Leveraging AI: Strategic Data Insights at JPMorgan Chase

Leveraging AI: Strategic Data Insights at JPMorgan Chase

Artificial Intelligence

Dec 18, 2025

Not sure what to do next with AI?

Assess readiness, risk, and priorities in under an hour.

Not sure what to do next with AI?

Assess readiness, risk, and priorities in under an hour.

➔ Schedule a Consultation

Why this matters now

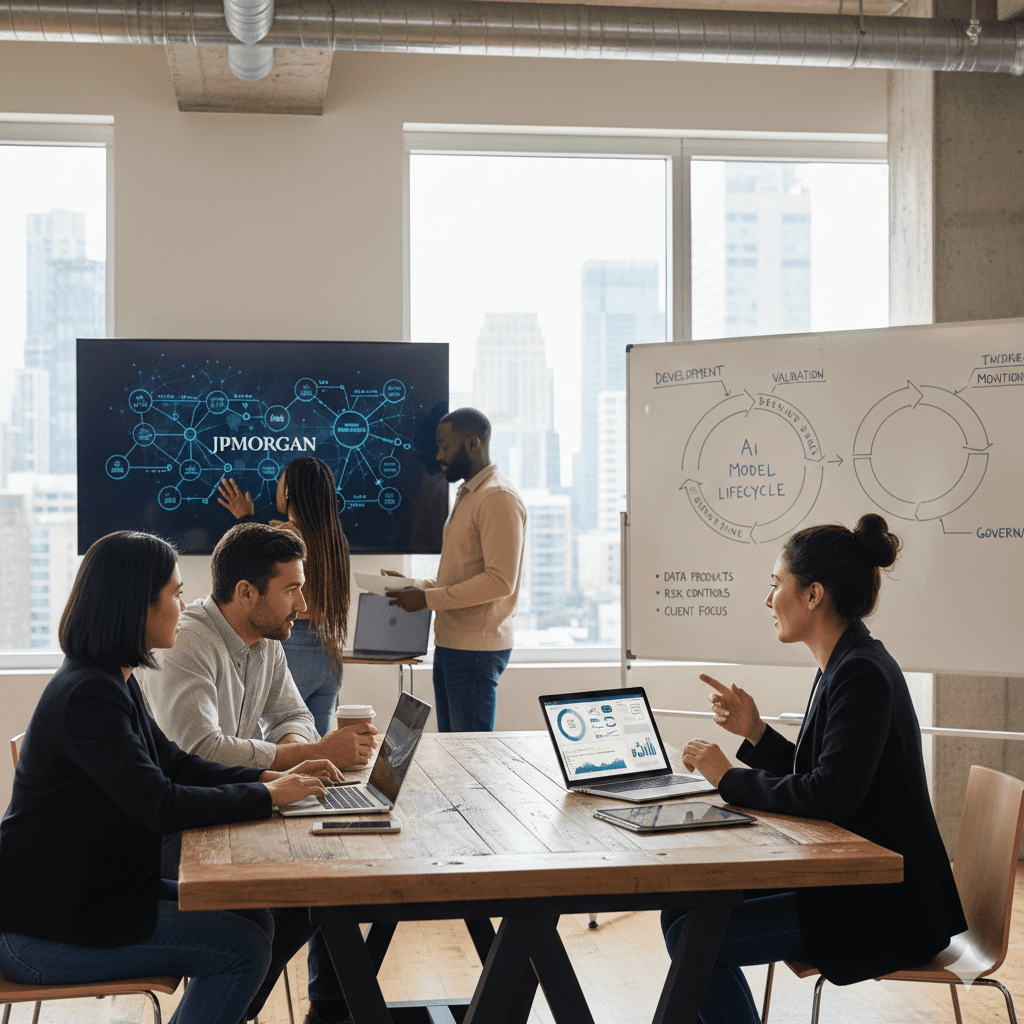

Banks with strong data foundations are converting AI from pilots into measurable value. JPMorgan Chase illustrates how to scale responsibly: building governed data products, operationalising model risk controls, and applying AI where it moves the needle—client service, risk, and engineering productivity. The result is faster decisions, better controls, and sharper execution.

Leadership and operating model

Firmwide CDO: Under the Firmwide Chief Data Officer, JPMorgan structures data governance, quality standards, and access patterns that feed AI safely. The CDO function aligns data platforms with model risk management (MRM), legal, and security. This top‑down mandate helps product teams ship AI features within clear control frameworks.

Technology leadership: The bank funds AI as part of a multi‑year modernisation agenda, prioritising platform investments (data fabric, catalogues, feature stores) and AI enablement (LLM platforms, coding assistants). This operating model balances central standards with federated execution.

