DBS Bank: IA + Google Cloud aumentan la productividad en 2025

DBS Bank: IA + Google Cloud aumentan la productividad en 2025

Recopilar

10 dic 2025

Not sure what to do next with AI?

Assess readiness, risk, and priorities in under an hour.

Not sure what to do next with AI?

Assess readiness, risk, and priorities in under an hour.

➔ Reserva una Consulta

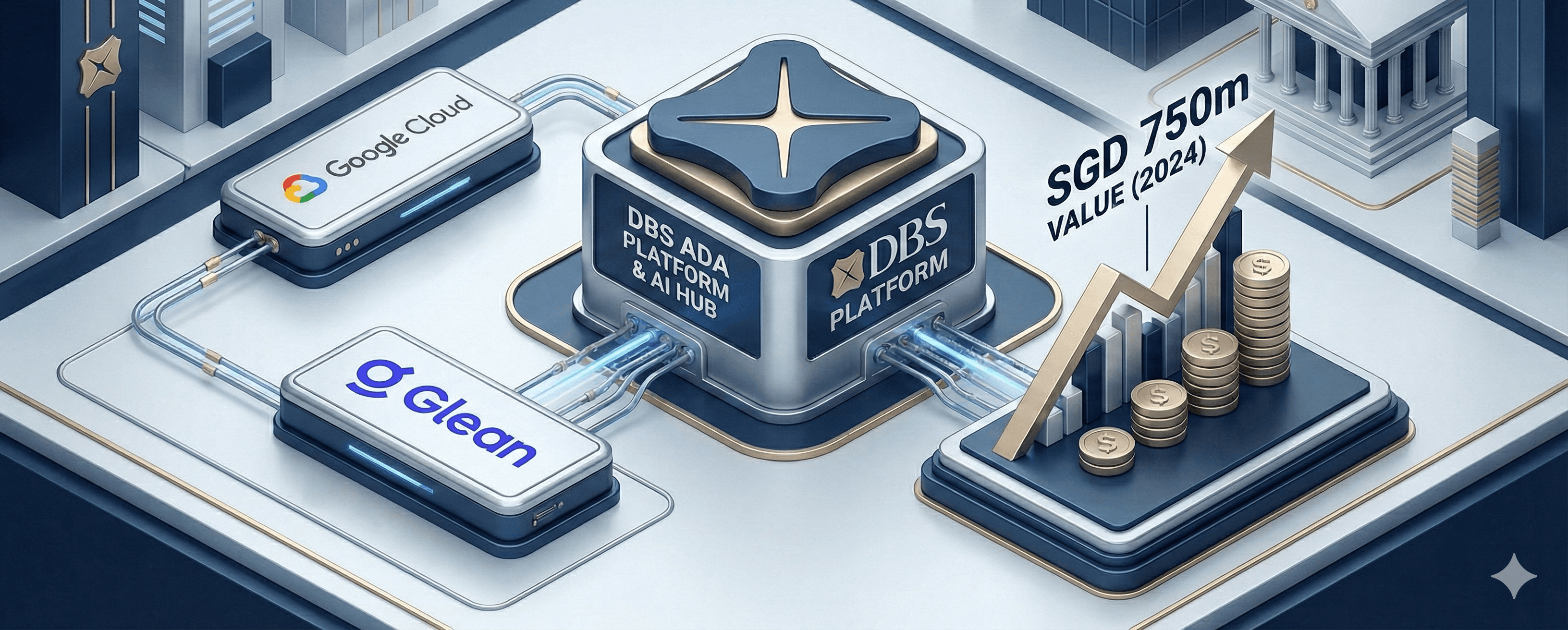

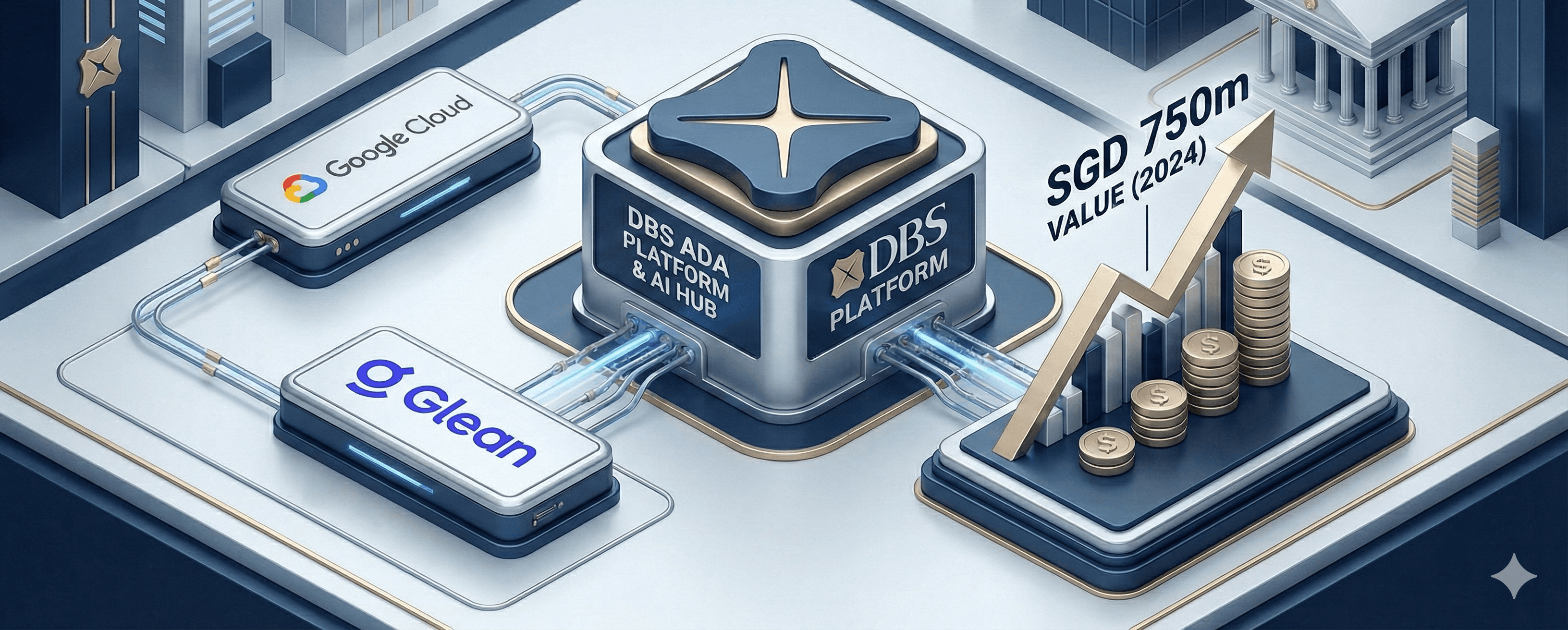

El programa de IA de DBS Bank ha pasado de ser piloto a una plataforma. Al integrar Google Cloud — en particular Vertex AI — con su plataforma interna ADA y la capa de Work AI de Glean, DBS ha convertido la IA en una herramienta diaria para decenas de miles de empleados. El impacto es real: coberturas independientes y análisis de la industria atribuyen aproximadamente SGD 750 millones (≈USD 563m) en valor económico a la IA en 2024, con un crecimiento adicional señalado para 2025.

