Avoid the AI Silo Tax: Miro + Forrester Strategy Insights

Avoid the AI Silo Tax: Miro + Forrester Strategy Insights

Miro

16 feb 2026

¿No sabes por dónde empezar con la IA?

Evalúa preparación, riesgos y prioridades en menos de una hora.

¿No sabes por dónde empezar con la IA?

Evalúa preparación, riesgos y prioridades en menos de una hora.

➔ Descarga nuestro paquete gratuito de preparación para IA

The AI silo tax is the hidden cost of running AI initiatives in isolation — duplicated tools, fragmented data, and constant context switching that slows delivery. Insights from Miro and Forrester show that organisations get better outcomes when AI is embedded into shared workflows, aligned to business value, and governed cross-functionally rather than owned by one team.

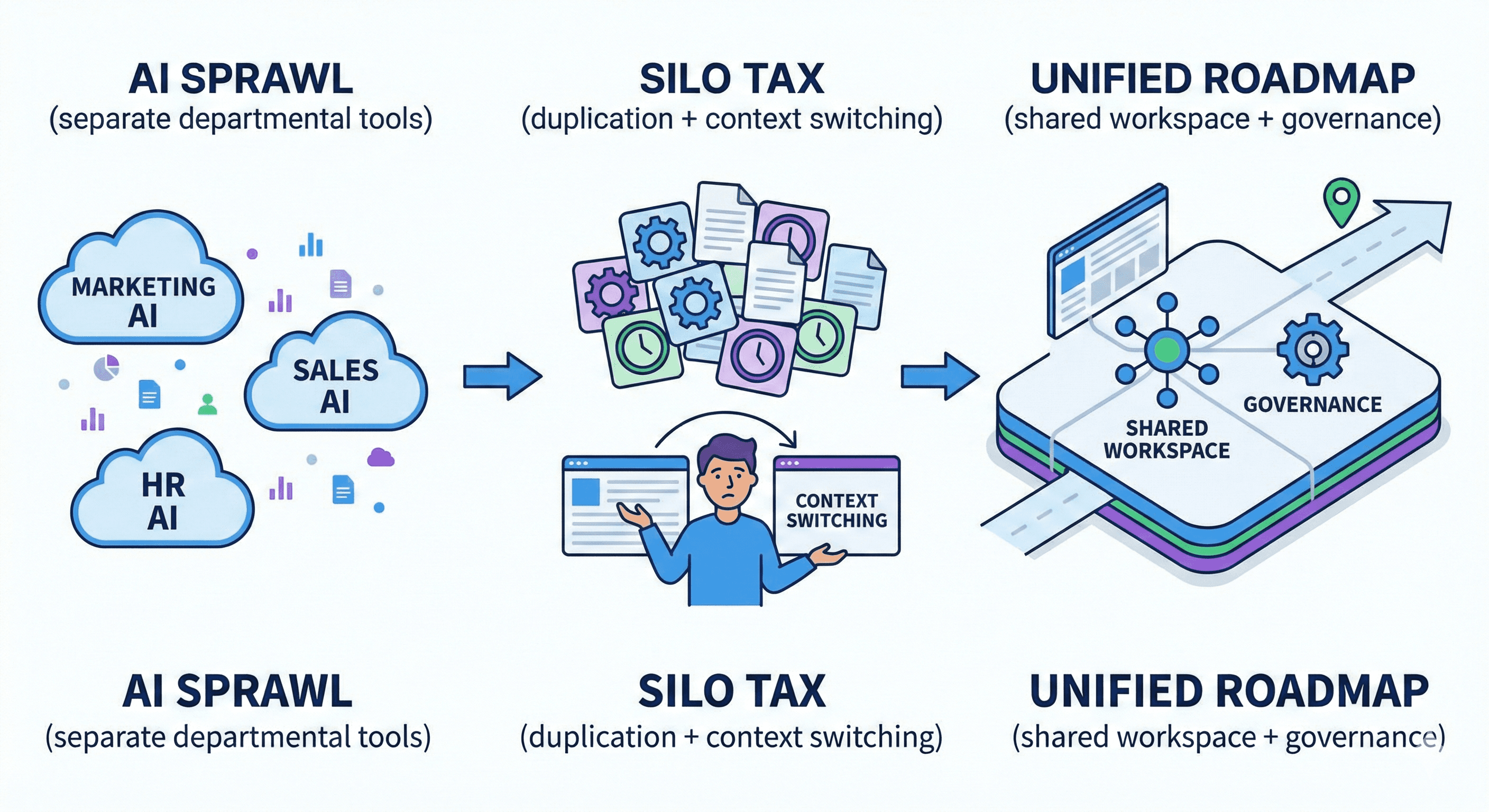

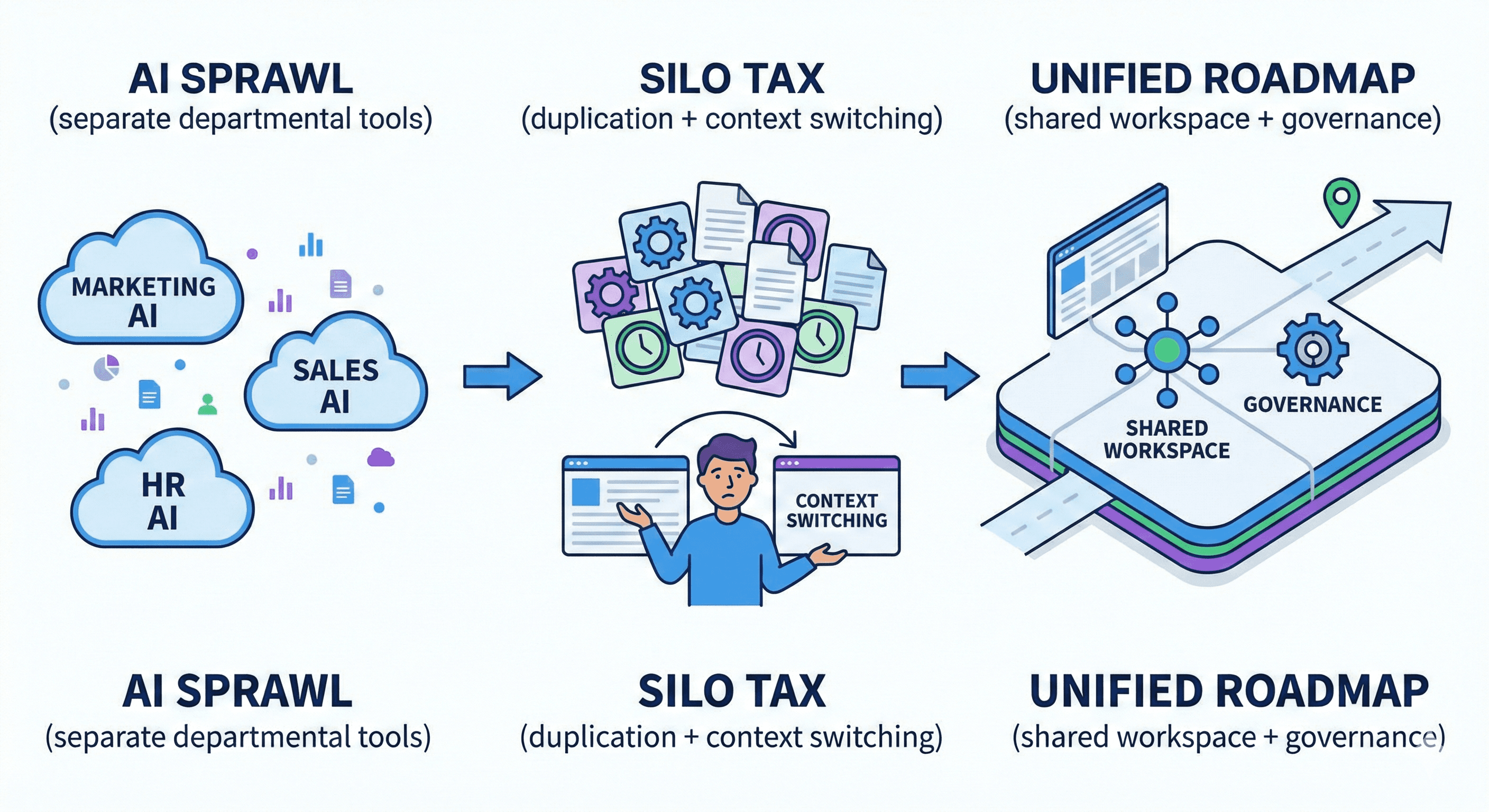

Most organisations don’t fail at AI because the technology is weak. They fail because AI gets implemented as a collection of disconnected experiments — one in marketing, one in product, one in IT — each with its own tools, data, and success metrics.