What’s new: from platforms to outcomes

Internal LLM and copilots: Employees use internal large‑language‑model tools for research, summarisation, and workflow acceleration, reducing manual effort in advisory, operations, and engineering.

450+ GenAI use cases in motion: Most early wins appear in back‑office efficiency and knowledge work, with targeted deployment for frontline teams.

Engineering productivity: A coding assistant accelerates boilerplate and test generation, freeing engineers for higher‑value work and improving delivery velocity.

Commercial impact: AI supports client service during volatility and contributes to sales growth in wealth and advisory channels.

Data foundations that make AI dependable

1) Governed data products. Curated, discoverable data products—exposed via catalogues and access policies—allow AI services to rely on consistent definitions and lineage.

2) Real‑time and near‑real‑time analytics. Streaming pipelines bring payments, transactions, and interaction data into models faster, powering timely alerts (e.g., fraud) and more responsive service.

3) Model lifecycle and risk controls. AI models pass through documented lifecycle stages (development, validation, monitoring). Controls cover bias, drift, performance, and explainability, with audit‑ready traces.

4) Human‑in‑the‑loop. Sensitive decisions (credit, trading, KYC) retain expert oversight. AI augments, not replaces, regulated judgements.

Practical applications

Fraud and financial crime: Machine‑learning models detect anomalous behaviour across channels, reducing false positives and accelerating genuine‑case handling.

Risk and treasury: AI assists with stress scenarios, early‑warning indicators, and liquidity signals by unifying market, credit, and operational data.

Client and adviser workflows: Internal assistants summarise portfolios, surface comparable products, and prepare meeting briefs—speeding response times and improving consistency.

Contact centres and operations: GenAI helps draft responses, triage requests, and update case notes, allowing agents to spend more time on complex issues.

Software engineering: Code generation, test creation, and refactor suggestions shorten cycle times and improve developer experience.

