DBS Bank: AI and Google Cloud Enhance Productivity by 2025

DBS Bank: AI and Google Cloud Enhance Productivity by 2025

Gather

Dec 10, 2025

Not sure what to do next with AI?

Assess readiness, risk, and priorities in under an hour.

Not sure what to do next with AI?

Assess readiness, risk, and priorities in under an hour.

➔ Schedule a Consultation

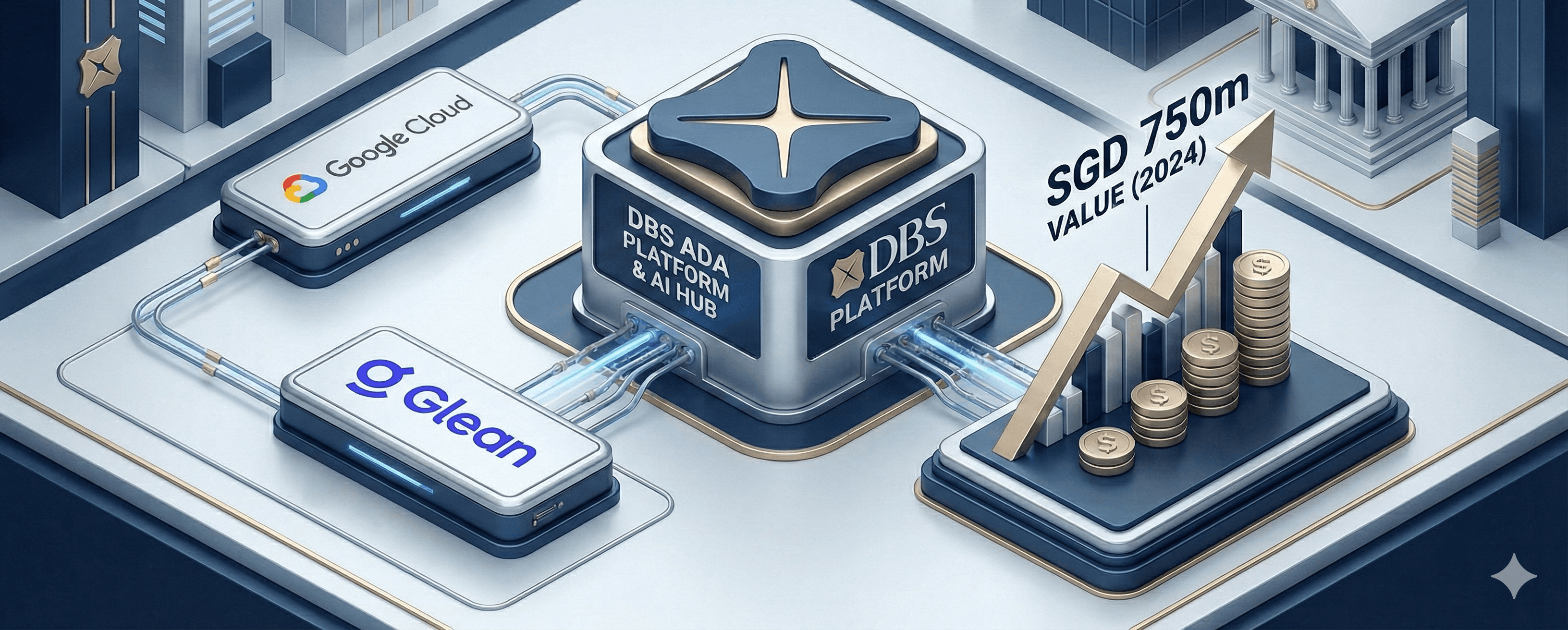

DBS Bank’s AI program has transitioned from pilot phases to full-scale platforms. By integrating Google Cloud — particularly Vertex AI — with its internal ADA platform and layering Glean’s Work AI, DBS has made AI an everyday asset for tens of thousands of employees. The impact is substantial: independent reports and industry analyses project roughly SGD 750 million (≈USD 563m) in economic value attributable to AI in 2024, with further growth expected in 2025.

Why it matters now

In banking, productivity is increasingly defined by how rapidly teams can locate information, summarize complex data, and safely initiate routine actions. DBS’s strategy demonstrates how to merge a managed data foundation (ADA), a robust model platform (Vertex AI), and a Work AI layer (Glean) to achieve time savings and improved decision-making — all while maintaining compliance.

What’s new?

