Enhancing AI in Manufacturing: A COO's Guide to Success (2026) for the Canadian Market

Enhancing AI in Manufacturing: A COO's Guide to Success (2026) for the Canadian Market

Artificial Intelligence

Dec 15, 2025

Not sure what to do next with AI?

Assess readiness, risk, and priorities in under an hour.

Not sure what to do next with AI?

Assess readiness, risk, and priorities in under an hour.

➔ Schedule a Consultation

The COO thesis: value comes from the enablers, not the demo

The COO100 Survey is clear: manufacturing leaders are heavily investing in AI, yet many are underinvesting in the foundations needed for lasting impact—this is why pilots stall and savings disappear after the first year. Treat AI as a production process: capability, control, cadence.

What changes in 2026

Two realities come together. First, boards expect plant-level productivity and quality improvements to be reflected in the financial statements, not just in presentations. Second, companies that report returns look different in their operating model and enablers—data pipelines connected to the production line, robust MLOps, rituals for adopting technology at the frontline, and governance that funds by value stream, not tool.

To scale AI in manufacturing, COOs must focus heavily on enablers: data/OT connectivity, MLOps, cross-functional operating models, and frontline adoption. The McKinsey COO100 survey shows high AI budgets but underinvestment in these foundations—explaining why pilots seldom lead to plant-wide performance. Make the enablers the programme.

From pilots to performance: five COO choices

1) Fund by value stream, not use case.

Stop spreading budgets across isolated “wins.” Finance a target value stream (e.g., packaging OEE or FPY) and connect all models, data work, and change activities to those KPIs. Leaders who scale AI organize around strategy, talent, operating model, technology, data, and adoption—and measure at that level.

2) Industrialize the data layer at the line.

Insist on the critical work: sensor quality, historian access, semantic models for equipment, and governed feature stores. If data aren't production-grade, neither are the models. (This is the most common underinvestment highlighted by the survey.)

3) Treat models like assets: MLOps for OT.

Standardize deployment to edge and cloud, implement drift monitoring, rollback, and change management trusted by your plant managers. Align model releases with maintenance windows just like any other asset change. High performers do this routinely.

4) Put adoption in the field.

Move improvement rituals (stand-ups, tiered meetings) to utilize AI insights by default—quality alerts, predicted downtime, energy anomalies—so operators embrace the tools, not just tolerate them. Adoption is a management system, not a communication plan.

5) Govern for scalability, not just approval.

Establish an AI control tower that manages the backlog, eliminates duplication, and retires models that don't prove their worth. Fund experiments, but advance only those with validated impacts on throughput, yield, cost-to-serve, and safety.