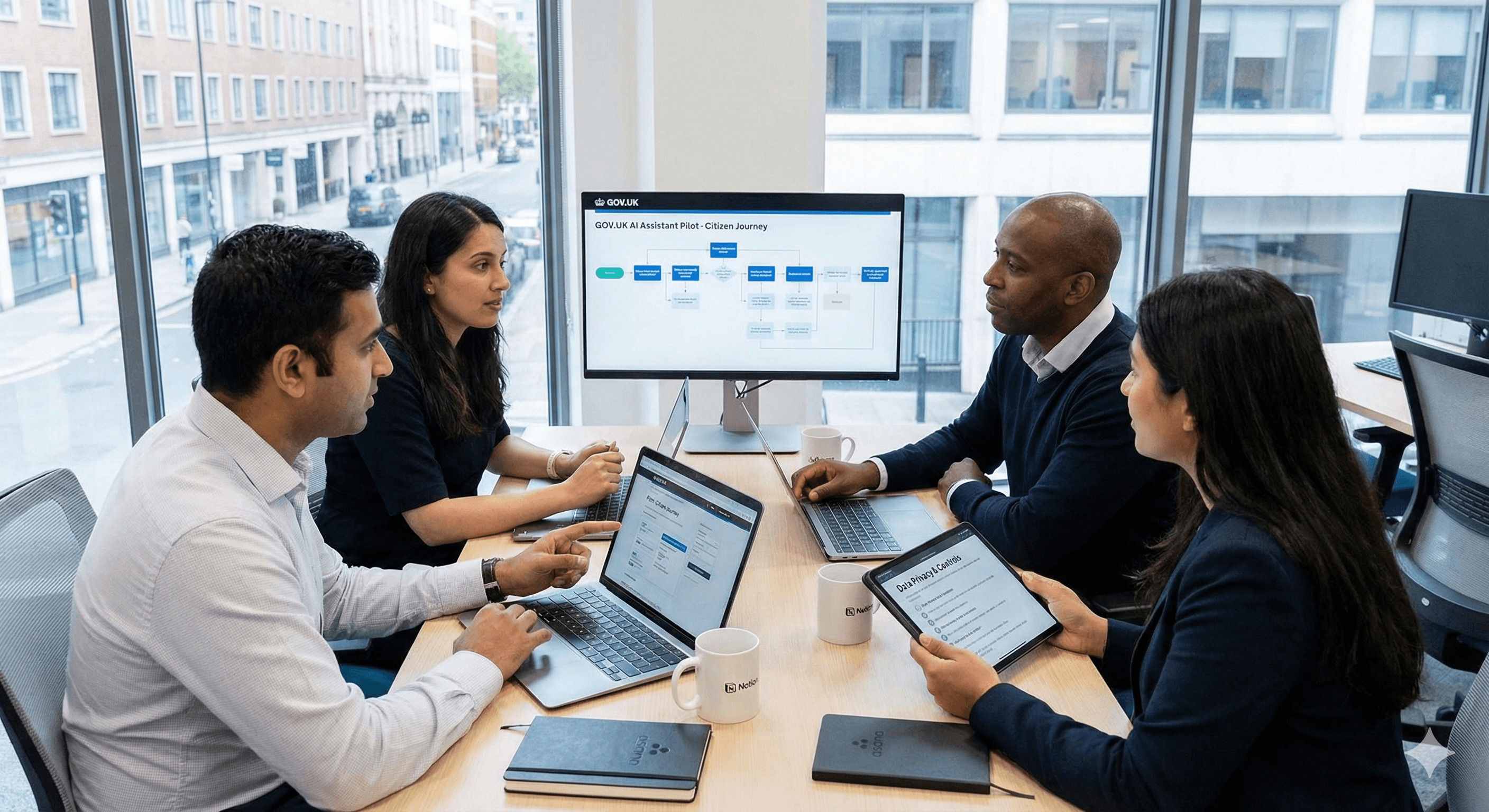

Por qué es importante ahora

La productividad bancaria se determina cada vez más por la rapidez con que los equipos pueden encontrar conocimiento, resumir información compleja y desencadenar acciones rutinarias de forma segura. El enfoque de DBS muestra cómo combinar una base de datos regulada (ADA), una sólida plataforma de modelos (Vertex AI) y una capa de Work AI (Glean) para ofrecer ahorros de tiempo y mejores decisiones, sin comprometer el cumplimiento.

¿Qué hay de nuevo?

Integración de la plataforma: Vertex AI de Google Cloud se integra en la plataforma de datos de autoservicio de DBS (ADA), apoyando la rápida expansión de casos de uso y la gestión automatizada de infraestructuras a medida que crecen los volúmenes.

Valor medible: Enfoques externos informan de un valor de ~SGD 750 millones de la IA en 2024, reflejando casos de uso de productividad y ingresos de base amplia.

Reconocimiento: DBS fue nombrado Mejor Banco de IA del Mundo en 2025, reflejando la profundidad de ejecución en operaciones y experiencias del cliente.

