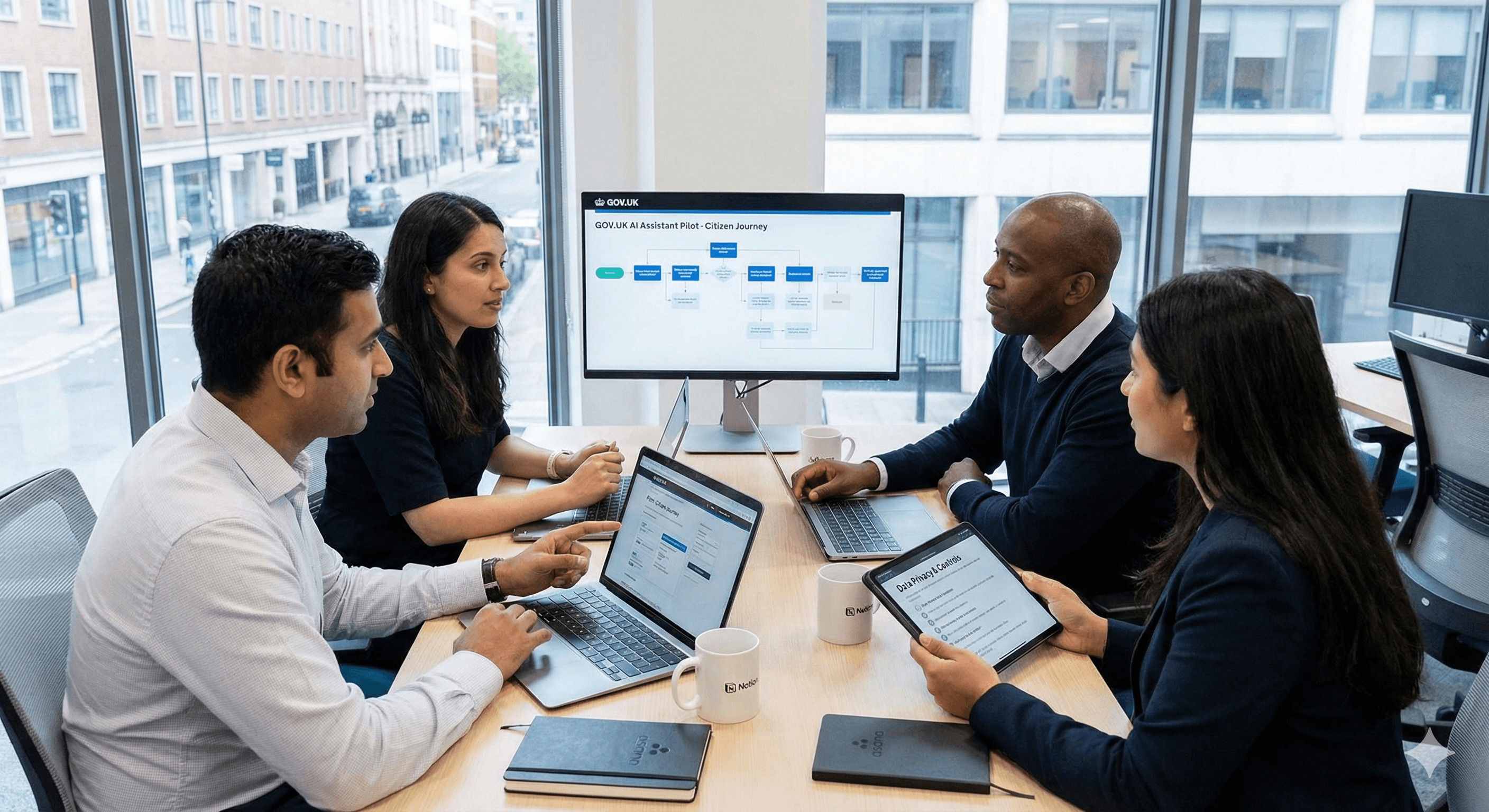

La quantum ya no es solo I+D. Los bancos están probando análisis híbridos cuántico-clásicos para comercio y riesgo, mientras los equipos de seguridad comienzan la migración al PQC para defenderse de “cosechar ahora, descifrar después”. La última perspectiva bancaria de McKinsey y el ensayo 2025 de HSBC–IBM muestran un progreso tangible, por lo que el movimiento inteligente es construir valor y resiliencia en paralelo.

