AI Workloads Are Reshaping Data Centre Economics

AI Workloads Are Reshaping Data Centre Economics

Artificial Intelligence

Dec 17, 2025

Not sure what to do next with AI?

Assess readiness, risk, and priorities in under an hour.

Not sure what to do next with AI?

Assess readiness, risk, and priorities in under an hour.

➔ Schedule a Consultation

AI workloads are changing data centre economics at speed. Power—not floorspace—is the binding constraint, pushing power-first leasing, higher rack densities, and rapid adoption of liquid cooling. Record absorption, tight vacancy and grid delays mean operators must plan for resilient power, smarter cooling, and flexible financing to future-proof new builds.

Key points

Power-first strategy: Leasing and valuation now hinge on secured megawatts, not just square footage. Markets show record demand and low vacancy as AI tenants pre-lease capacity.

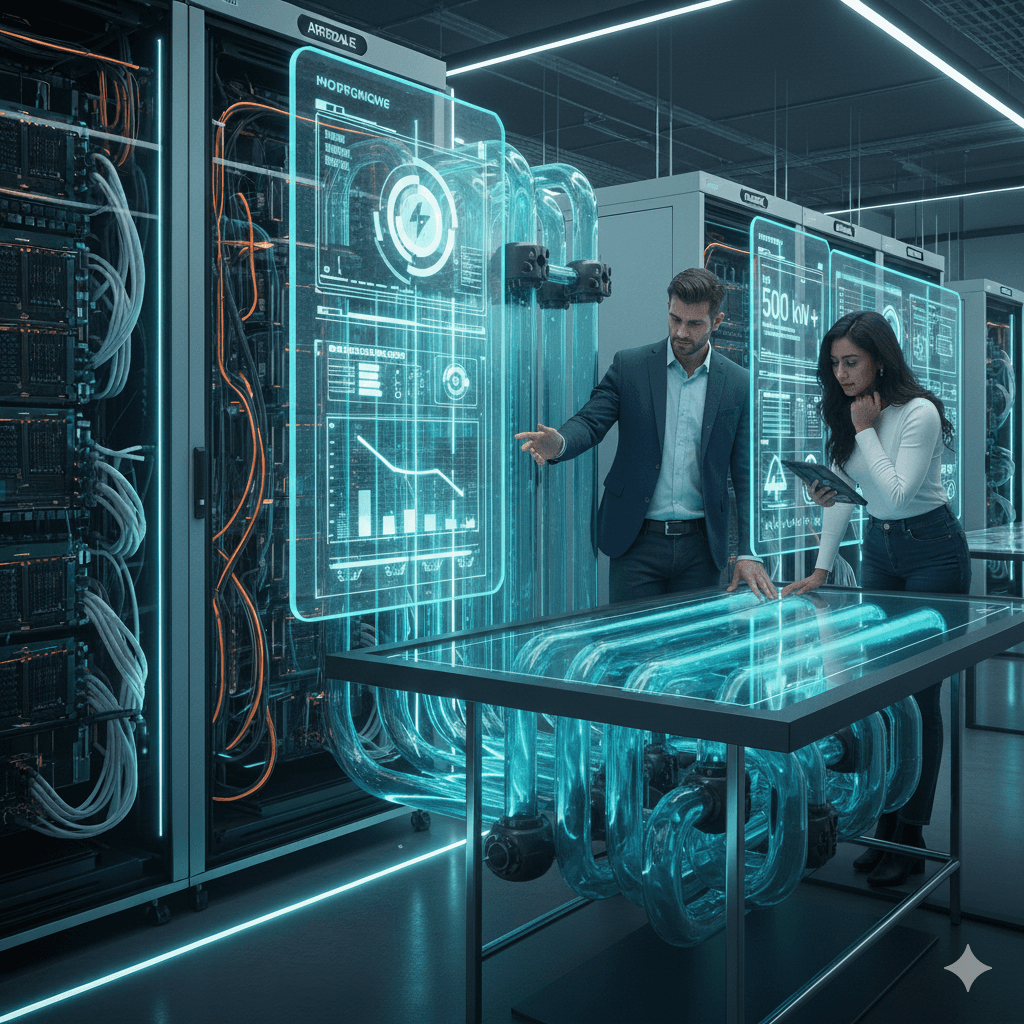

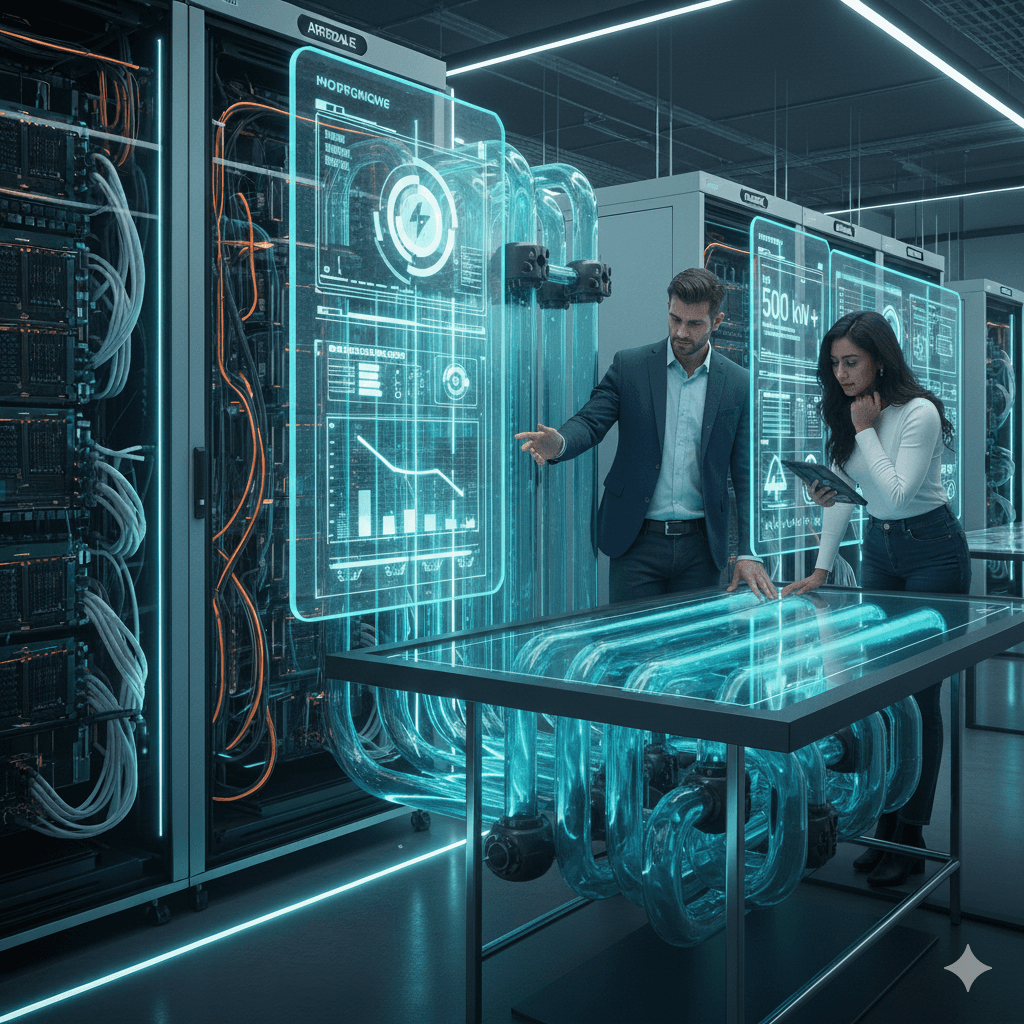

Higher rack densities: AI training/inference drives rack densities far beyond historical norms; liquid cooling is rising to manage 50–300 kW+ AI racks.

Operational efficiency: New power profiles and cooling designs improve throughput where grid power is scarce.

How it works

Leasing economics are power-led. North America and EMEA report record absorption and rising rents as AI demand outstrips deliverable power; London led EMEA H1 2025 take-up amid 2024 pre-leasing converting to live demand.

Grid constraints reshape build sequencing. UK and wider EMEA developers face connection delays, prompting speculative grid applications, “power-first” site selection, and bridge-power strategies while awaiting permanent connections.

Thermal/energy design shifts. Average enterprise racks (5–10 kW) no longer represent AI halls; liquid cooling (direct-to-chip/immersion) plus optimised airflow and heat reuse reduce infrastructure overheads even as total IT load rises.

Power architectures evolve. Vendors are piloting higher-voltage DC distribution and tunable power profiles to maximise performance per watt in power-constrained “AI factories.”

Practical steps or examples

Secure power early. Prioritise sites with firmed grid capacity or credible bridge power; align PPAs/renewables to hedge volatility and meet ESG.

Design for density. Plan aisles and white space for 50–300 kW AI racks and liquid cooling retrofits—even if Phase 1 launches at lower density.

Engineer for efficiency, not just PUE. Use updated energy models and telemetry; as IT load share grows, infrastructure efficiency (and water use) still meaningfully impacts OPEX.

Lease with flexibility. Structure take-or-pay and staged ramp schedules that align MW delivery with GPU cluster arrivals to reduce stranded capacity. Market data shows AI tenants driving absorption and rent increases.