That fragmentation creates a silo tax: the compounding cost of duplication, tool sprawl, and missed reuse. AI can improve individual productivity, but if it isn’t integrated into shared workflows, the organisation pays for AI twice — once in licences and pilots, and again in the friction it creates.

Recent Miro sessions with Forrester make the problem (and the fix) clearer. In one webinar, Miro and Forrester highlight that leaders increasingly see collaboration as make-or-break for achieving company goals — but current AI deployments often pull work apart rather than bringing it together.

What is the “AI silo tax”?

The AI silo tax is the operational drag that shows up when AI tools, data, and initiatives are isolated by department.

It usually looks like:

Duplicate work: multiple teams solve the same problems in parallel.

Tool-hopping: people switch between core systems and AI tools, losing context and momentum.

Inconsistent governance: different standards for risk, privacy, quality, and evaluation.

Low adoption at scale: pilots succeed locally, but don’t translate into organisation-wide impact.

The key point: silo tax isn’t just “inefficiency”. It actively reduces the returns from AI investment.

What Miro + Forrester found (and why it matters)

A commissioned Forrester Consulting study (Q3 2025) surveyed 518 decision-makers across product development, IT, and lines of business. The headline theme: leaders want AI to improve teamwork and execution — not just individual output.

Findings featured in the on-demand webinar include:

Nearly 90% of leaders say improving collaboration is critical to achieving company goals.

75% say most AI tools focus on individual work rather than team productivity.

69% say switching between work tools and AI tools disrupts their workflow.

83% want shared, canvas-based workspaces with AI that help teams work better.

Taken together, that’s your business case for tackling the silo tax: it’s not about “more AI tools”. It’s about AI in the flow of work, where cross-functional teams make decisions and deliver outcomes.

