BBVA et OpenAI : Comment ChatGPT Enterprise redéfinit le secteur bancaire en 2025

BBVA et OpenAI : Comment ChatGPT Enterprise redéfinit le secteur bancaire en 2025

OpenAI

ChatGPT

11 déc. 2025

Not sure what to do next with AI?

Assess readiness, risk, and priorities in under an hour.

Not sure what to do next with AI?

Assess readiness, risk, and priorities in under an hour.

➔ Réservez une consultation

BBVA et OpenAI élargissent leur collaboration pluriannuelle pour déployer ChatGPT Enterprise auprès d'environ 120 000 employés. Après un projet pilote ayant permis d'économiser environ trois heures par semaine sur des tâches routinières, BBVA développe l'IA de la productivité aux flux de travail et aux canaux clients, y compris des prototypes pour une application bancaire native de ChatGPT et son assistant « Blue ».

Pourquoi cela compte maintenant : BBVA élargit son partenariat avec OpenAI et offre ChatGPT Enterprise à environ 120 000 employés, suite à un projet pilote qui aurait permis d'économiser aux employés environ trois heures par semaine sur des tâches routinières. Cela marque l'un des plus grands déploiements d'IA en entreprise dans le secteur bancaire mondial.

Quoi de neuf

Déploiement mondial pour ~120k personnes. BBVA déploie ChatGPT Enterprise à l'ensemble du groupe dans le cadre d'une transformation IA pluriannuelle. Bloomberg+1

Des pilotes à la production. Après un déploiement initial (env. 11k utilisateurs) et des économies de temps documentées, BBVA passe des cas d'utilisation de productivité à l'automatisation des workflows et des canaux client. Bloomberg+1

Au-delà du back-office. BBVA a expérimenté une application bancaire conversationnelle au sein de ChatGPT et fait progresser Blue, son assistant IA pour les clients—indiquant de futures expériences bancaires nativement conversationnelles. Finextra Research+1