Beneficios clave

Mejora de rendimiento (a corto plazo): Los métodos híbridos cuántico-clásicos mejoran cargas de trabajo específicas: optimización de portafolios y colateral, probabilidad de ganar un RFQ y precios de Monte Carlo, superando los puntos de referencia clásicos en pruebas iniciales.

Durabilidad de seguridad (imprescindible): Con los estándares PQC de NIST finalizados y las líneas de tiempo del NCSC del Reino Unido publicadas, los consejos deben tratar el PQC como un programa de cambio a 10 años, no como un parche.

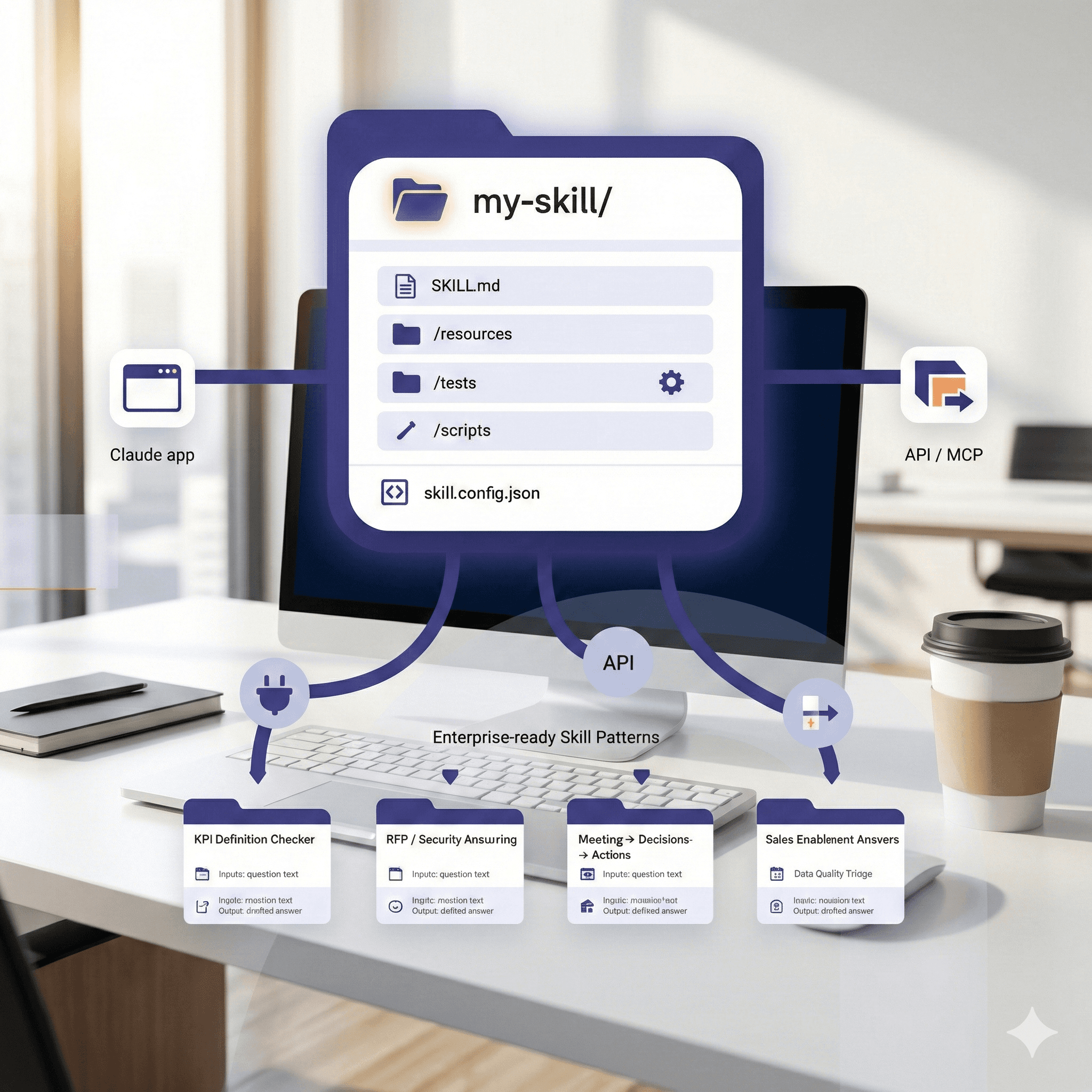

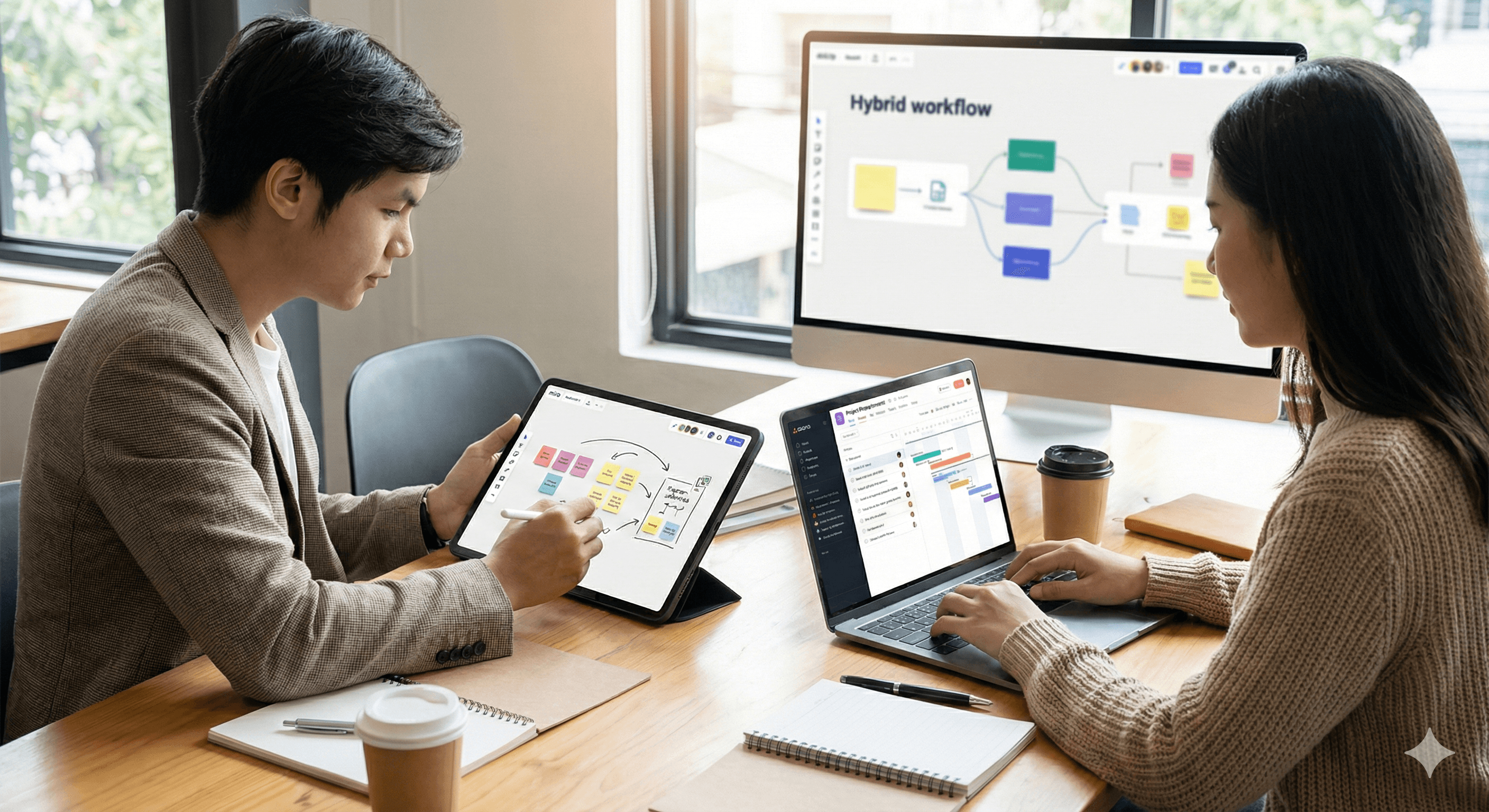

Ajuste para la transformación digital: La quantum se convierte en un carril de capacidades: datos / modelos / computación orquestados en clásico, GPU y cuántico, con agilidad criptográfica integrada en cada capa.