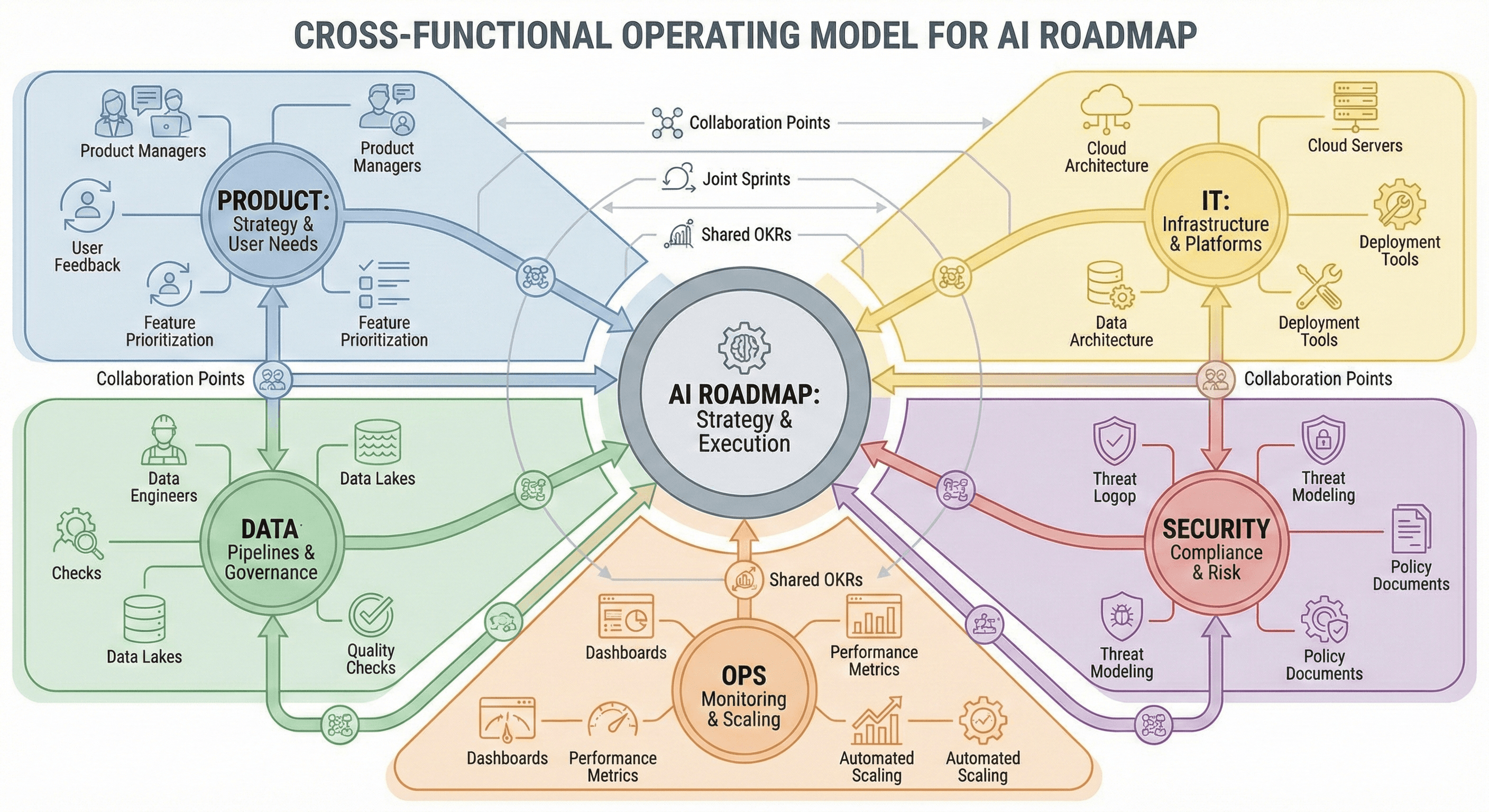

The practical fix: move from AI sprawl to a deployment model

A helpful way to avoid the silo tax is to treat AI like any other major capability: it needs strategy, execution, and governance — across departments.

