OpenAI launches RFP to strengthen the US AI supply chain via domestic manufacturing

OpenAI launches RFP to strengthen the US AI supply chain via domestic manufacturing

OpenAI

Artificial Intelligence

Jan 15, 2026

Uncertain about how to get started with AI?

Evaluate your readiness, potential risks, and key priorities in less than an hour.

Uncertain about how to get started with AI?

Evaluate your readiness, potential risks, and key priorities in less than an hour.

➔ Download Our Free AI Preparedness Pack

OpenAI has issued a call for U.S. manufacturers and partners able to build critical components for AI at scale. The programme is aimed at shortening build timelines, strengthening supply‑chain resilience, and extending technology leadership as demand for AI compute and embodied AI surges.

The RFP groups needs into three tracks:

Data‑centre inputs — compute, power, cooling, racks and networking.

Consumer electronics — modules, components, and tooling used in AI‑enabled devices.

Advanced robotics — including gearboxes, motors and power electronics.

Why this is significant

Resilience: Brings key production steps onshore to reduce exposure to global bottlenecks.

Speed: Shorter logistics chains and faster iteration for next-gen AI systems.

Jobs & investment: Supports high-value roles across fabrication, advanced packaging, electromechanical systems and data-centre infrastructure.

Context: the AI race — why OpenAI needs this

Exploding compute demand: Training and serving frontier models require rapidly growing volumes of accelerators, memory (HBM), and advanced packaging. Securing domestic suppliers helps ensure predictable access to these inputs.

Bottlenecks in the stack: From advanced substrates and CoWoS-style packaging to power, cooling, racks and optics, chokepoints delay deployments. Building U.S. capacity across these links reduces single points of failure.

Power and thermal constraints: Dense AI clusters intensify power delivery and heat removal needs. Localised manufacturing of PDUs, busbars, chillers, cold plates and high‑efficiency enclosures accelerates rollout.

Shift from labs to products: As AI moves into consumer devices and embodied robotics, OpenAI needs reliable domestic sources for precision mechanics (gearboxes, motors), control electronics and CE modules.

Geopolitics and trade risk: Export controls, tariffs and logistics shocks can lengthen lead times. Domestic manufacturing derisks supply for time‑critical programmes.

Speed to learn: Faster, localised build cycles mean quicker experimentation and iteration on model training and inference infrastructure—an edge in a fast‑moving race.

Ecosystem signalling: Committing to U.S. suppliers encourages investment in upstream materials, tooling and workforce—compounding capacity over time.

Who should apply

U.S. manufacturers and consortiums with existing or near‑term capacity in any of the three focus areas.

Suppliers of enabling technologies such as advanced packaging, thermal management, optics, precision motion, and related tooling.

Partners able to demonstrate scalable facilities, quality systems, and domestic value‑add.

What to include in your proposal

Scope alignment: State the focus area(s) you address and the bottlenecks you solve.

Capacity & timeline: Facilities, equipment plan, throughput targets, ramp schedule.

Resilience plan: Second‑sourcing, traceability, and supplier localisation in the U.S.

Workforce & compliance: Hiring, training, safety, and relevant controls.

Impact: Quantify lead‑time reduction, yield targets, and domestic value‑add.

Key dates

Publish date: 15 January 2026

Reviews: Ongoing, rolling

Final deadline: June 2026

How Generation Digital can help

Bid readiness: Rapid scoping of eligibility, evidence and milestones.

Proposal support: Structure, narrative, and KPI design.