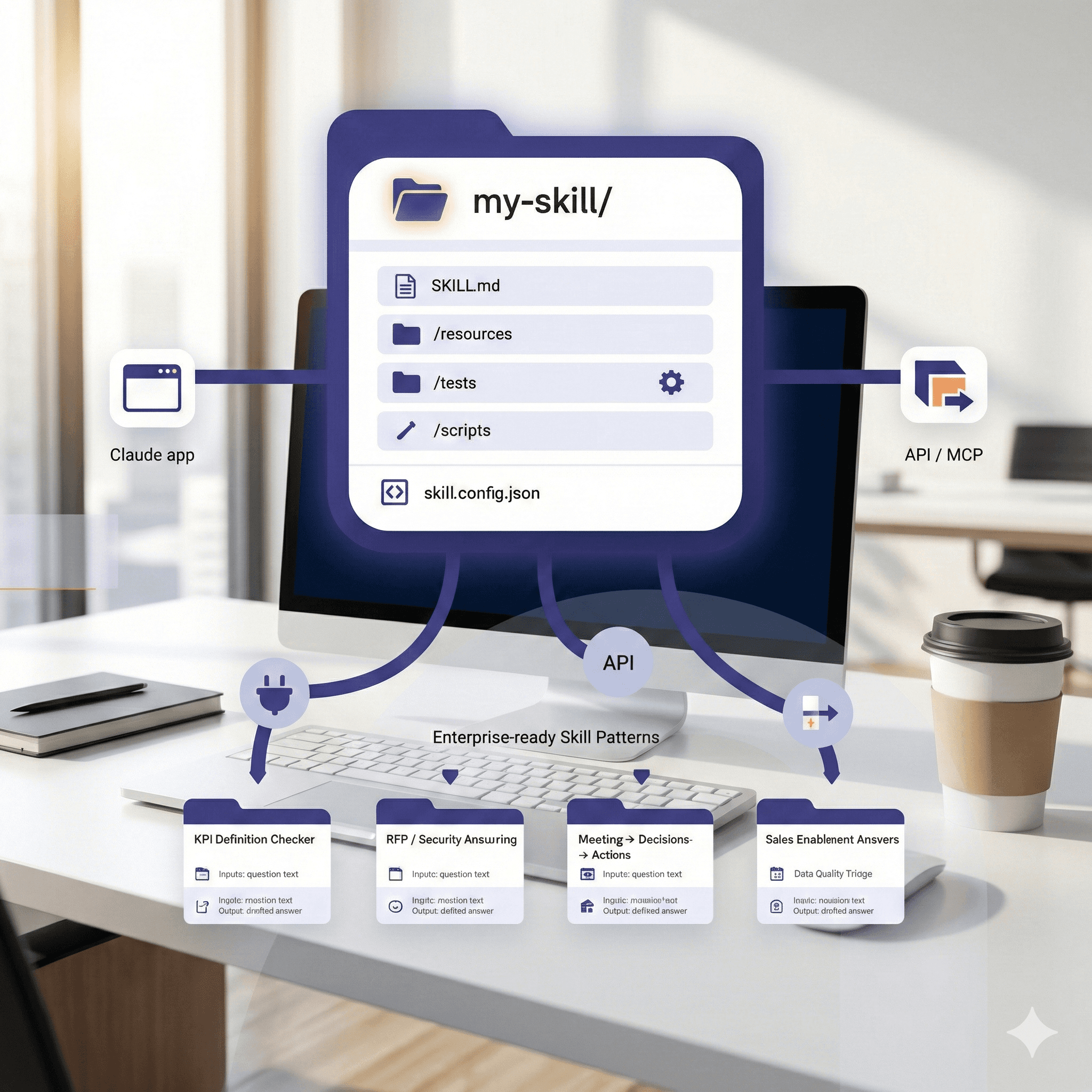

How it works: reference architecture (high level)

Ingest & quality: Batch and streaming pipelines land raw data into secure zones with automated quality checks, schema validation, and PII controls.

Curation & governance: Business‑aligned data products with lineage, metadata, and access policies; catalogue and mesh patterns make data discoverable.

Feature & model layers: Reusable features, experiment tracking, and MLOps orchestrate training, deployment, and monitoring.

LLM enablement: Retrieval‑augmented generation (RAG) patterns connect models to governed sources. Guardrails manage prompt injection, data leakage, and output filters.

Controls & audit: Model risk, compliance, and security controls instrument every stage—producing artefacts for validation and regulatory review.

Implementation checklist for banks

Start with data products for your top ten AI use cases; define owners, SLAs, and quality metrics.

Establish MRM‑aligned model governance from day one (documentation, validation, monitoring, explainability).

Build LLM safety: retrieval governance, role‑based access, and red‑team testing.

Enable developer productivity with a coding assistant and golden paths for MLOps.

Prove commercial value: commit to a small set of KPIs (cycle time, sales uplift, loss‑rate reduction) and publish quarterly results.

Common pitfalls to avoid

Data sprawl without ownership. A mesh is only useful when products have accountable owners and quality SLAs.

Model proliferation. Consolidate features and models; standardise monitoring and rollback.

LLM without retrieval governance. Uncontrolled access risks leakage and hallucinations.

Pilot purgatory. Tie every build to a business‑owned KPI and sunset what doesn’t move it.

What’s next

Expect broader agentic workflows, tighter integration of real‑time signals, and expanded guardrails for autonomy. The differentiator remains unchanged: trusted data plus disciplined governance, not just bigger models.

Summary

JPMorgan shows how to turn data into durable advantage: governed foundations, disciplined risk controls, and targeted AI that improves client outcomes and productivity. If you’re shaping a bank‑wide AI roadmap, Generation Digital can help define use cases, data products, and controls that ship value fast. Let’s modernise your data and AI stack—safely and pragmatically.

FAQs

How does AI improve data management at JPMorgan Chase?

By enforcing governance, lineage, and access controls, data products become reliable sources for analytics and AI. That supports faster insights, safer models, and better auditability.

What are the benefits of AI in financial services?

Sharper risk detection, improved client service, and higher engineering and operational productivity—delivered within regulatory guardrails.

Can AI predict market trends?

AI can identify patterns and leading indicators, but banks deploy human‑in‑the‑loop oversight and limits for high‑impact decisions.

How does JPMorgan manage AI risk?

Through model lifecycle controls (validation, monitoring, explainability), MRM alignment, and documented governance across data and model pipelines.

Why this matters now

Banks with strong data foundations are converting AI from pilots into measurable value. JPMorgan Chase illustrates how to scale responsibly: building governed data products, operationalising model risk controls, and applying AI where it moves the needle—client service, risk, and engineering productivity. The result is faster decisions, better controls, and sharper execution.

Leadership and operating model

Firmwide CDO: Under the Firmwide Chief Data Officer, JPMorgan structures data governance, quality standards, and access patterns that feed AI safely. The CDO function aligns data platforms with model risk management (MRM), legal, and security. This top‑down mandate helps product teams ship AI features within clear control frameworks.

Technology leadership: The bank funds AI as part of a multi‑year modernisation agenda, prioritising platform investments (data fabric, catalogues, feature stores) and AI enablement (LLM platforms, coding assistants). This operating model balances central standards with federated execution.

What’s new: from platforms to outcomes

Internal LLM and copilots: Employees use internal large‑language‑model tools for research, summarisation, and workflow acceleration, reducing manual effort in advisory, operations, and engineering.