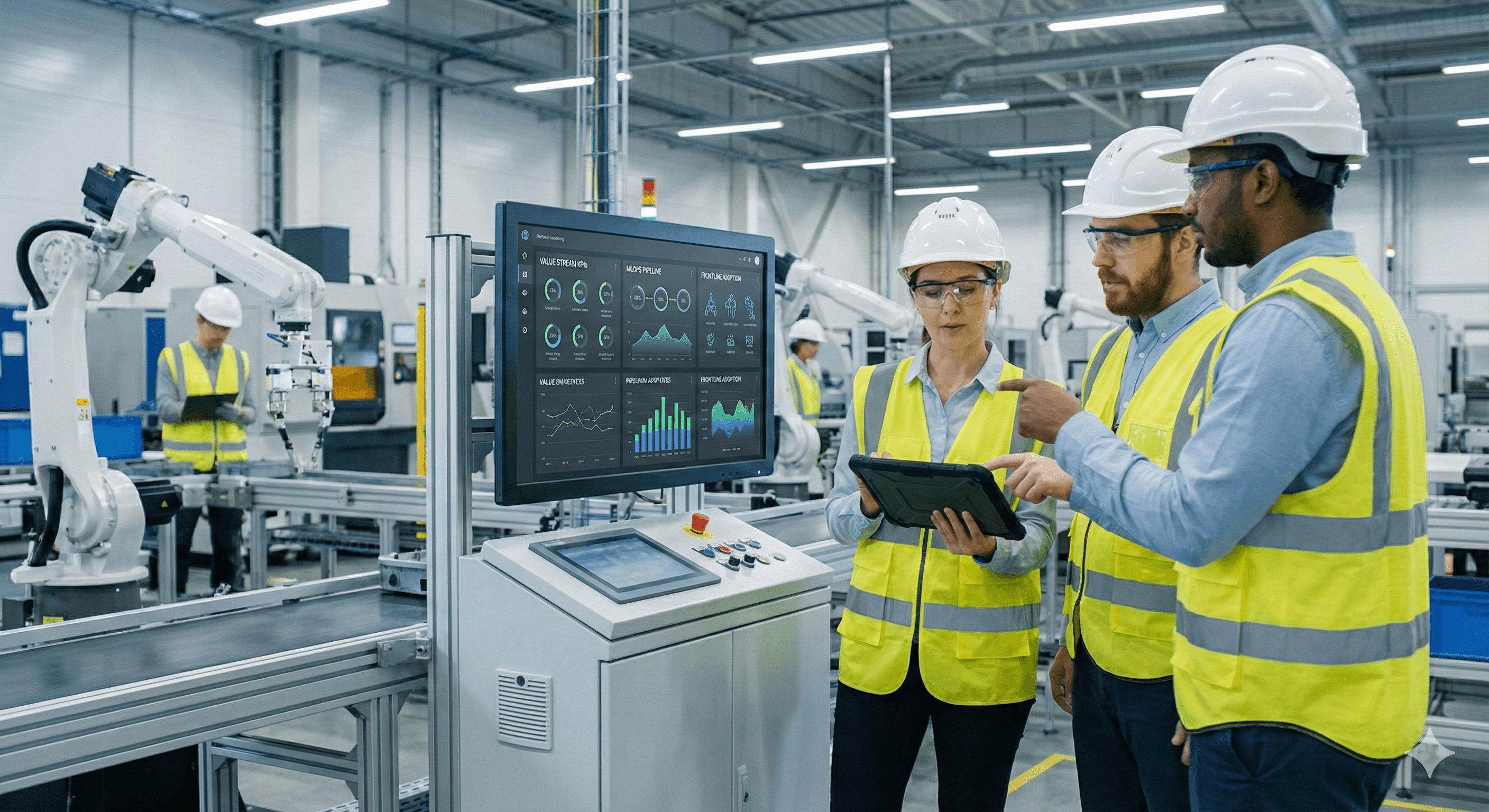

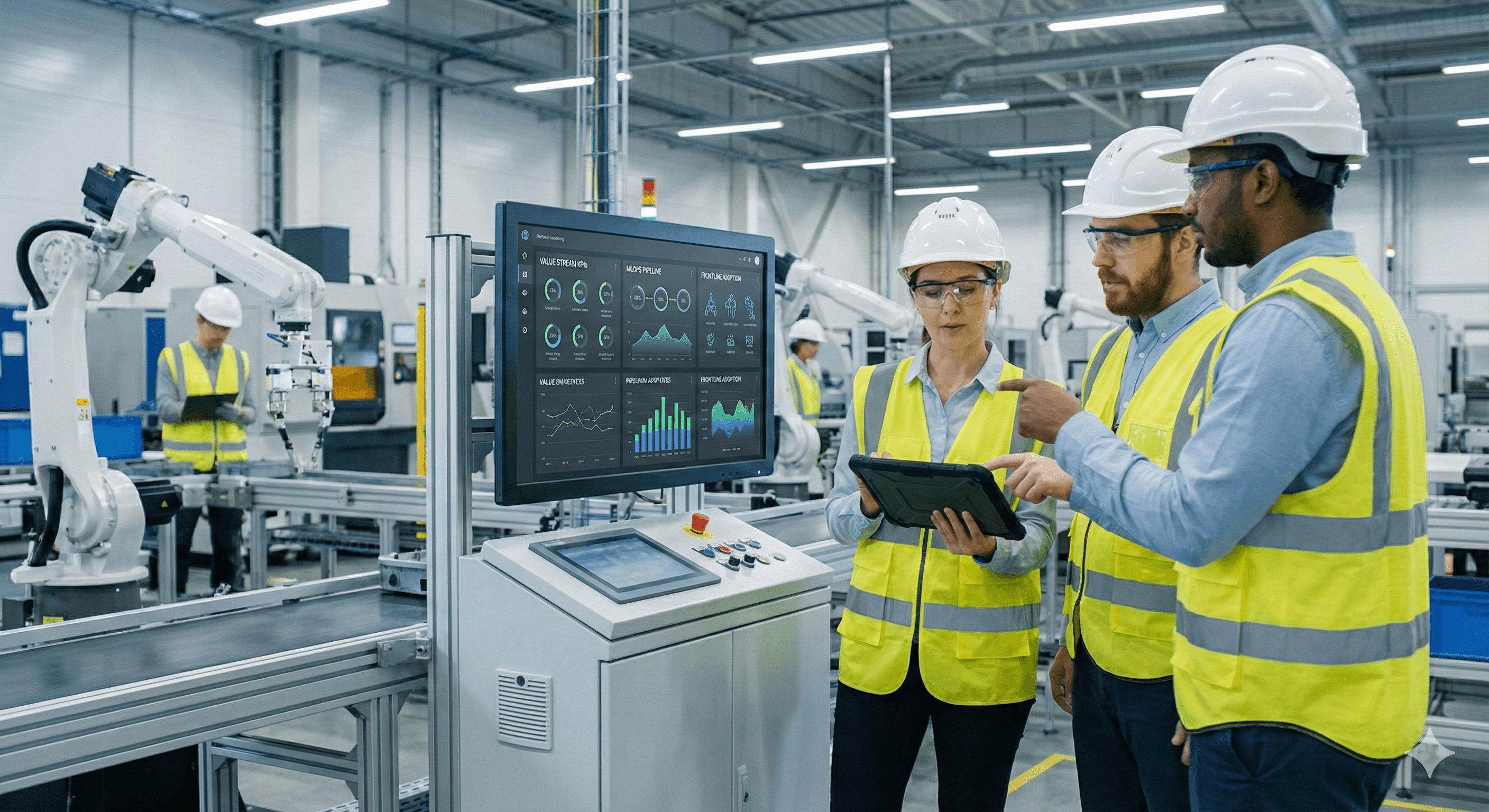

What success looks like on the factory floor

OEE, FPY, and MTBF move together, not in isolation—because models are integrated into maintenance, quality, and planning workflows, not just dashboards.

Learning cycle every two weeks: new data, retrain, redeploy, verify; models are treated like equipment—maintained, audited, and replaced when outdated.

Enterprise-wide reuse: one playbook for vision QA or energy optimization, replicated to similar lines/plants with 80% common components.

(Canadian note: adoption is accelerating; Canada now leads North America in smart-manufacturing AI penetration—proof that the ecosystem is ready if enablers are in place.)

FAQs

Q1: What is the primary benefit of AI in manufacturing?

When scaled through the enablers, AI simultaneously improves yield, throughput, and energy efficiency—showing up in OEE, FPY, and cost per unit, not just in pilot stories. McKinsey & Company

Q2: Why do companies underinvest in enablers?

Because use-cases are visible and fundable, while data infrastructure, MLOps, and change management seem like overhead. The COO100 warns this is precisely what undermines long-term sustainability. McKinsey & Company

Q3: How can COOs ensure successful scaling?

