Les charges de travail d'IA transforment l'économie des centres de données

Les charges de travail d'IA transforment l'économie des centres de données

IA

17 déc. 2025

Not sure what to do next with AI?

Assess readiness, risk, and priorities in under an hour.

Not sure what to do next with AI?

Assess readiness, risk, and priorities in under an hour.

➔ Réservez une consultation

.

Étapes pratiques ou exemples

Se procurer de l'énergie tôt. Priorisez les sites avec une capacité de réseau confirmée ou une puissance de transition crédible; alignez les PPA/renouvelables pour couvrir la volatilité et répondre aux critères ESG.

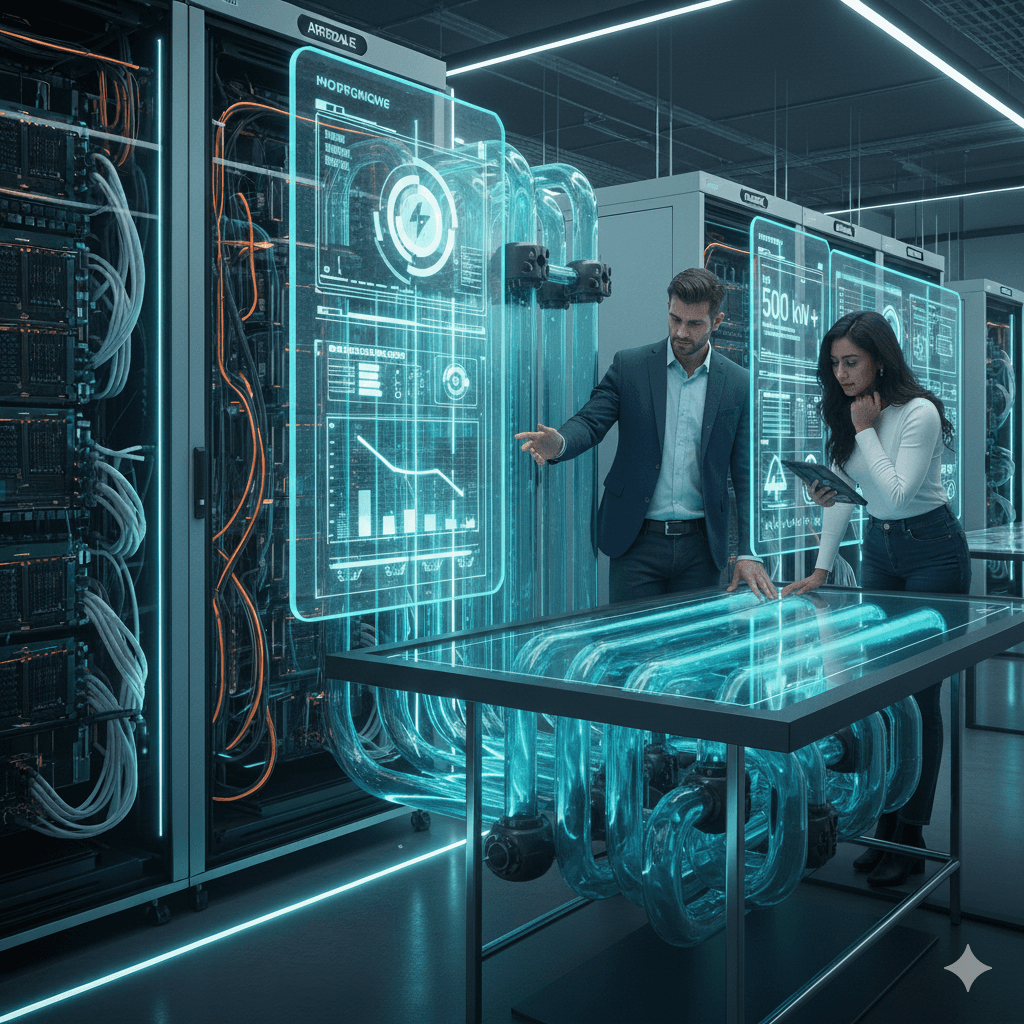

Concevez pour la densité. Planifiez les allées et l'espace blanc pour des racks IA de 50–300 kW et des rétrofits de refroidissement liquide—même si la phase 1 démarre à une densité inférieure.

Ingénierie pour l'efficacité, pas seulement le PUE. Utilisez des modèles énergétiques mis à jour et de la télémétrie; alors que la part de charge informatique augmente, l'efficacité de l'infrastructure (et l'utilisation de l'eau) impactent encore significativement l'OPEX.

Louez avec flexibilité. Structurez des calendriers de rampes échelonnées et d'obligations de paiement qui alignent la livraison de MW avec les arrivées de clusters GPU pour réduire la capacité inutilisée. Les données du marché montrent que les locataires IA stimulent l'absorption et les augmentations de loyers.

FAQ

Q1 : Comment les charges de travail de l'IA influencent-elles les opérations des centres de données ?

Elles priorisent la disponibilité et la densité de la puissance plutôt que l'espace brut, accélérant le refroidissement liquide et les opérations optimisées énergétiquement pour maintenir les clusters de GPU. tomshardware.com

Q2 : Quels sont les impacts économiques sur les décisions de location et de construction ?

L'absorption record, la hausse des loyers et les délais de connexion poussent vers une location axée sur la puissance et des rampes de MW en phases; les sites avec capacité ferme commandent des primes. CBRE

Q3 : Comment les centres de données s'adaptent-ils techniquement ?