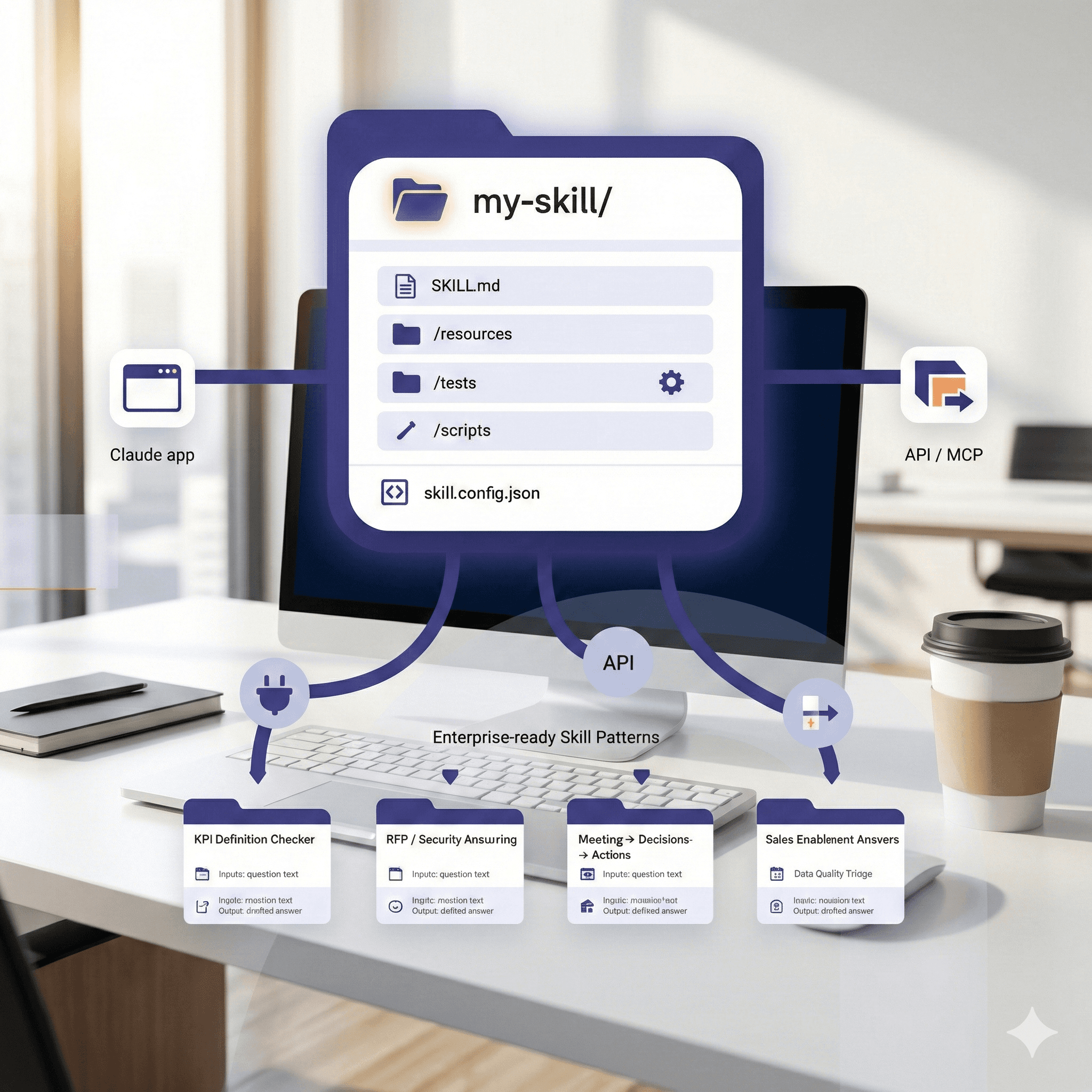

Comment cela fonctionne (en un coup d'œil)

ChatGPT Enterprise offre un assistant IA d'entreprise avec des contrôles d'administration, la confidentialité des données et des limites accrues adaptées aux charges de travail réglementées. BBVA l'intègre dans le travail quotidien et les processus sélectionnés (juridique, opérations, support client), OpenAI fournissant un soutien stratégique sur les modèles d'échelle.

Cas d'utilisation pratiques

Connaissances de première ligne à vitesse

Rédiger des réponses à des questions complexes sur les politiques ou les produits ; BBVA a construit un Assistant Juridique pour la Banque de Détail pour aider à gérer environ 40k questions/an des succursales.Opérations et middle-office

Résumer les cas, générer les premiers brouillons, et extraire des extraits de politiques, libérant les humains pour des décisions de jugement. Les économies de temps du projet pilote suggèrent un retour significatif d'heures hebdomadaires.Expérience client

Passage du chat web/app à des trajets conversationnels via Blue et des expériences bancaires potentielles natives de ChatGPT (découverte, FAQ, meilleure action suivante).Facilitation des risques et de la conformité

Prompts structurés qui citent des politiques, gardent des traces d'audit, et acheminent les cas complexes vers des spécialistes (modèle inspiré par les notes de cas de BBVA d'OpenAI).

Avantages visés par BBVA

Autonomisation des employés à grande échelle : accès sécurisé à l'IA pour environ 120k personnes.

Efficacité et rapidité : des économies précoces de environ 3 heures/semaine durant la phase pilote.

Méthodes de travail natives de l'IA : passage de l'utilisation individuelle aux flux de travail et canaux client.

Signaux d'innovation sur le marché : prototypes comme les applications bancaires natives de ChatGPT.

Garde-fous : ce que les banques doivent réussir

Gouvernance et confidentialité des données : appliquer le DLP de niveau bancaire, l'enregistrement et la rédaction ; utiliser des instances d'entreprise et des listes blanches pour contrôler les intégrations. (Voir l'accent mis par BBVA et OpenAI sur le déploiement en entreprise.)