Work AI a gran escala: Glean y Google Cloud se citan como facilitadores para que 40,000 empleados trabajen más rápido y desbloqueen nuevos agentes y bots de IA; las publicaciones sugieren ahorros de tiempo del 5-10% en el trabajo diario. (Afirmación según comunicaciones de socios.)

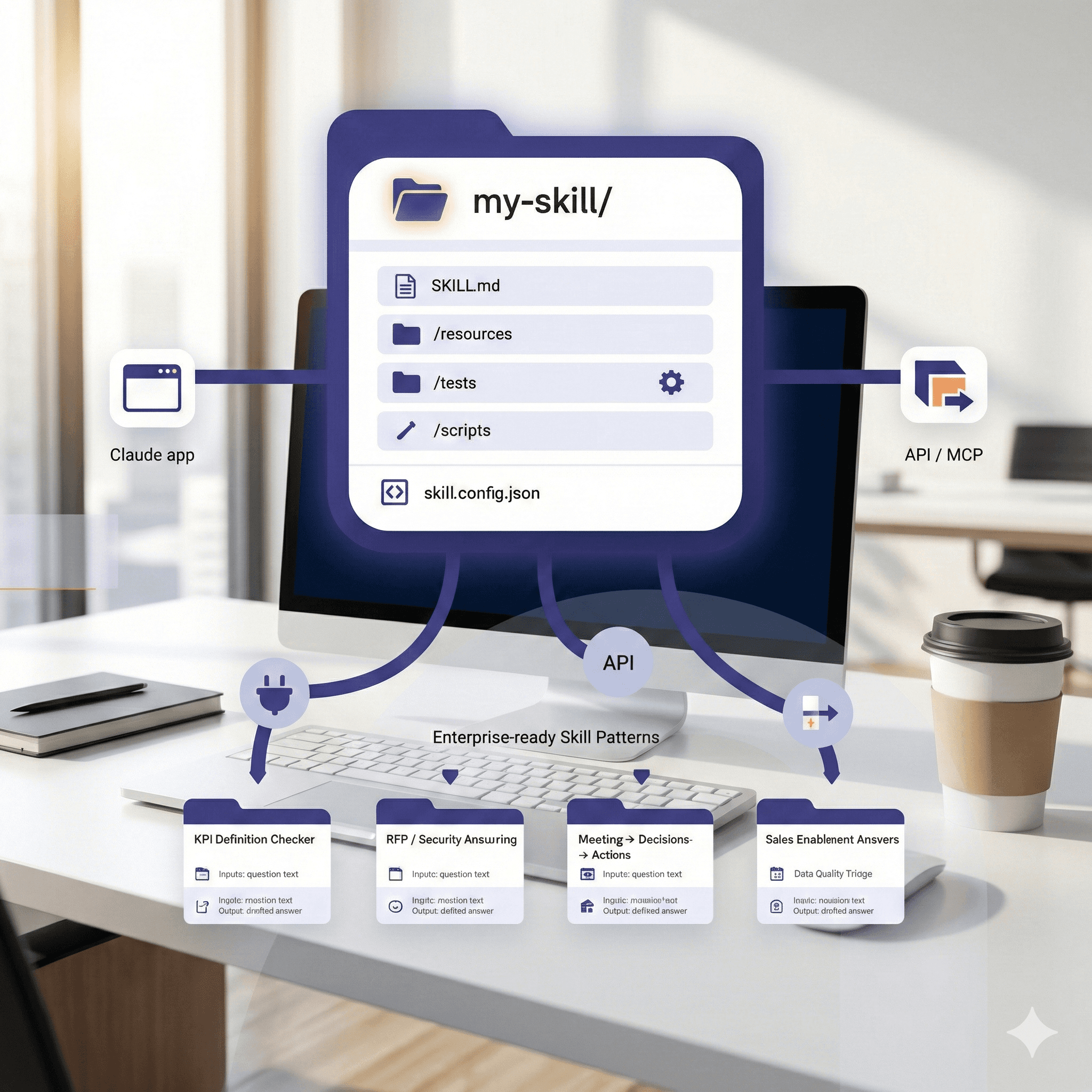

Cómo funciona el stack

Fundación de datos (ADA): Productos de datos limpios y regulados alimentan la IA de forma segura. Los controles de acceso y el linaje mantienen contentos a los auditores.