En concevant pour des racks de 50–300 kW+, en adoptant le refroidissement liquide, en optimisant le flux d'air/réutilisation de la chaleur et en explorant la distribution d'énergie haute tension et les solutions de puissance de transition. Aon | tomshardware.com | Airedale

Q4 : L'impact environnemental augmente-t-il ?

Oui—les empreintes d'énergie et d'eau sont scrutées; les opérateurs répondent avec de l'efficacité, des renouvelables et des stratégies de récupération de chaleur, alors que les études prévoient une croissance continue des charges IA. The Verge

Résumé

L'IA est désormais le centre de gravité pour l'économie des centres de données. Pour rester compétitif, priorisez des sites sécurisés en MW, des conceptions prêtes pour la densité et des baux flexibles, soutenus par des plans clairs d'efficacité et de durabilité. C'est ainsi que les opérateurs livrent rapidement la capacité IA sans trop dépenser pour de l'énergie inutilisée ou des rénovations prématurées.

.

Étapes pratiques ou exemples

Se procurer de l'énergie tôt. Priorisez les sites avec une capacité de réseau confirmée ou une puissance de transition crédible; alignez les PPA/renouvelables pour couvrir la volatilité et répondre aux critères ESG.

Concevez pour la densité. Planifiez les allées et l'espace blanc pour des racks IA de 50–300 kW et des rétrofits de refroidissement liquide—même si la phase 1 démarre à une densité inférieure.

Ingénierie pour l'efficacité, pas seulement le PUE. Utilisez des modèles énergétiques mis à jour et de la télémétrie; alors que la part de charge informatique augmente, l'efficacité de l'infrastructure (et l'utilisation de l'eau) impactent encore significativement l'OPEX.

Louez avec flexibilité. Structurez des calendriers de rampes échelonnées et d'obligations de paiement qui alignent la livraison de MW avec les arrivées de clusters GPU pour réduire la capacité inutilisée. Les données du marché montrent que les locataires IA stimulent l'absorption et les augmentations de loyers.

FAQ

Q1 : Comment les charges de travail de l'IA influencent-elles les opérations des centres de données ?

Elles priorisent la disponibilité et la densité de la puissance plutôt que l'espace brut, accélérant le refroidissement liquide et les opérations optimisées énergétiquement pour maintenir les clusters de GPU. tomshardware.com

Q2 : Quels sont les impacts économiques sur les décisions de location et de construction ?

L'absorption record, la hausse des loyers et les délais de connexion poussent vers une location axée sur la puissance et des rampes de MW en phases; les sites avec capacité ferme commandent des primes. CBRE

Q3 : Comment les centres de données s'adaptent-ils techniquement ?

En concevant pour des racks de 50–300 kW+, en adoptant le refroidissement liquide, en optimisant le flux d'air/réutilisation de la chaleur et en explorant la distribution d'énergie haute tension et les solutions de puissance de transition. Aon | tomshardware.com | Airedale

Q4 : L'impact environnemental augmente-t-il ?

Oui—les empreintes d'énergie et d'eau sont scrutées; les opérateurs répondent avec de l'efficacité, des renouvelables et des stratégies de récupération de chaleur, alors que les études prévoient une croissance continue des charges IA. The Verge

Résumé

L'IA est désormais le centre de gravité pour l'économie des centres de données. Pour rester compétitif, priorisez des sites sécurisés en MW, des conceptions prêtes pour la densité et des baux flexibles, soutenus par des plans clairs d'efficacité et de durabilité. C'est ainsi que les opérateurs livrent rapidement la capacité IA sans trop dépenser pour de l'énergie inutilisée ou des rénovations prématurées.

Recevez des conseils pratiques directement dans votre boîte de réception

En vous abonnant, vous consentez à ce que Génération Numérique stocke et traite vos informations conformément à notre politique de confidentialité. Vous pouvez lire la politique complète sur gend.co/privacy.

Génération

Numérique

Bureau au Royaume-Uni

33 rue Queen,

Londres

EC4R 1AP

Royaume-Uni

Bureau au Canada

1 University Ave,

Toronto,

ON M5J 1T1,

Canada

Bureau NAMER

77 Sands St,

Brooklyn,

NY 11201,

États-Unis

Bureau EMEA

Rue Charlemont, Saint Kevin's, Dublin,

D02 VN88,

Irlande

Bureau du Moyen-Orient

6994 Alsharq 3890,

An Narjis,

Riyad 13343,

Arabie Saoudite

Numéro d'entreprise : 256 9431 77 | Droits d'auteur 2026 | Conditions générales | Politique de confidentialité

Génération

Numérique

Bureau au Royaume-Uni

33 rue Queen,

Londres

EC4R 1AP

Royaume-Uni

Bureau au Canada

1 University Ave,

Toronto,

ON M5J 1T1,

Canada

Bureau NAMER

77 Sands St,

Brooklyn,

NY 11201,

États-Unis

Bureau EMEA

Rue Charlemont, Saint Kevin's, Dublin,

D02 VN88,

Irlande

Bureau du Moyen-Orient

6994 Alsharq 3890,

An Narjis,

Riyad 13343,

Arabie Saoudite

Numéro d'entreprise : 256 9431 77

Conditions générales

Politique de confidentialité

Droit d'auteur 2026