FAQs

Q1: How are AI workloads influencing data centre operations?

They prioritise power availability and density over raw space, accelerating liquid cooling and energy-optimised operations to keep GPU clusters fed. tomshardware.com

Q2: What are the economic impacts on leasing and build decisions?

Record absorption, rising rents, and connection delays push power-first leasing and phased MW ramps; sites with firm capacity command premiums. CBRE

Q3: How do data centres adapt technically?

By designing for 50–300 kW+ racks, adopting liquid cooling, optimising airflow/heat reuse, and exploring higher-voltage power distribution and bridge-power solutions. Aon | tomshardware.com | Airedale

Q4: Is the environmental impact rising?

Yes—energy and water footprints are under scrutiny; operators counter with efficiency, renewables and heat-recovery strategies, while studies forecast continued growth from AI loads. The Verge

Summary

AI is now the centre of gravity for data centre economics. To stay competitive, prioritise MW-secure sites, density-ready designs, and flexible leases, backed by clear efficiency and sustainability plans. This is how operators deliver AI capacity quickly without over-spending on stranded power or premature retrofits.

AI workloads are changing data centre economics at speed. Power—not floorspace—is the binding constraint, pushing power-first leasing, higher rack densities, and rapid adoption of liquid cooling. Record absorption, tight vacancy and grid delays mean operators must plan for resilient power, smarter cooling, and flexible financing to future-proof new builds.

Key points

Power-first strategy: Leasing and valuation now hinge on secured megawatts, not just square footage. Markets show record demand and low vacancy as AI tenants pre-lease capacity.

Higher rack densities: AI training/inference drives rack densities far beyond historical norms; liquid cooling is rising to manage 50–300 kW+ AI racks.

Operational efficiency: New power profiles and cooling designs improve throughput where grid power is scarce.

How it works

Leasing economics are power-led. North America and EMEA report record absorption and rising rents as AI demand outstrips deliverable power; London led EMEA H1 2025 take-up amid 2024 pre-leasing converting to live demand.

Grid constraints reshape build sequencing. UK and wider EMEA developers face connection delays, prompting speculative grid applications, “power-first” site selection, and bridge-power strategies while awaiting permanent connections.

Thermal/energy design shifts. Average enterprise racks (5–10 kW) no longer represent AI halls; liquid cooling (direct-to-chip/immersion) plus optimised airflow and heat reuse reduce infrastructure overheads even as total IT load rises.

Power architectures evolve. Vendors are piloting higher-voltage DC distribution and tunable power profiles to maximise performance per watt in power-constrained “AI factories.”

Practical steps or examples

Secure power early. Prioritise sites with firmed grid capacity or credible bridge power; align PPAs/renewables to hedge volatility and meet ESG.

Design for density. Plan aisles and white space for 50–300 kW AI racks and liquid cooling retrofits—even if Phase 1 launches at lower density.

Engineer for efficiency, not just PUE. Use updated energy models and telemetry; as IT load share grows, infrastructure efficiency (and water use) still meaningfully impacts OPEX.

Lease with flexibility. Structure take-or-pay and staged ramp schedules that align MW delivery with GPU cluster arrivals to reduce stranded capacity. Market data shows AI tenants driving absorption and rent increases.

FAQs

Q1: How are AI workloads influencing data centre operations?

They prioritise power availability and density over raw space, accelerating liquid cooling and energy-optimised operations to keep GPU clusters fed. tomshardware.com

Q2: What are the economic impacts on leasing and build decisions?

Record absorption, rising rents, and connection delays push power-first leasing and phased MW ramps; sites with firm capacity command premiums. CBRE

Q3: How do data centres adapt technically?

By designing for 50–300 kW+ racks, adopting liquid cooling, optimising airflow/heat reuse, and exploring higher-voltage power distribution and bridge-power solutions. Aon | tomshardware.com | Airedale

Q4: Is the environmental impact rising?

Yes—energy and water footprints are under scrutiny; operators counter with efficiency, renewables and heat-recovery strategies, while studies forecast continued growth from AI loads. The Verge

Summary

AI is now the centre of gravity for data centre economics. To stay competitive, prioritise MW-secure sites, density-ready designs, and flexible leases, backed by clear efficiency and sustainability plans. This is how operators deliver AI capacity quickly without over-spending on stranded power or premature retrofits.

Receive practical advice directly in your inbox

By subscribing, you agree to allow Generation Digital to store and process your information according to our privacy policy. You can review the full policy at gend.co/privacy.

Generation

Digital

Business Number: 256 9431 77 | Copyright 2026 | Terms and Conditions | Privacy Policy

Generation

Digital