Run AI like a production program: value-stream funding, robust data/OT, disciplined MLOps, and adoption rituals on the shop floor. Govern with a unified backlog and phase out what doesn’t deliver. McKinsey & Company

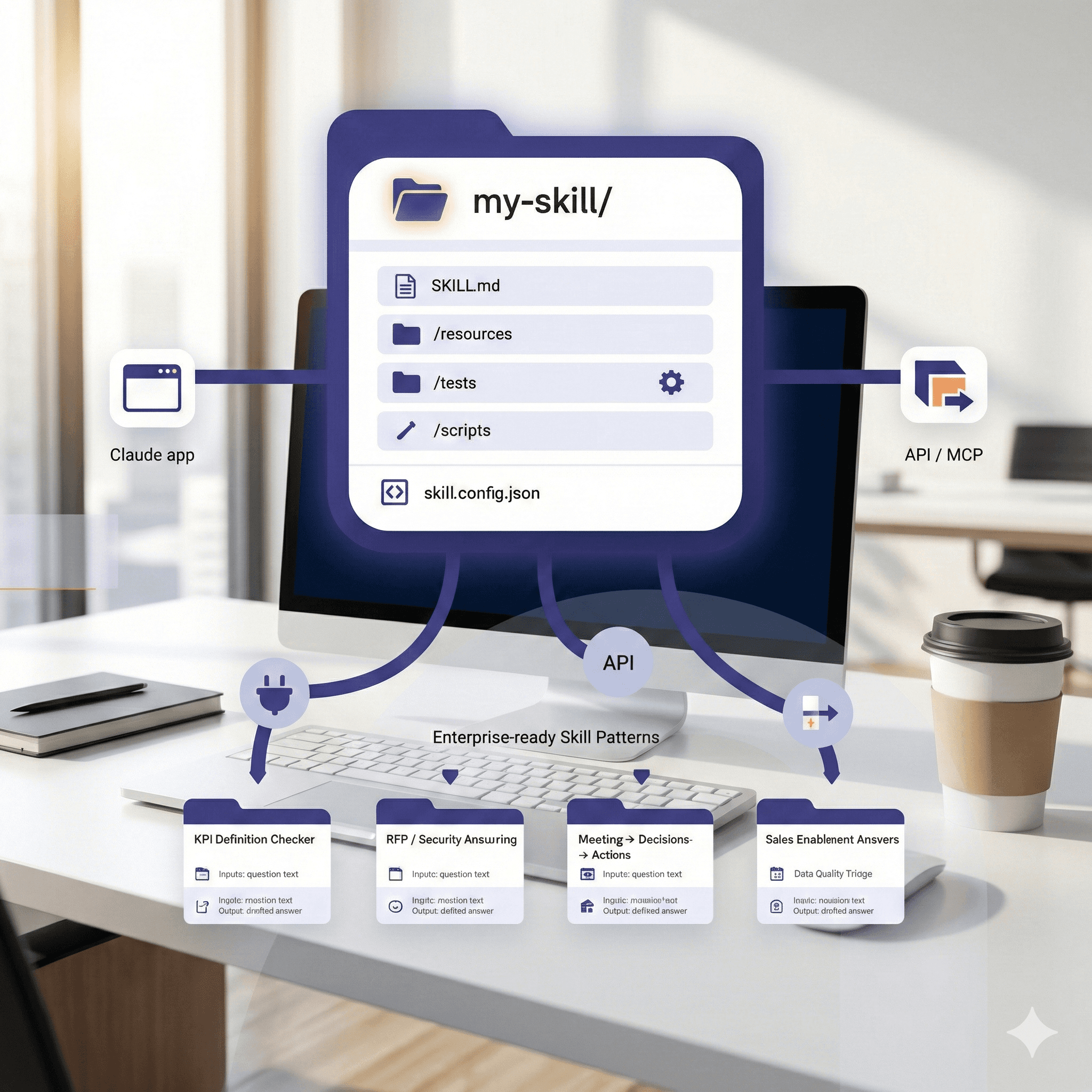

Software Options

Asana for value-stream OKRs and cross-plant release schedules.