Gestion des risques de prompts et de modèles : définir des messages approuvés, examiner les résultats, et intégrer des modèles d'escalade ; traiter les prompts comme du code.

Conformité et auditabilité : garantir que l'utilisation du modèle est enregistrée et explicable ; s'aligner avec les régulations régionales.

Gestion du changement : formation, manuels de prompts, et adoption mesurable sont essentiels pour atteindre l'échelle de BBVA.

Ce que cela signifie pour les banques du Royaume-Uni et de l'UE

Le mouvement de BBVA montre que l'échelle est possible maintenant — avec une IA d'entreprise préservant la confidentialité et de réels signaux de ROI. Si vous opérez dans un marché réglementé, le plan d'action est clair : commencez par les flux de connaissances, mesurez le temps économisé, puis étendez aux parcours clients contrôlés.

FAQ

Q1 : Combien d'employés de BBVA bénéficieront de ChatGPT Enterprise ?

Environ 120 000, alors que BBVA développe son partenariat avec OpenAI à l'échelle du groupe. Bloomberg

Q2 : Quels résultats BBVA a-t-il constatés lors des pilotes ?

Une économie rapportée de environ 3 heures/semaine sur des tâches routinières pour les premiers utilisateurs, ce qui a soutenu le déploiement élargi. Bloomberg

Q3 : L'IA atteindra-t-elle les canaux clients ?

Oui — BBVA fait progresser Blue (son assistant IA) et a démontré un concept d'application bancaire conversationnelle native de ChatGPT. Cinco Días+1

Q4 : Est-ce sécurisé pour une banque ?

BBVA utilise ChatGPT Enterprise avec des contrôles d'entreprise et intègre l'IA dans une approche de gouvernance structurée et évolutive. OpenAI

BBVA et OpenAI élargissent leur collaboration pluriannuelle pour déployer ChatGPT Enterprise auprès d'environ 120 000 employés. Après un projet pilote ayant permis d'économiser environ trois heures par semaine sur des tâches routinières, BBVA développe l'IA de la productivité aux flux de travail et aux canaux clients, y compris des prototypes pour une application bancaire native de ChatGPT et son assistant « Blue ».

Pourquoi cela compte maintenant : BBVA élargit son partenariat avec OpenAI et offre ChatGPT Enterprise à environ 120 000 employés, suite à un projet pilote qui aurait permis d'économiser aux employés environ trois heures par semaine sur des tâches routinières. Cela marque l'un des plus grands déploiements d'IA en entreprise dans le secteur bancaire mondial.

Quoi de neuf

Déploiement mondial pour ~120k personnes. BBVA déploie ChatGPT Enterprise à l'ensemble du groupe dans le cadre d'une transformation IA pluriannuelle. Bloomberg+1

Des pilotes à la production. Après un déploiement initial (env. 11k utilisateurs) et des économies de temps documentées, BBVA passe des cas d'utilisation de productivité à l'automatisation des workflows et des canaux client. Bloomberg+1

Au-delà du back-office. BBVA a expérimenté une application bancaire conversationnelle au sein de ChatGPT et fait progresser Blue, son assistant IA pour les clients—indiquant de futures expériences bancaires nativement conversationnelles. Finextra Research+1

Comment cela fonctionne (en un coup d'œil)

ChatGPT Enterprise offre un assistant IA d'entreprise avec des contrôles d'administration, la confidentialité des données et des limites accrues adaptées aux charges de travail réglementées. BBVA l'intègre dans le travail quotidien et les processus sélectionnés (juridique, opérations, support client), OpenAI fournissant un soutien stratégique sur les modèles d'échelle.