Platform integration: Google Cloud’s Vertex AI is integrated into DBS’s self-service data platform (ADA), facilitating rapid scaling of use cases and automated infrastructure management as data volumes expand.

Measurable value: External evaluations report ~SGD 750m in value stemming from AI in 2024, reflecting broad-based productivity and revenue use cases.

Recognition: DBS was named World’s Best AI Bank in 2025, underscoring comprehensive execution throughout operations and customer experiences.

Work AI at scale: Glean and Google Cloud are credited with enabling 40,000 employees to work more efficiently and unlock new AI agents and bots; reports suggest 5–10% time savings in daily work. (Claim per partner communications.)

How the stack works

Data foundation (ADA): Clean, governed data products ensure safe AI operation with access controls and lineage keeping auditors satisfied.

Model platform (Vertex AI): Teams use managed tools to build, evaluate, and deploy diverse use cases — ranging from summarization and classification to agentic workflows with advanced models.

Work AI layer (Glean): Employees can search across systems, generate reports, and initiate actions using agents integrated into daily tools, reducing the “find-understand-act” cycle across operations, risk, and customer service teams. (Per vendor + public materials.)

Guardrails: Policies and monitoring enforce responsible AI — a critical aspect in regulated banking. DBS publishes its responsible AI approach, stressing governance and trust.

Practical examples

Operations: AI decreases manual processing time in essential back-office workflows; analysts report significant time reductions alongside increased throughput.

Frontline knowledge: Staff can seamlessly access knowledge across systems and create summaries rapidly, facilitating quicker, more consistent customer interactions. (Per partner communications.)

Risk & compliance: Generative AI speeds up adverse news screening and documentation processes, allowing teams to concentrate on assessments rather than sifting through information.

A repeatable rollout blueprint

Start with a governed data layer. Initially define high-value data products and access policies; remember that AI without clean, accessible data can falter.

Adopt a managed model platform. Focus on standardizing tools like Vertex AI for evaluation, deployment, and monitoring to prevent tool proliferation.

Activate Work AI for employees. Implement an enterprise-search and assistant layer (e.g., Glean) to transition AI into daily productivity — beyond just a testing project.

Measure, then scale. Track time savings, throughput, quality, and risk outcomes; reinvest where results are proven (DBS’s 2024 figures showcase compounding effects).

Embed responsible AI. Incorporate model governance, human-in-the-loop processes, and audit trails from the onset.

Results to watch

Time saved per employee: Partner communications suggest 5–10% time savings at DBS from Work AI — a valuable benchmark for business cases. (Directional; validate locally.)

Value creation: Monitor economic impacts akin to DBS’s reported ~SGD 750m (2024) as programs develop.

Recognition & resilience metrics: Awards and case studies indicate maturity; operational KPIs (cycle times, error rates) demonstrate durability.

Summary & next steps

DBS exemplifies that productivity gains stem from comprehensive system design, not isolated pilot projects: governed data (ADA), a robust AI platform (Vertex AI), and a Work AI layer (Glean) integrated into employee workflows. When building your roadmap, start with one or two cross-functional use cases, establish governance, and continuously measure outcomes.

Talk to Generation Digital to plan a pilot combining Google Cloud and Glean for swift, secure productivity gains — then scale effectively.

FAQ

How does AI enhance productivity at DBS Bank?

By streamlining the “find-understand-act” process: enterprise search, summarization, and agents diminish manual tasks while accelerating decision-making across teams.

What role does Google Cloud play?

Google Cloud’s Vertex AI supports model development, evaluation, and deployment, integrated with DBS’s ADA platform to securely scale use cases.

Where does Glean fit?

Glean establishes the Work AI layer — enabling search, assistant, and agent workflows across daily tools — contributing to overall employee productivity. (Per vendor materials.)

Is this approach acknowledged by the industry?

Yes. DBS was recognized as the World’s Best AI Bank in 2025, highlighting their execution at scale.

DBS Bank’s AI program has transitioned from pilot phases to full-scale platforms. By integrating Google Cloud — particularly Vertex AI — with its internal ADA platform and layering Glean’s Work AI, DBS has made AI an everyday asset for tens of thousands of employees. The impact is substantial: independent reports and industry analyses project roughly SGD 750 million (≈USD 563m) in economic value attributable to AI in 2024, with further growth expected in 2025.