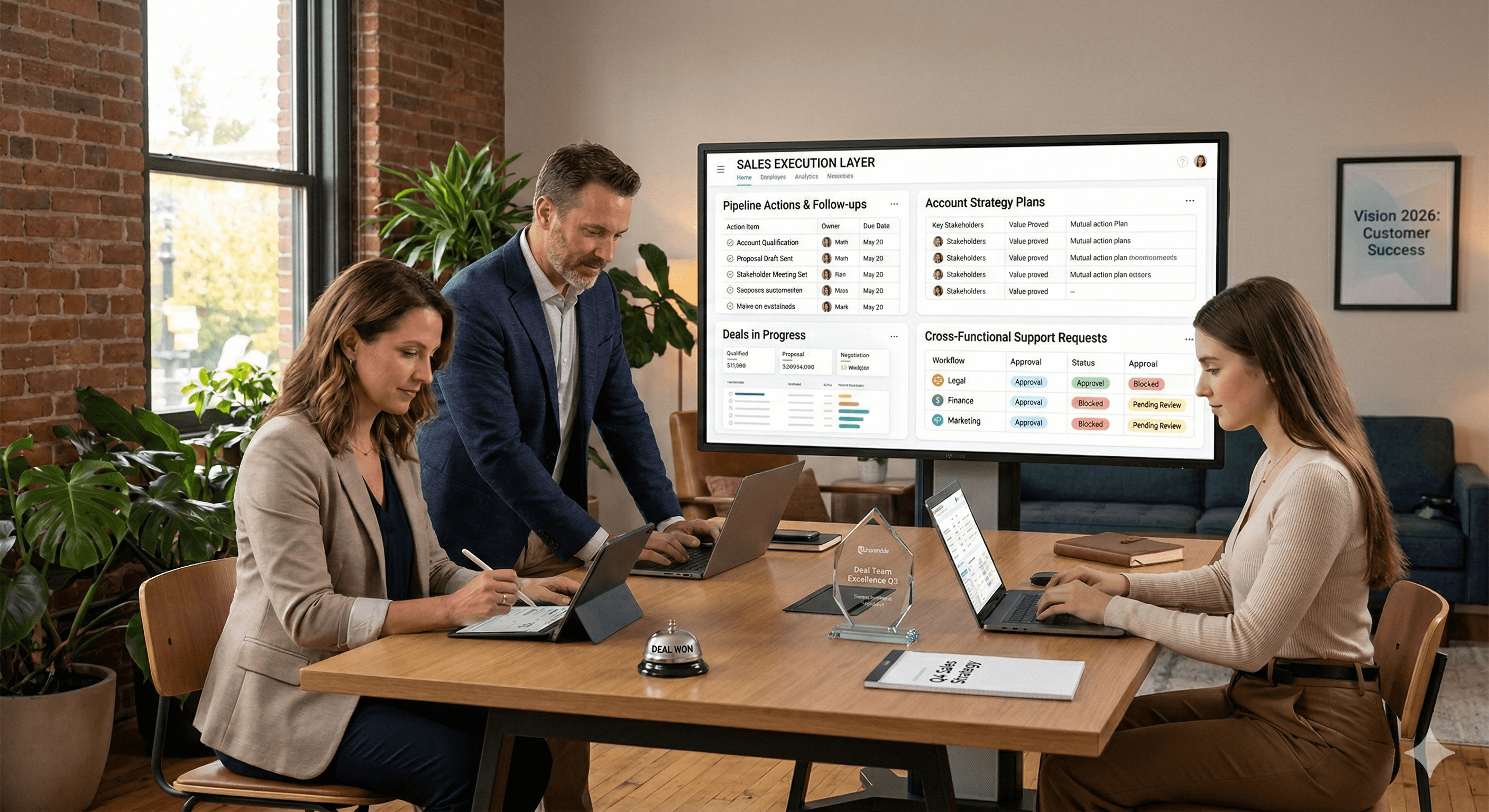

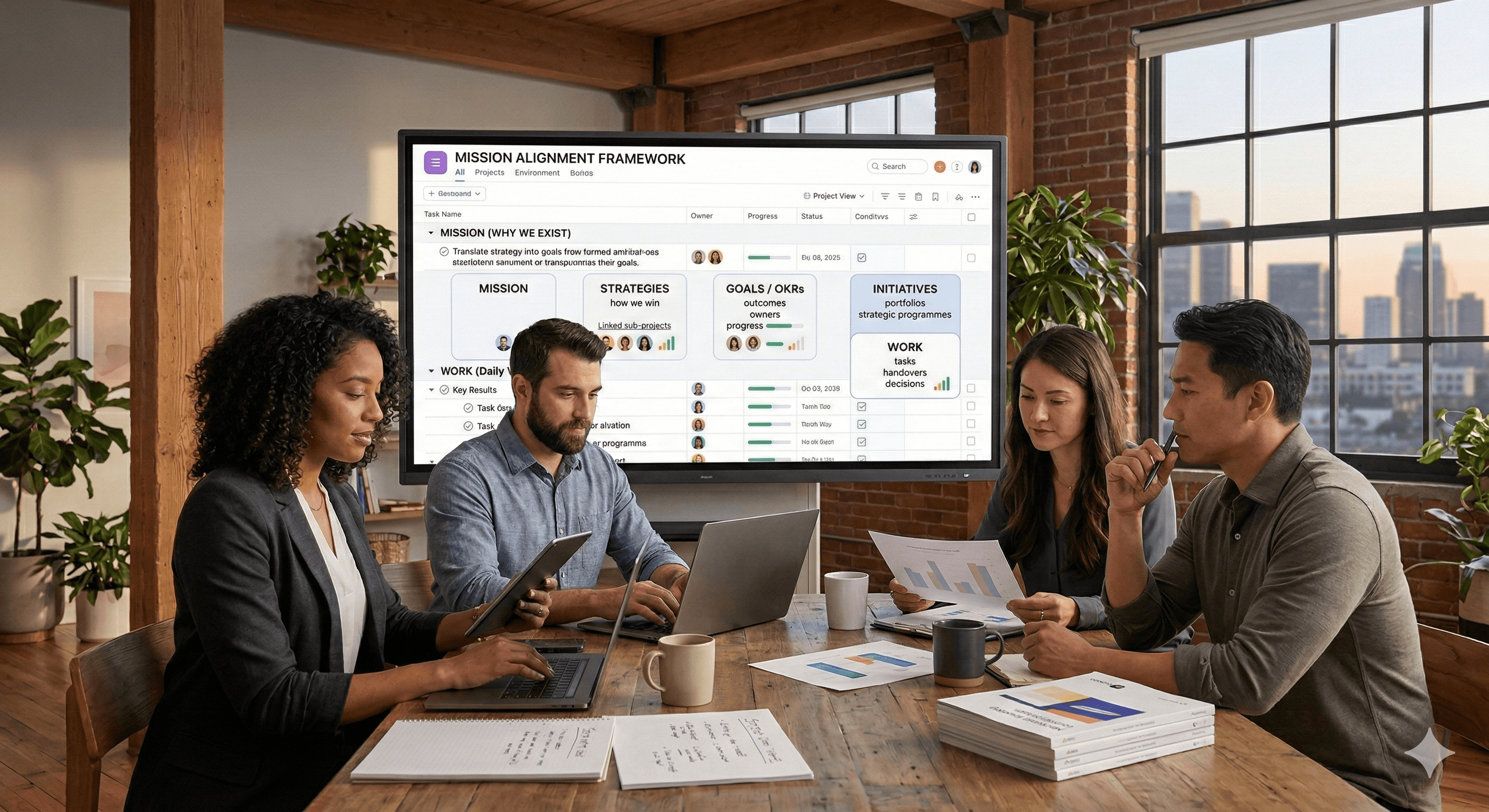

Delivery tooling: Asana for programme control, Miro for reviews and design, Notion for documentation and audit trail.

Contact us to assess fit and accelerate your submission.

FAQs

When is the deadline?

June 2026; proposals reviewed on a rolling basis.

Who’s eligible?

U.S.-based manufacturers and partners that can scale capacity in data‑centre inputs, consumer electronics, or advanced robotics.

What’s the goal?

Shorten timelines, strengthen resilience, and extend U.S. technology leadership across the AI hardware stack.

OpenAI has issued a call for U.S. manufacturers and partners able to build critical components for AI at scale. The programme is aimed at shortening build timelines, strengthening supply‑chain resilience, and extending technology leadership as demand for AI compute and embodied AI surges.