Cómo funciona

Análisis: El trabajo cuántico moderno en finanzas es híbrido, usando procesadores cuánticos a corto plazo junto con IA/ML clásica. HSBC e IBM reportaron hasta un 34% mejor predicción de ejecución de RFQ de bonos usando características transformadas cuánticamente en datos reales de bonos corporativos europeos, una de las señales más fuertes del sector hasta ahora.

Seguridad: En agosto de 2024, NIST finalizó tres estándares PQC: FIPS 203 (ML-KEM) para establecimiento de claves, FIPS 204 (ML-DSA) y FIPS 205 (SLH-DSA) para firmas, iniciando migraciones empresariales; el NCSC del Reino Unido emitió líneas de tiempo de migración (identificar para 2028, priorizar para 2031, transitar para 2035).

Chequeo de realidad: la mayoría de los logros “en producción” hoy en día son inspirados en cuántica o híbridos; la ventaja cuántica completa para cargas de trabajo bancarias amplias aún está emergiendo, pero el reloj de seguridad ya está en marcha. Evident Insights

Pasos prácticos (un plan de 12 meses que realmente puede ejecutar)

A) Pista alfa — creación de valor con análisis cuánticos

Escoja 1–2 problemas rentables: optimización de portafolios o colateral, probabilidad de ganar RFQ, o estrés de XVA. Construya una métrica de éxito (p. ej., deslizamiento, aumento de atribución de PnL). McKinsey & Company

Configure una pila híbrida: tuberías clásicas + simulación GPU + acceso a un servicio cuántico administrado (a través de socios). Reutilice bibliotecas y esquemas de descomposición tipo QAOA/QAOA para universos de tamaño real. jpmorganchase.com

Ejecute un piloto limitado en datos históricos → modo sombra limitado en vivo → alternancias de producción protegidas. Publique un análisis post-mortem sea cual sea el resultado. Financial Times

B) Pista beta — cuántico-seguro por diseño (migración PQC)

Cree un inventario criptográfico: mapee dónde viven RSA/ECDH/ECDSA (TLS, mensajería, HSMs, aplicaciones, proveedores). Trátelo como un registro de activos regulatorio. CISA

Adopte TLS híbrido ahora donde sea posible (p. ej., X25519+ML-KEM-768) para contrarrestar el captura ahora/descifra después; las principales redes de distribución de contenido ya protegen a la mayoría del tráfico web humano con PQC. Control Plane

Priorice datos y claves de larga vida (pagos, KYC, archivos). Migre el primer firmamento para software/firmware y CAs raíz; luego intercambio de claves. NCSC

Fije hitos alineados con el NCSC: descubrimiento para 2028, actualizaciones prioritarias para 2031, transición amplia para 2035, con responsabilidad a nivel de junta. NCSC

Ejemplos que lo hacen real

HSBC × IBM (2025): las características híbridas cuánticas mejoraron la predicción de ejecución de RFQ en un ~34% en bonos corporativos europeos, evidencia de que los dispositivos ruidosos pueden ayudar cuando se combinan con ML clásico.

Investigación de JPMorgan: aceleraciones teóricas para QAOA en tareas de optimización; código abierto QOKit para simulaciones escalables.

Pipelines de optimización de portafolios: descomposición cuántico/clásica para grandes portafolios con restricciones (JPMorgan × AWS × Caltech, 2024).

Optimización de colateral: McKinsey destaca la adecuada adaptación de la cuántica para problemas de asignación con muchas restricciones— ganancias en costos y liquidez cuando se escala.

Preguntas frecuentes

P1: ¿Cómo cambia la cuántica las estrategias de inversión?

Acelerando la optimización combinatoria y el análisis tipo Monte Carlo, por ejemplo, una mejor asignación de portafolios/colateral y orientación de RFQ, a menudo a través de modelos híbridos que superan los puntos de referencia clásicos en pilotos. Financial Times

P2: ¿Qué papel juega la cuántica en la ciberseguridad?

El cambio principal es la criptografía post-cuántica. Los estándares ML-KEM/ML-DSA/SLH-DSA de NIST ahora son estándares; el NCSC del Reino Unido ha establecido cronogramas de migración. TLS híbrido ayuda hoy contra captura ahora, descifra después. NIST | NCSC

P3: ¿Realmente los bancos lo están usando?