Why it matters now

In banking, productivity is increasingly defined by how rapidly teams can locate information, summarize complex data, and safely initiate routine actions. DBS’s strategy demonstrates how to merge a managed data foundation (ADA), a robust model platform (Vertex AI), and a Work AI layer (Glean) to achieve time savings and improved decision-making — all while maintaining compliance.

What’s new?

Platform integration: Google Cloud’s Vertex AI is integrated into DBS’s self-service data platform (ADA), facilitating rapid scaling of use cases and automated infrastructure management as data volumes expand.

Measurable value: External evaluations report ~SGD 750m in value stemming from AI in 2024, reflecting broad-based productivity and revenue use cases.

Recognition: DBS was named World’s Best AI Bank in 2025, underscoring comprehensive execution throughout operations and customer experiences.

Work AI at scale: Glean and Google Cloud are credited with enabling 40,000 employees to work more efficiently and unlock new AI agents and bots; reports suggest 5–10% time savings in daily work. (Claim per partner communications.)

How the stack works

Data foundation (ADA): Clean, governed data products ensure safe AI operation with access controls and lineage keeping auditors satisfied.

Model platform (Vertex AI): Teams use managed tools to build, evaluate, and deploy diverse use cases — ranging from summarization and classification to agentic workflows with advanced models.

Work AI layer (Glean): Employees can search across systems, generate reports, and initiate actions using agents integrated into daily tools, reducing the “find-understand-act” cycle across operations, risk, and customer service teams. (Per vendor + public materials.)

Guardrails: Policies and monitoring enforce responsible AI — a critical aspect in regulated banking. DBS publishes its responsible AI approach, stressing governance and trust.

Practical examples

Operations: AI decreases manual processing time in essential back-office workflows; analysts report significant time reductions alongside increased throughput.

Frontline knowledge: Staff can seamlessly access knowledge across systems and create summaries rapidly, facilitating quicker, more consistent customer interactions. (Per partner communications.)

Risk & compliance: Generative AI speeds up adverse news screening and documentation processes, allowing teams to concentrate on assessments rather than sifting through information.

A repeatable rollout blueprint

Start with a governed data layer. Initially define high-value data products and access policies; remember that AI without clean, accessible data can falter.

Adopt a managed model platform. Focus on standardizing tools like Vertex AI for evaluation, deployment, and monitoring to prevent tool proliferation.

Activate Work AI for employees. Implement an enterprise-search and assistant layer (e.g., Glean) to transition AI into daily productivity — beyond just a testing project.

Measure, then scale. Track time savings, throughput, quality, and risk outcomes; reinvest where results are proven (DBS’s 2024 figures showcase compounding effects).

Embed responsible AI. Incorporate model governance, human-in-the-loop processes, and audit trails from the onset.

Results to watch

Time saved per employee: Partner communications suggest 5–10% time savings at DBS from Work AI — a valuable benchmark for business cases. (Directional; validate locally.)

Value creation: Monitor economic impacts akin to DBS’s reported ~SGD 750m (2024) as programs develop.

Recognition & resilience metrics: Awards and case studies indicate maturity; operational KPIs (cycle times, error rates) demonstrate durability.

Summary & next steps

DBS exemplifies that productivity gains stem from comprehensive system design, not isolated pilot projects: governed data (ADA), a robust AI platform (Vertex AI), and a Work AI layer (Glean) integrated into employee workflows. When building your roadmap, start with one or two cross-functional use cases, establish governance, and continuously measure outcomes.

Talk to Generation Digital to plan a pilot combining Google Cloud and Glean for swift, secure productivity gains — then scale effectively.

FAQ

How does AI enhance productivity at DBS Bank?

By streamlining the “find-understand-act” process: enterprise search, summarization, and agents diminish manual tasks while accelerating decision-making across teams.

What role does Google Cloud play?

Google Cloud’s Vertex AI supports model development, evaluation, and deployment, integrated with DBS’s ADA platform to securely scale use cases.

Where does Glean fit?

Glean establishes the Work AI layer — enabling search, assistant, and agent workflows across daily tools — contributing to overall employee productivity. (Per vendor materials.)

Is this approach acknowledged by the industry?

Yes. DBS was recognized as the World’s Best AI Bank in 2025, highlighting their execution at scale.

Receive practical advice directly in your inbox

By subscribing, you agree to allow Generation Digital to store and process your information according to our privacy policy. You can review the full policy at gend.co/privacy.

Generation

Digital

Business Number: 256 9431 77 | Copyright 2026 | Terms and Conditions | Privacy Policy

Generation

Digital