Plataforma de modelos (Vertex AI): Los equipos usan herramientas gestionadas para construir, evaluar y desplegar casos de uso, desde resumen y clasificación hasta flujos de trabajo agéncicos con modelos de clase Gemini.

Capa de Work AI (Glean): Los empleados buscan en los sistemas, generan resúmenes y desencadenan acciones a través de agentes ubicados en herramientas diarias. Esto reduce el ciclo de "buscar-entender-actuar" en operaciones, riesgos y equipos de clientes. (Según materiales de vendedores y públicos.)

Barreras de seguridad: Las políticas y el monitoreo imponen una IA responsable, vital en la banca regulada. DBS publica su perspectiva de IA responsable, enfatizando la gobernanza y la confianza.

Ejemplos prácticos

Operaciones: La IA reduce el tiempo de procesamiento manual en flujos de trabajo clave de back-office; los analistas citan reducciones significativas junto a un mayor rendimiento.

Conocimiento de primera línea: El personal puede recuperar conocimiento de sistemas cruzados y redactar resúmenes en segundos, apoyando respuestas al cliente más rápidas y consistentes. (Según comunicaciones de socios.)

Riesgo y cumplimiento: La IA generativa acelera la revisión de noticias adversas y la documentación, ayudando a los equipos a centrarse en los juicios en lugar de en el filtrado.

Un plan de implementación repetible

Comience con una capa de datos regulada. Defina primero productos de datos de alto valor y políticas de acceso; la IA sin datos limpios y accesibles se detiene.

Adopte una plataforma de modelos gestionada. Estandarice usando una plataforma como Vertex AI para evaluación, implementación y monitoreo para evitar la dispersión de herramientas.

Active Work AI para los empleados. Despliegue una capa de búsqueda empresarial y asistente (por ejemplo, Glean) para convertir la IA en productividad diaria, no solo en un proyecto de laboratorio.

Mida y luego escale. Rastree el tiempo ahorrado, el rendimiento, la calidad y los resultados de riesgo; reinvierta donde se haya probado el valor (las cifras de DBS de 2024 ilustran el efecto acumulativo).

Incorpore IA responsable. Implemente gobernanza de modelos, humanos en el bucle y registros de auditoría desde el primer día.

Resultados a observar

Tiempo ahorrado por empleado: Las comunicaciones de socios sugieren ahorros de tiempo del 5-10% en DBS desde Work AI — un punto de referencia útil para casos empresariales. (Orientativo; valide localmente.)

Creación de valor: Rastrear el impacto económico similar a los reportados ~SGD 750 millones de DBS (2024) a medida que los programas maduran.

Reconocimiento y métricas de resistencia: Premios y estudios de caso indican madurez; los KPIs operacionales (tiempos de ciclo, tasas de error) prueban durabilidad.

Resumen y próximos pasos

DBS muestra que las ganancias en productividad provienen del diseño del sistema, no de pilotos aislados: datos regulados (ADA), una plataforma de IA fuerte (Vertex AI) y una capa de Work AI (Glean) que encuentra a los empleados donde trabajan. Si estás construyendo tu hoja de ruta, comienza con uno o dos casos de uso transversales, conecta la gobernanza y mide sin descanso.

Hable con Generation Digital para planificar un piloto que combine Google Cloud y Glean para lograr victorias de productividad rápidas y seguras, y luego escale.

Preguntas Frecuentes

¿Cómo mejora la IA la productividad en DBS Bank?

Al comprimir el ciclo "buscar-entender-actuar": la búsqueda empresarial, el resumen y los agentes reducen el esfuerzo manual y aceleran la toma de decisiones en los equipos.

¿Qué papel desempeña Google Cloud?

Vertex AI de Google Cloud sustenta el desarrollo de modelos, la evaluación y la implementación, integrado con la plataforma ADA de DBS para escalar casos de uso de manera segura.