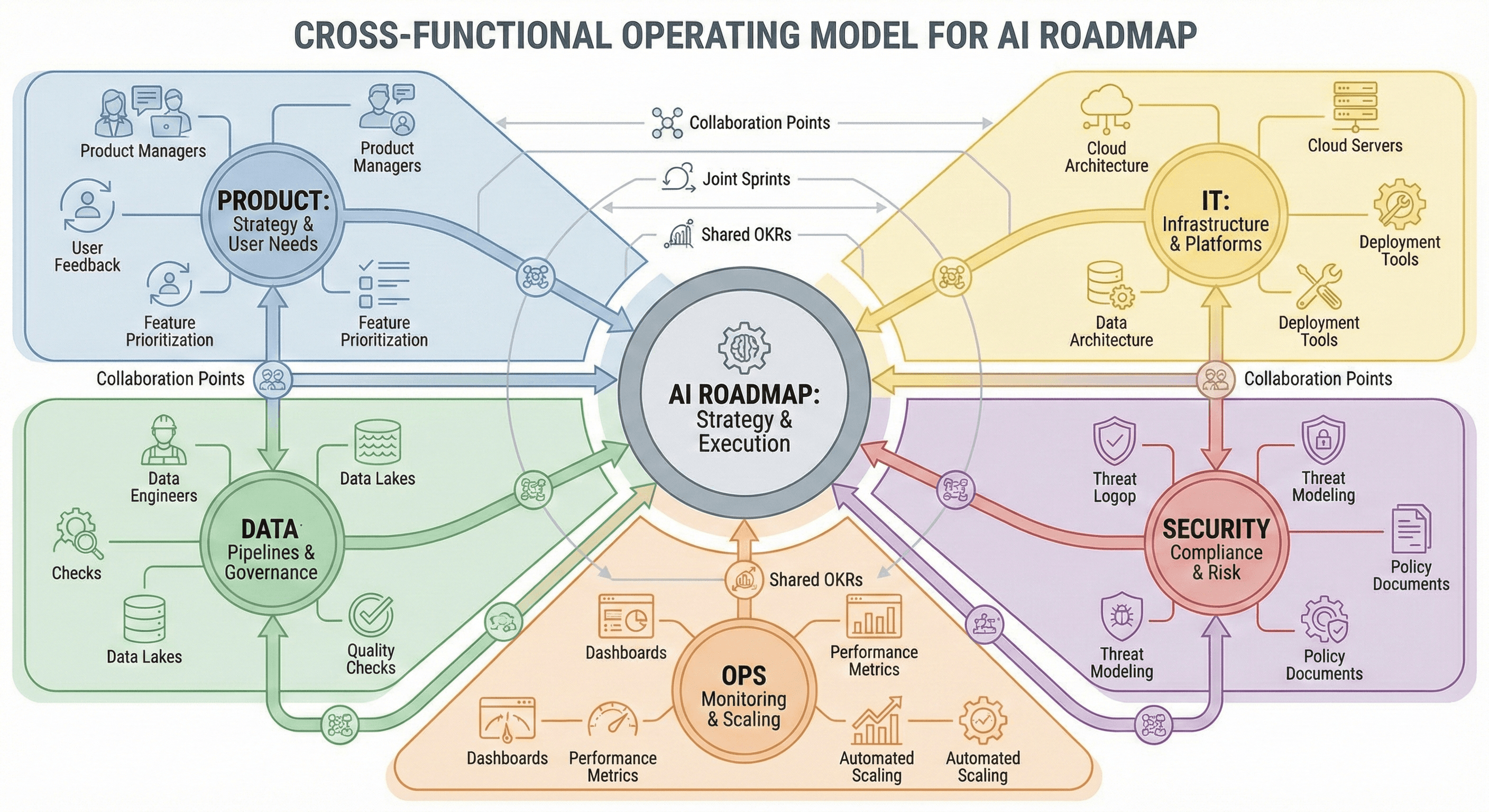

Forrester’s AI deployment thinking (as shared through Miro resources) can be summarised as a three-part approach:

1) Align AI to business value

Stop chasing novelty. Map AI use cases to the levers that matter: revenue drivers, cost reduction, risk controls, customer experience, cycle time.

2) Plan and execute as one roadmap

Avoid “department-by-department rollouts” with no shared architecture. Build a unified deployment roadmap that embeds AI into existing workflows and core tools, so adoption doesn’t rely on people remembering to open a separate AI product.

3) Govern and optimise continuously

Set clear guardrails (data, privacy, evaluation, model usage) and build feedback loops so AI performance improves over time. If governance is optional, the organisation ends up with multiple standards — and the silo tax returns.

Where Miro fits in an AI strategy

Miro’s role is not to be “another AI tool”. It’s to act as a shared workspace that makes strategy, discovery, delivery and governance visible across functions — so AI doesn’t live in disconnected documents, chats, and departmental backlogs.

In practice, that means:

creating a single place for AI use case discovery and prioritisation

making assumptions, risks, and decisions explicit (so they can be reviewed)

supporting cross-functional planning from early discovery through delivery

reducing context switching by keeping work and AI support in the same workflow

Practical steps you can take this quarter

If you want to reduce silo tax without slowing innovation, focus on a few high-leverage moves:

Inventory AI in use today (tools, pilots, shadow usage, workflows).

Define 3–5 organisation-level outcomes AI must support (not department goals).

Create a cross-functional AI working group (product, IT, data, security, operations).

Prioritise use cases by value + feasibility, then standardise how you evaluate success.

Embed AI into shared workflows (where handoffs happen) rather than adding more standalone tools.

Set minimum governance (data access, model usage policy, auditability, and review cadence).

Summary

The AI silo tax is real — and it’s expensive. The fastest way to reduce it is to stop treating AI as a collection of separate departmental experiments and start treating it as a cross-functional capability: aligned to business value, executed as a shared roadmap, and governed consistently.

Next steps: Generation Digital can help you diagnose where silo tax is showing up (tool sprawl, duplicated initiatives, governance gaps), then design a practical deployment model that teams will actually adopt.