The RFP groups needs into three tracks:

Data‑centre inputs — compute, power, cooling, racks and networking.

Consumer electronics — modules, components, and tooling used in AI‑enabled devices.

Advanced robotics — including gearboxes, motors and power electronics.

Why this is significant

Resilience: Brings key production steps onshore to reduce exposure to global bottlenecks.

Speed: Shorter logistics chains and faster iteration for next-gen AI systems.

Jobs & investment: Supports high-value roles across fabrication, advanced packaging, electromechanical systems and data-centre infrastructure.

Context: the AI race — why OpenAI needs this

Exploding compute demand: Training and serving frontier models require rapidly growing volumes of accelerators, memory (HBM), and advanced packaging. Securing domestic suppliers helps ensure predictable access to these inputs.

Bottlenecks in the stack: From advanced substrates and CoWoS-style packaging to power, cooling, racks and optics, chokepoints delay deployments. Building U.S. capacity across these links reduces single points of failure.

Power and thermal constraints: Dense AI clusters intensify power delivery and heat removal needs. Localised manufacturing of PDUs, busbars, chillers, cold plates and high‑efficiency enclosures accelerates rollout.

Shift from labs to products: As AI moves into consumer devices and embodied robotics, OpenAI needs reliable domestic sources for precision mechanics (gearboxes, motors), control electronics and CE modules.

Geopolitics and trade risk: Export controls, tariffs and logistics shocks can lengthen lead times. Domestic manufacturing derisks supply for time‑critical programmes.

Speed to learn: Faster, localised build cycles mean quicker experimentation and iteration on model training and inference infrastructure—an edge in a fast‑moving race.

Ecosystem signalling: Committing to U.S. suppliers encourages investment in upstream materials, tooling and workforce—compounding capacity over time.

Who should apply

U.S. manufacturers and consortiums with existing or near‑term capacity in any of the three focus areas.

Suppliers of enabling technologies such as advanced packaging, thermal management, optics, precision motion, and related tooling.

Partners able to demonstrate scalable facilities, quality systems, and domestic value‑add.

What to include in your proposal

Scope alignment: State the focus area(s) you address and the bottlenecks you solve.

Capacity & timeline: Facilities, equipment plan, throughput targets, ramp schedule.

Resilience plan: Second‑sourcing, traceability, and supplier localisation in the U.S.

Workforce & compliance: Hiring, training, safety, and relevant controls.

Impact: Quantify lead‑time reduction, yield targets, and domestic value‑add.

Key dates

Publish date: 15 January 2026

Reviews: Ongoing, rolling

Final deadline: June 2026

How Generation Digital can help

Bid readiness: Rapid scoping of eligibility, evidence and milestones.

Proposal support: Structure, narrative, and KPI design.

Delivery tooling: Asana for programme control, Miro for reviews and design, Notion for documentation and audit trail.

Contact us to assess fit and accelerate your submission.

FAQs

When is the deadline?

June 2026; proposals reviewed on a rolling basis.

Who’s eligible?

U.S.-based manufacturers and partners that can scale capacity in data‑centre inputs, consumer electronics, or advanced robotics.

What’s the goal?

Shorten timelines, strengthen resilience, and extend U.S. technology leadership across the AI hardware stack.

Receive weekly AI news and advice straight to your inbox

By subscribing, you agree to allow Generation Digital to store and process your information according to our privacy policy. You can review the full policy at gend.co/privacy.

Upcoming Workshops and Webinars

Streamlined Operations for Canadian Businesses - Asana

Virtual Webinar

Wednesday, February 25, 2026

Online

Collaborate with AI Team Members - Asana

In-Person Workshop

Thursday, February 26, 2026

Toronto, Canada

From Concept to Prototype - AI in Miro

Online Webinar

Wednesday, February 18, 2026

Online

Generation

Digital

Business Number: 256 9431 77 | Copyright 2026 | Terms and Conditions | Privacy Policy

Generation

Digital