¿Dónde encaja Glean?

Glean proporciona la capa de Work AI — búsqueda, asistente y flujos de trabajo de agentes en herramientas diarias — permitiendo una productividad amplia de los empleados. (Según materiales de vendedores).

¿Este enfoque es reconocido por la industria?

Sí. DBS fue nombrado Mejor Banco de IA del Mundo en 2025, destacando la ejecución a gran escala.

El programa de IA de DBS Bank ha pasado de ser piloto a una plataforma. Al integrar Google Cloud — en particular Vertex AI — con su plataforma interna ADA y la capa de Work AI de Glean, DBS ha convertido la IA en una herramienta diaria para decenas de miles de empleados. El impacto es real: coberturas independientes y análisis de la industria atribuyen aproximadamente SGD 750 millones (≈USD 563m) en valor económico a la IA en 2024, con un crecimiento adicional señalado para 2025.

Por qué es importante ahora

La productividad bancaria se determina cada vez más por la rapidez con que los equipos pueden encontrar conocimiento, resumir información compleja y desencadenar acciones rutinarias de forma segura. El enfoque de DBS muestra cómo combinar una base de datos regulada (ADA), una sólida plataforma de modelos (Vertex AI) y una capa de Work AI (Glean) para ofrecer ahorros de tiempo y mejores decisiones, sin comprometer el cumplimiento.

¿Qué hay de nuevo?

Integración de la plataforma: Vertex AI de Google Cloud se integra en la plataforma de datos de autoservicio de DBS (ADA), apoyando la rápida expansión de casos de uso y la gestión automatizada de infraestructuras a medida que crecen los volúmenes.

Valor medible: Enfoques externos informan de un valor de ~SGD 750 millones de la IA en 2024, reflejando casos de uso de productividad y ingresos de base amplia.

Reconocimiento: DBS fue nombrado Mejor Banco de IA del Mundo en 2025, reflejando la profundidad de ejecución en operaciones y experiencias del cliente.

Work AI a gran escala: Glean y Google Cloud se citan como facilitadores para que 40,000 empleados trabajen más rápido y desbloqueen nuevos agentes y bots de IA; las publicaciones sugieren ahorros de tiempo del 5-10% en el trabajo diario. (Afirmación según comunicaciones de socios.)

Cómo funciona el stack

Fundación de datos (ADA): Productos de datos limpios y regulados alimentan la IA de forma segura. Los controles de acceso y el linaje mantienen contentos a los auditores.

Plataforma de modelos (Vertex AI): Los equipos usan herramientas gestionadas para construir, evaluar y desplegar casos de uso, desde resumen y clasificación hasta flujos de trabajo agéncicos con modelos de clase Gemini.

Capa de Work AI (Glean): Los empleados buscan en los sistemas, generan resúmenes y desencadenan acciones a través de agentes ubicados en herramientas diarias. Esto reduce el ciclo de "buscar-entender-actuar" en operaciones, riesgos y equipos de clientes. (Según materiales de vendedores y públicos.)

Barreras de seguridad: Las políticas y el monitoreo imponen una IA responsable, vital en la banca regulada. DBS publica su perspectiva de IA responsable, enfatizando la gobernanza y la confianza.

Ejemplos prácticos

Operaciones: La IA reduce el tiempo de procesamiento manual en flujos de trabajo clave de back-office; los analistas citan reducciones significativas junto a un mayor rendimiento.

Conocimiento de primera línea: El personal puede recuperar conocimiento de sistemas cruzados y redactar resúmenes en segundos, apoyando respuestas al cliente más rápidas y consistentes. (Según comunicaciones de socios.)

Riesgo y cumplimiento: La IA generativa acelera la revisión de noticias adversas y la documentación, ayudando a los equipos a centrarse en los juicios en lugar de en el filtrado.

Un plan de implementación repetible

Comience con una capa de datos regulada. Defina primero productos de datos de alto valor y políticas de acceso; la IA sin datos limpios y accesibles se detiene.

Adopte una plataforma de modelos gestionada. Estandarice usando una plataforma como Vertex AI para evaluación, implementación y monitoreo para evitar la dispersión de herramientas.