FAQs

Q1: What is an AI silo tax?

It’s the hidden cost of running AI initiatives in isolation — duplicated work, fragmented data, inconsistent governance, and workflow disruption caused by tool switching.

Q2: How can organisations avoid the AI silo tax?

By aligning AI to shared business outcomes, executing through a unified cross-functional roadmap, and setting consistent governance so reuse and adoption can scale.

Q3: What role does Miro play in AI strategy?

Miro can act as a shared workspace where teams align on goals, map workflows, prioritise use cases, and keep delivery and governance visible across departments.

Q4: Isn’t this just a technology problem?

Not really. Silo tax is usually an operating model problem: unclear ownership, disconnected workflows, and misaligned incentives. Technology can reduce friction, but the strategy and governance must be cross-functional.

The AI silo tax is the hidden cost of running AI initiatives in isolation — duplicated tools, fragmented data, and constant context switching that slows delivery. Insights from Miro and Forrester show that organisations get better outcomes when AI is embedded into shared workflows, aligned to business value, and governed cross-functionally rather than owned by one team.

Most organisations don’t fail at AI because the technology is weak. They fail because AI gets implemented as a collection of disconnected experiments — one in marketing, one in product, one in IT — each with its own tools, data, and success metrics.

That fragmentation creates a silo tax: the compounding cost of duplication, tool sprawl, and missed reuse. AI can improve individual productivity, but if it isn’t integrated into shared workflows, the organisation pays for AI twice — once in licences and pilots, and again in the friction it creates.

Recent Miro sessions with Forrester make the problem (and the fix) clearer. In one webinar, Miro and Forrester highlight that leaders increasingly see collaboration as make-or-break for achieving company goals — but current AI deployments often pull work apart rather than bringing it together.

What is the “AI silo tax”?

The AI silo tax is the operational drag that shows up when AI tools, data, and initiatives are isolated by department.

It usually looks like:

Duplicate work: multiple teams solve the same problems in parallel.

Tool-hopping: people switch between core systems and AI tools, losing context and momentum.

Inconsistent governance: different standards for risk, privacy, quality, and evaluation.

Low adoption at scale: pilots succeed locally, but don’t translate into organisation-wide impact.

The key point: silo tax isn’t just “inefficiency”. It actively reduces the returns from AI investment.

What Miro + Forrester found (and why it matters)

A commissioned Forrester Consulting study (Q3 2025) surveyed 518 decision-makers across product development, IT, and lines of business. The headline theme: leaders want AI to improve teamwork and execution — not just individual output.

Findings featured in the on-demand webinar include:

Nearly 90% of leaders say improving collaboration is critical to achieving company goals.

75% say most AI tools focus on individual work rather than team productivity.

69% say switching between work tools and AI tools disrupts their workflow.

83% want shared, canvas-based workspaces with AI that help teams work better.

Taken together, that’s your business case for tackling the silo tax: it’s not about “more AI tools”. It’s about AI in the flow of work, where cross-functional teams make decisions and deliver outcomes.

The practical fix: move from AI sprawl to a deployment model

A helpful way to avoid the silo tax is to treat AI like any other major capability: it needs strategy, execution, and governance — across departments.

Forrester’s AI deployment thinking (as shared through Miro resources) can be summarised as a three-part approach:

1) Align AI to business value

Stop chasing novelty. Map AI use cases to the levers that matter: revenue drivers, cost reduction, risk controls, customer experience, cycle time.

2) Plan and execute as one roadmap

Avoid “department-by-department rollouts” with no shared architecture. Build a unified deployment roadmap that embeds AI into existing workflows and core tools, so adoption doesn’t rely on people remembering to open a separate AI product.

3) Govern and optimise continuously

Set clear guardrails (data, privacy, evaluation, model usage) and build feedback loops so AI performance improves over time. If governance is optional, the organisation ends up with multiple standards — and the silo tax returns.

Where Miro fits in an AI strategy

Miro’s role is not to be “another AI tool”. It’s to act as a shared workspace that makes strategy, discovery, delivery and governance visible across functions — so AI doesn’t live in disconnected documents, chats, and departmental backlogs.