Sí, varios bancos de nivel uno están ejecutando pilotos híbridos (por ejemplo, comercio de bonos de HSBC–IBM) mientras establecen programas PQC alineados con la orientación del NCSC/CISA. Financial Times

Resumen

Trate la cuántica como dos programas: (1) un camino de valor apuntando a un puñado de análisis de alto impacto donde lo cuántico híbrido puede elevar los resultados; y (2) un camino de seguridad que ejecute la migración PQC con agilidad criptográfica, TLS híbrido y gobernanza de proveedores. Comience ahora; mida con firmeza; evite el exceso de entusiasmo.

Los bancos están utilizando análisis híbridos cuántico-clásicos para mejorar el comercio y el riesgo mientras migran al PQC estándar de NIST para defenderse contra amenazas cuánticas, logrando ganancias de rendimiento y seguridad a largo plazo en paralelo.

La quantum ya no es solo I+D. Los bancos están probando análisis híbridos cuántico-clásicos para comercio y riesgo, mientras los equipos de seguridad comienzan la migración al PQC para defenderse de “cosechar ahora, descifrar después”. La última perspectiva bancaria de McKinsey y el ensayo 2025 de HSBC–IBM muestran un progreso tangible, por lo que el movimiento inteligente es construir valor y resiliencia en paralelo.

Beneficios clave

Mejora de rendimiento (a corto plazo): Los métodos híbridos cuántico-clásicos mejoran cargas de trabajo específicas: optimización de portafolios y colateral, probabilidad de ganar un RFQ y precios de Monte Carlo, superando los puntos de referencia clásicos en pruebas iniciales.

Durabilidad de seguridad (imprescindible): Con los estándares PQC de NIST finalizados y las líneas de tiempo del NCSC del Reino Unido publicadas, los consejos deben tratar el PQC como un programa de cambio a 10 años, no como un parche.

Ajuste para la transformación digital: La quantum se convierte en un carril de capacidades: datos / modelos / computación orquestados en clásico, GPU y cuántico, con agilidad criptográfica integrada en cada capa.

Cómo funciona

Análisis: El trabajo cuántico moderno en finanzas es híbrido, usando procesadores cuánticos a corto plazo junto con IA/ML clásica. HSBC e IBM reportaron hasta un 34% mejor predicción de ejecución de RFQ de bonos usando características transformadas cuánticamente en datos reales de bonos corporativos europeos, una de las señales más fuertes del sector hasta ahora.

Seguridad: En agosto de 2024, NIST finalizó tres estándares PQC: FIPS 203 (ML-KEM) para establecimiento de claves, FIPS 204 (ML-DSA) y FIPS 205 (SLH-DSA) para firmas, iniciando migraciones empresariales; el NCSC del Reino Unido emitió líneas de tiempo de migración (identificar para 2028, priorizar para 2031, transitar para 2035).

Chequeo de realidad: la mayoría de los logros “en producción” hoy en día son inspirados en cuántica o híbridos; la ventaja cuántica completa para cargas de trabajo bancarias amplias aún está emergiendo, pero el reloj de seguridad ya está en marcha. Evident Insights

Pasos prácticos (un plan de 12 meses que realmente puede ejecutar)

A) Pista alfa — creación de valor con análisis cuánticos

Escoja 1–2 problemas rentables: optimización de portafolios o colateral, probabilidad de ganar RFQ, o estrés de XVA. Construya una métrica de éxito (p. ej., deslizamiento, aumento de atribución de PnL). McKinsey & Company

Configure una pila híbrida: tuberías clásicas + simulación GPU + acceso a un servicio cuántico administrado (a través de socios). Reutilice bibliotecas y esquemas de descomposición tipo QAOA/QAOA para universos de tamaño real. jpmorganchase.com

Ejecute un piloto limitado en datos históricos → modo sombra limitado en vivo → alternancias de producción protegidas. Publique un análisis post-mortem sea cual sea el resultado. Financial Times

B) Pista beta — cuántico-seguro por diseño (migración PQC)

Cree un inventario criptográfico: mapee dónde viven RSA/ECDH/ECDSA (TLS, mensajería, HSMs, aplicaciones, proveedores). Trátelo como un registro de activos regulatorio. CISA