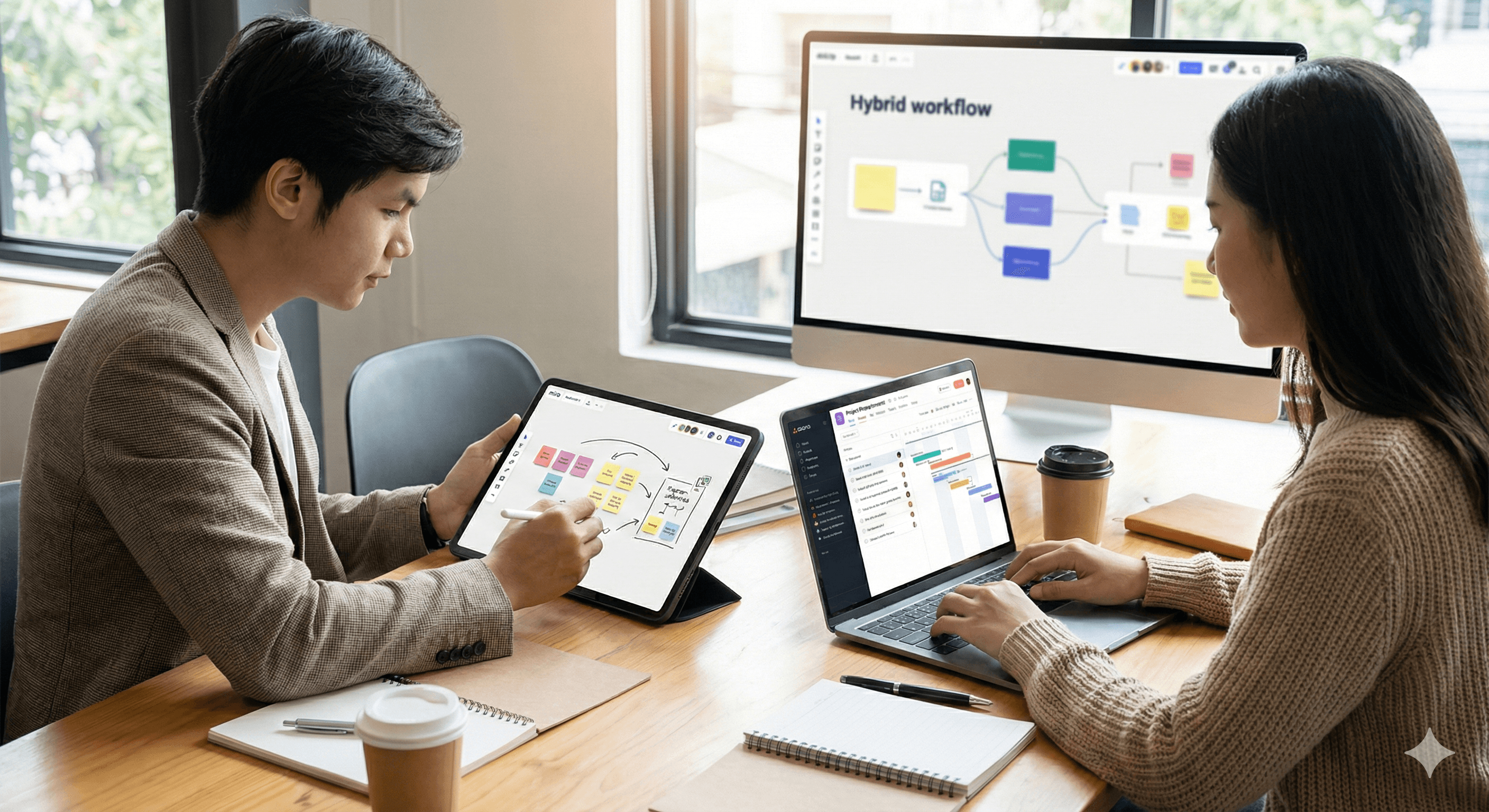

Miro for mapping line-level data and failure modes.

Notion for standard work, playbooks, and model guides.

Glean for controlled access to engineering knowledge.

Next Steps?

Ready to turn pilots into performance? Generation Digital helps COOs establish the AI enablers—from data to the shop floor—and build the operating model that scales across facilities.