In practice, that means:

creating a single place for AI use case discovery and prioritisation

making assumptions, risks, and decisions explicit (so they can be reviewed)

supporting cross-functional planning from early discovery through delivery

reducing context switching by keeping work and AI support in the same workflow

Practical steps you can take this quarter

If you want to reduce silo tax without slowing innovation, focus on a few high-leverage moves:

Inventory AI in use today (tools, pilots, shadow usage, workflows).

Define 3–5 organisation-level outcomes AI must support (not department goals).

Create a cross-functional AI working group (product, IT, data, security, operations).

Prioritise use cases by value + feasibility, then standardise how you evaluate success.

Embed AI into shared workflows (where handoffs happen) rather than adding more standalone tools.

Set minimum governance (data access, model usage policy, auditability, and review cadence).

Summary

The AI silo tax is real — and it’s expensive. The fastest way to reduce it is to stop treating AI as a collection of separate departmental experiments and start treating it as a cross-functional capability: aligned to business value, executed as a shared roadmap, and governed consistently.

Next steps: Generation Digital can help you diagnose where silo tax is showing up (tool sprawl, duplicated initiatives, governance gaps), then design a practical deployment model that teams will actually adopt.

FAQs

Q1: What is an AI silo tax?

It’s the hidden cost of running AI initiatives in isolation — duplicated work, fragmented data, inconsistent governance, and workflow disruption caused by tool switching.

Q2: How can organisations avoid the AI silo tax?

By aligning AI to shared business outcomes, executing through a unified cross-functional roadmap, and setting consistent governance so reuse and adoption can scale.

Q3: What role does Miro play in AI strategy?

Miro can act as a shared workspace where teams align on goals, map workflows, prioritise use cases, and keep delivery and governance visible across departments.

Q4: Isn’t this just a technology problem?

Not really. Silo tax is usually an operating model problem: unclear ownership, disconnected workflows, and misaligned incentives. Technology can reduce friction, but the strategy and governance must be cross-functional.

Recibe noticias y consejos sobre IA cada semana en tu bandeja de entrada

Al suscribirte, das tu consentimiento para que Generation Digital almacene y procese tus datos de acuerdo con nuestra política de privacidad. Puedes leer la política completa en gend.co/privacy.

Próximos talleres y seminarios web

Claridad Operacional a Gran Escala - Asana

Webinar Virtual

Miércoles 25 de febrero de 2026

En línea

Trabaja con compañeros de equipo de IA - Asana

Taller Presencial

Jueves 26 de febrero de 2026

Londres, Reino Unido

De Idea a Prototipo: IA en Miro

Seminario Web Virtual

Miércoles 18 de febrero de 2026

En línea

Generación

Digital

Oficina en Reino Unido

Generation Digital Ltd

33 Queen St,

Londres

EC4R 1AP

Reino Unido

Oficina en Canadá

Generation Digital Americas Inc

181 Bay St., Suite 1800

Toronto, ON, M5J 2T9

Canadá

Oficina en EE. UU.

Generation Digital Américas Inc

77 Sands St,

Brooklyn, NY 11201,

Estados Unidos

Oficina de la UE

Software Generación Digital

Edificio Elgee

Dundalk

A91 X2R3

Irlanda

Oficina en Medio Oriente

6994 Alsharq 3890,

An Narjis,

Riad 13343,

Arabia Saudita

Número de la empresa: 256 9431 77 | Derechos de autor 2026 | Términos y Condiciones | Política de Privacidad

Generación

Digital

Oficina en Reino Unido

Generation Digital Ltd

33 Queen St,

Londres

EC4R 1AP

Reino Unido

Oficina en Canadá

Generation Digital Americas Inc

181 Bay St., Suite 1800

Toronto, ON, M5J 2T9

Canadá

Oficina en EE. UU.

Generation Digital Américas Inc

77 Sands St,

Brooklyn, NY 11201,

Estados Unidos

Oficina de la UE

Software Generación Digital

Edificio Elgee

Dundalk

A91 X2R3

Irlanda

Oficina en Medio Oriente

6994 Alsharq 3890,

An Narjis,

Riad 13343,

Arabia Saudita