Adopte TLS híbrido ahora donde sea posible (p. ej., X25519+ML-KEM-768) para contrarrestar el captura ahora/descifra después; las principales redes de distribución de contenido ya protegen a la mayoría del tráfico web humano con PQC. Control Plane

Priorice datos y claves de larga vida (pagos, KYC, archivos). Migre el primer firmamento para software/firmware y CAs raíz; luego intercambio de claves. NCSC

Fije hitos alineados con el NCSC: descubrimiento para 2028, actualizaciones prioritarias para 2031, transición amplia para 2035, con responsabilidad a nivel de junta. NCSC

Ejemplos que lo hacen real

HSBC × IBM (2025): las características híbridas cuánticas mejoraron la predicción de ejecución de RFQ en un ~34% en bonos corporativos europeos, evidencia de que los dispositivos ruidosos pueden ayudar cuando se combinan con ML clásico.

Investigación de JPMorgan: aceleraciones teóricas para QAOA en tareas de optimización; código abierto QOKit para simulaciones escalables.

Pipelines de optimización de portafolios: descomposición cuántico/clásica para grandes portafolios con restricciones (JPMorgan × AWS × Caltech, 2024).

Optimización de colateral: McKinsey destaca la adecuada adaptación de la cuántica para problemas de asignación con muchas restricciones— ganancias en costos y liquidez cuando se escala.

Preguntas frecuentes

P1: ¿Cómo cambia la cuántica las estrategias de inversión?

Acelerando la optimización combinatoria y el análisis tipo Monte Carlo, por ejemplo, una mejor asignación de portafolios/colateral y orientación de RFQ, a menudo a través de modelos híbridos que superan los puntos de referencia clásicos en pilotos. Financial Times

P2: ¿Qué papel juega la cuántica en la ciberseguridad?

El cambio principal es la criptografía post-cuántica. Los estándares ML-KEM/ML-DSA/SLH-DSA de NIST ahora son estándares; el NCSC del Reino Unido ha establecido cronogramas de migración. TLS híbrido ayuda hoy contra captura ahora, descifra después. NIST | NCSC

P3: ¿Realmente los bancos lo están usando?

Sí, varios bancos de nivel uno están ejecutando pilotos híbridos (por ejemplo, comercio de bonos de HSBC–IBM) mientras establecen programas PQC alineados con la orientación del NCSC/CISA. Financial Times

Resumen

Trate la cuántica como dos programas: (1) un camino de valor apuntando a un puñado de análisis de alto impacto donde lo cuántico híbrido puede elevar los resultados; y (2) un camino de seguridad que ejecute la migración PQC con agilidad criptográfica, TLS híbrido y gobernanza de proveedores. Comience ahora; mida con firmeza; evite el exceso de entusiasmo.

Recibe consejos prácticos directamente en tu bandeja de entrada

Al suscribirte, das tu consentimiento para que Generation Digital almacene y procese tus datos de acuerdo con nuestra política de privacidad. Puedes leer la política completa en gend.co/privacy.

Generación

Digital

Oficina en el Reino Unido

33 Queen St,

Londres

EC4R 1AP

Reino Unido

Oficina en Canadá

1 University Ave,

Toronto,

ON M5J 1T1,

Canadá

Oficina NAMER

77 Sands St,

Brooklyn,

NY 11201,

Estados Unidos

Oficina EMEA

Calle Charlemont, Saint Kevin's, Dublín,

D02 VN88,

Irlanda

Oficina en Medio Oriente

6994 Alsharq 3890,

An Narjis,

Riyadh 13343,

Arabia Saudita

Número de la empresa: 256 9431 77 | Derechos de autor 2026 | Términos y Condiciones | Política de Privacidad

Generación

Digital

Oficina en el Reino Unido

33 Queen St,

Londres

EC4R 1AP

Reino Unido

Oficina en Canadá

1 University Ave,

Toronto,

ON M5J 1T1,

Canadá

Oficina NAMER

77 Sands St,

Brooklyn,

NY 11201,

Estados Unidos

Oficina EMEA

Calle Charlemont, Saint Kevin's, Dublín,

D02 VN88,

Irlanda

Oficina en Medio Oriente

6994 Alsharq 3890,

An Narjis,

Riyadh 13343,

Arabia Saudita