The COO thesis: value comes from the enablers, not the demo

The COO100 Survey is clear: manufacturing leaders are heavily investing in AI, yet many are underinvesting in the foundations needed for lasting impact—this is why pilots stall and savings disappear after the first year. Treat AI as a production process: capability, control, cadence.

What changes in 2026

Two realities come together. First, boards expect plant-level productivity and quality improvements to be reflected in the financial statements, not just in presentations. Second, companies that report returns look different in their operating model and enablers—data pipelines connected to the production line, robust MLOps, rituals for adopting technology at the frontline, and governance that funds by value stream, not tool.

To scale AI in manufacturing, COOs must focus heavily on enablers: data/OT connectivity, MLOps, cross-functional operating models, and frontline adoption. The McKinsey COO100 survey shows high AI budgets but underinvestment in these foundations—explaining why pilots seldom lead to plant-wide performance. Make the enablers the programme.

From pilots to performance: five COO choices

1) Fund by value stream, not use case.

Stop spreading budgets across isolated “wins.” Finance a target value stream (e.g., packaging OEE or FPY) and connect all models, data work, and change activities to those KPIs. Leaders who scale AI organize around strategy, talent, operating model, technology, data, and adoption—and measure at that level.

2) Industrialize the data layer at the line.

Insist on the critical work: sensor quality, historian access, semantic models for equipment, and governed feature stores. If data aren't production-grade, neither are the models. (This is the most common underinvestment highlighted by the survey.)

3) Treat models like assets: MLOps for OT.

Standardize deployment to edge and cloud, implement drift monitoring, rollback, and change management trusted by your plant managers. Align model releases with maintenance windows just like any other asset change. High performers do this routinely.

4) Put adoption in the field.

Move improvement rituals (stand-ups, tiered meetings) to utilize AI insights by default—quality alerts, predicted downtime, energy anomalies—so operators embrace the tools, not just tolerate them. Adoption is a management system, not a communication plan.

5) Govern for scalability, not just approval.

Establish an AI control tower that manages the backlog, eliminates duplication, and retires models that don't prove their worth. Fund experiments, but advance only those with validated impacts on throughput, yield, cost-to-serve, and safety.

What success looks like on the factory floor

OEE, FPY, and MTBF move together, not in isolation—because models are integrated into maintenance, quality, and planning workflows, not just dashboards.

Learning cycle every two weeks: new data, retrain, redeploy, verify; models are treated like equipment—maintained, audited, and replaced when outdated.

Enterprise-wide reuse: one playbook for vision QA or energy optimization, replicated to similar lines/plants with 80% common components.

(Canadian note: adoption is accelerating; Canada now leads North America in smart-manufacturing AI penetration—proof that the ecosystem is ready if enablers are in place.)

FAQs

Q1: What is the primary benefit of AI in manufacturing?

When scaled through the enablers, AI simultaneously improves yield, throughput, and energy efficiency—showing up in OEE, FPY, and cost per unit, not just in pilot stories. McKinsey & Company

Q2: Why do companies underinvest in enablers?

Because use-cases are visible and fundable, while data infrastructure, MLOps, and change management seem like overhead. The COO100 warns this is precisely what undermines long-term sustainability. McKinsey & Company

Q3: How can COOs ensure successful scaling?

Run AI like a production program: value-stream funding, robust data/OT, disciplined MLOps, and adoption rituals on the shop floor. Govern with a unified backlog and phase out what doesn’t deliver. McKinsey & Company

Software Options

Asana for value-stream OKRs and cross-plant release schedules.

Miro for mapping line-level data and failure modes.

Notion for standard work, playbooks, and model guides.

Glean for controlled access to engineering knowledge.

Next Steps?

Ready to turn pilots into performance? Generation Digital helps COOs establish the AI enablers—from data to the shop floor—and build the operating model that scales across facilities.

Receive practical advice directly in your inbox

By subscribing, you agree to allow Generation Digital to store and process your information according to our privacy policy. You can review the full policy at gend.co/privacy.

Generation

Digital

Business Number: 256 9431 77 | Copyright 2026 | Terms and Conditions | Privacy Policy

Generation

Digital