450+ GenAI use cases in motion: Most early wins appear in back‑office efficiency and knowledge work, with targeted deployment for frontline teams.

Engineering productivity: A coding assistant accelerates boilerplate and test generation, freeing engineers for higher‑value work and improving delivery velocity.

Commercial impact: AI supports client service during volatility and contributes to sales growth in wealth and advisory channels.

Data foundations that make AI dependable

1) Governed data products. Curated, discoverable data products—exposed via catalogues and access policies—allow AI services to rely on consistent definitions and lineage.

2) Real‑time and near‑real‑time analytics. Streaming pipelines bring payments, transactions, and interaction data into models faster, powering timely alerts (e.g., fraud) and more responsive service.

3) Model lifecycle and risk controls. AI models pass through documented lifecycle stages (development, validation, monitoring). Controls cover bias, drift, performance, and explainability, with audit‑ready traces.

4) Human‑in‑the‑loop. Sensitive decisions (credit, trading, KYC) retain expert oversight. AI augments, not replaces, regulated judgements.

Practical applications

Fraud and financial crime: Machine‑learning models detect anomalous behaviour across channels, reducing false positives and accelerating genuine‑case handling.

Risk and treasury: AI assists with stress scenarios, early‑warning indicators, and liquidity signals by unifying market, credit, and operational data.

Client and adviser workflows: Internal assistants summarise portfolios, surface comparable products, and prepare meeting briefs—speeding response times and improving consistency.

Contact centres and operations: GenAI helps draft responses, triage requests, and update case notes, allowing agents to spend more time on complex issues.

Software engineering: Code generation, test creation, and refactor suggestions shorten cycle times and improve developer experience.

How it works: reference architecture (high level)

Ingest & quality: Batch and streaming pipelines land raw data into secure zones with automated quality checks, schema validation, and PII controls.

Curation & governance: Business‑aligned data products with lineage, metadata, and access policies; catalogue and mesh patterns make data discoverable.

Feature & model layers: Reusable features, experiment tracking, and MLOps orchestrate training, deployment, and monitoring.

LLM enablement: Retrieval‑augmented generation (RAG) patterns connect models to governed sources. Guardrails manage prompt injection, data leakage, and output filters.

Controls & audit: Model risk, compliance, and security controls instrument every stage—producing artefacts for validation and regulatory review.

Implementation checklist for banks

Start with data products for your top ten AI use cases; define owners, SLAs, and quality metrics.

Establish MRM‑aligned model governance from day one (documentation, validation, monitoring, explainability).

Build LLM safety: retrieval governance, role‑based access, and red‑team testing.

Enable developer productivity with a coding assistant and golden paths for MLOps.

Prove commercial value: commit to a small set of KPIs (cycle time, sales uplift, loss‑rate reduction) and publish quarterly results.

Common pitfalls to avoid

Data sprawl without ownership. A mesh is only useful when products have accountable owners and quality SLAs.

Model proliferation. Consolidate features and models; standardise monitoring and rollback.

LLM without retrieval governance. Uncontrolled access risks leakage and hallucinations.

Pilot purgatory. Tie every build to a business‑owned KPI and sunset what doesn’t move it.

What’s next

Expect broader agentic workflows, tighter integration of real‑time signals, and expanded guardrails for autonomy. The differentiator remains unchanged: trusted data plus disciplined governance, not just bigger models.

Summary

JPMorgan shows how to turn data into durable advantage: governed foundations, disciplined risk controls, and targeted AI that improves client outcomes and productivity. If you’re shaping a bank‑wide AI roadmap, Generation Digital can help define use cases, data products, and controls that ship value fast. Let’s modernise your data and AI stack—safely and pragmatically.

FAQs

How does AI improve data management at JPMorgan Chase?

By enforcing governance, lineage, and access controls, data products become reliable sources for analytics and AI. That supports faster insights, safer models, and better auditability.

What are the benefits of AI in financial services?

Sharper risk detection, improved client service, and higher engineering and operational productivity—delivered within regulatory guardrails.

Can AI predict market trends?

AI can identify patterns and leading indicators, but banks deploy human‑in‑the‑loop oversight and limits for high‑impact decisions.

How does JPMorgan manage AI risk?

Through model lifecycle controls (validation, monitoring, explainability), MRM alignment, and documented governance across data and model pipelines.

Receive practical advice directly in your inbox

By subscribing, you agree to allow Generation Digital to store and process your information according to our privacy policy. You can review the full policy at gend.co/privacy.

Generation

Digital

Business Number: 256 9431 77 | Copyright 2026 | Terms and Conditions | Privacy Policy

Generation

Digital