Active Work AI para los empleados. Despliegue una capa de búsqueda empresarial y asistente (por ejemplo, Glean) para convertir la IA en productividad diaria, no solo en un proyecto de laboratorio.

Mida y luego escale. Rastree el tiempo ahorrado, el rendimiento, la calidad y los resultados de riesgo; reinvierta donde se haya probado el valor (las cifras de DBS de 2024 ilustran el efecto acumulativo).

Incorpore IA responsable. Implemente gobernanza de modelos, humanos en el bucle y registros de auditoría desde el primer día.

Resultados a observar

Tiempo ahorrado por empleado: Las comunicaciones de socios sugieren ahorros de tiempo del 5-10% en DBS desde Work AI — un punto de referencia útil para casos empresariales. (Orientativo; valide localmente.)

Creación de valor: Rastrear el impacto económico similar a los reportados ~SGD 750 millones de DBS (2024) a medida que los programas maduran.

Reconocimiento y métricas de resistencia: Premios y estudios de caso indican madurez; los KPIs operacionales (tiempos de ciclo, tasas de error) prueban durabilidad.

Resumen y próximos pasos

DBS muestra que las ganancias en productividad provienen del diseño del sistema, no de pilotos aislados: datos regulados (ADA), una plataforma de IA fuerte (Vertex AI) y una capa de Work AI (Glean) que encuentra a los empleados donde trabajan. Si estás construyendo tu hoja de ruta, comienza con uno o dos casos de uso transversales, conecta la gobernanza y mide sin descanso.

Hable con Generation Digital para planificar un piloto que combine Google Cloud y Glean para lograr victorias de productividad rápidas y seguras, y luego escale.

Preguntas Frecuentes

¿Cómo mejora la IA la productividad en DBS Bank?

Al comprimir el ciclo "buscar-entender-actuar": la búsqueda empresarial, el resumen y los agentes reducen el esfuerzo manual y aceleran la toma de decisiones en los equipos.

¿Qué papel desempeña Google Cloud?

Vertex AI de Google Cloud sustenta el desarrollo de modelos, la evaluación y la implementación, integrado con la plataforma ADA de DBS para escalar casos de uso de manera segura.

¿Dónde encaja Glean?

Glean proporciona la capa de Work AI — búsqueda, asistente y flujos de trabajo de agentes en herramientas diarias — permitiendo una productividad amplia de los empleados. (Según materiales de vendedores).

¿Este enfoque es reconocido por la industria?

Sí. DBS fue nombrado Mejor Banco de IA del Mundo en 2025, destacando la ejecución a gran escala.

Recibe consejos prácticos directamente en tu bandeja de entrada

Al suscribirte, das tu consentimiento para que Generation Digital almacene y procese tus datos de acuerdo con nuestra política de privacidad. Puedes leer la política completa en gend.co/privacy.

Generación

Digital

Oficina en el Reino Unido

33 Queen St,

Londres

EC4R 1AP

Reino Unido

Oficina en Canadá

1 University Ave,

Toronto,

ON M5J 1T1,

Canadá

Oficina NAMER

77 Sands St,

Brooklyn,

NY 11201,

Estados Unidos

Oficina EMEA

Calle Charlemont, Saint Kevin's, Dublín,

D02 VN88,

Irlanda

Oficina en Medio Oriente

6994 Alsharq 3890,

An Narjis,

Riyadh 13343,

Arabia Saudita

Número de la empresa: 256 9431 77 | Derechos de autor 2026 | Términos y Condiciones | Política de Privacidad

Generación

Digital

Oficina en el Reino Unido

33 Queen St,

Londres

EC4R 1AP

Reino Unido

Oficina en Canadá

1 University Ave,

Toronto,

ON M5J 1T1,

Canadá

Oficina NAMER

77 Sands St,

Brooklyn,

NY 11201,

Estados Unidos

Oficina EMEA

Calle Charlemont, Saint Kevin's, Dublín,

D02 VN88,

Irlanda

Oficina en Medio Oriente

6994 Alsharq 3890,

An Narjis,

Riyadh 13343,

Arabia Saudita