Cas d'utilisation pratiques

Connaissances de première ligne à vitesse

Rédiger des réponses à des questions complexes sur les politiques ou les produits ; BBVA a construit un Assistant Juridique pour la Banque de Détail pour aider à gérer environ 40k questions/an des succursales.Opérations et middle-office

Résumer les cas, générer les premiers brouillons, et extraire des extraits de politiques, libérant les humains pour des décisions de jugement. Les économies de temps du projet pilote suggèrent un retour significatif d'heures hebdomadaires.Expérience client

Passage du chat web/app à des trajets conversationnels via Blue et des expériences bancaires potentielles natives de ChatGPT (découverte, FAQ, meilleure action suivante).Facilitation des risques et de la conformité

Prompts structurés qui citent des politiques, gardent des traces d'audit, et acheminent les cas complexes vers des spécialistes (modèle inspiré par les notes de cas de BBVA d'OpenAI).

Avantages visés par BBVA

Autonomisation des employés à grande échelle : accès sécurisé à l'IA pour environ 120k personnes.

Efficacité et rapidité : des économies précoces de environ 3 heures/semaine durant la phase pilote.

Méthodes de travail natives de l'IA : passage de l'utilisation individuelle aux flux de travail et canaux client.

Signaux d'innovation sur le marché : prototypes comme les applications bancaires natives de ChatGPT.

Garde-fous : ce que les banques doivent réussir

Gouvernance et confidentialité des données : appliquer le DLP de niveau bancaire, l'enregistrement et la rédaction ; utiliser des instances d'entreprise et des listes blanches pour contrôler les intégrations. (Voir l'accent mis par BBVA et OpenAI sur le déploiement en entreprise.)

Gestion des risques de prompts et de modèles : définir des messages approuvés, examiner les résultats, et intégrer des modèles d'escalade ; traiter les prompts comme du code.

Conformité et auditabilité : garantir que l'utilisation du modèle est enregistrée et explicable ; s'aligner avec les régulations régionales.

Gestion du changement : formation, manuels de prompts, et adoption mesurable sont essentiels pour atteindre l'échelle de BBVA.

Ce que cela signifie pour les banques du Royaume-Uni et de l'UE

Le mouvement de BBVA montre que l'échelle est possible maintenant — avec une IA d'entreprise préservant la confidentialité et de réels signaux de ROI. Si vous opérez dans un marché réglementé, le plan d'action est clair : commencez par les flux de connaissances, mesurez le temps économisé, puis étendez aux parcours clients contrôlés.

FAQ

Q1 : Combien d'employés de BBVA bénéficieront de ChatGPT Enterprise ?

Environ 120 000, alors que BBVA développe son partenariat avec OpenAI à l'échelle du groupe. Bloomberg

Q2 : Quels résultats BBVA a-t-il constatés lors des pilotes ?

Une économie rapportée de environ 3 heures/semaine sur des tâches routinières pour les premiers utilisateurs, ce qui a soutenu le déploiement élargi. Bloomberg

Q3 : L'IA atteindra-t-elle les canaux clients ?

Oui — BBVA fait progresser Blue (son assistant IA) et a démontré un concept d'application bancaire conversationnelle native de ChatGPT. Cinco Días+1

Q4 : Est-ce sécurisé pour une banque ?

BBVA utilise ChatGPT Enterprise avec des contrôles d'entreprise et intègre l'IA dans une approche de gouvernance structurée et évolutive. OpenAI

Recevez des conseils pratiques directement dans votre boîte de réception

En vous abonnant, vous consentez à ce que Génération Numérique stocke et traite vos informations conformément à notre politique de confidentialité. Vous pouvez lire la politique complète sur gend.co/privacy.

Génération

Numérique

Bureau au Royaume-Uni

33 rue Queen,

Londres

EC4R 1AP

Royaume-Uni

Bureau au Canada

1 University Ave,

Toronto,

ON M5J 1T1,

Canada

Bureau NAMER

77 Sands St,

Brooklyn,

NY 11201,

États-Unis

Bureau EMEA

Rue Charlemont, Saint Kevin's, Dublin,

D02 VN88,

Irlande

Bureau du Moyen-Orient

6994 Alsharq 3890,

An Narjis,

Riyad 13343,

Arabie Saoudite

Numéro d'entreprise : 256 9431 77 | Droits d'auteur 2026 | Conditions générales | Politique de confidentialité

Génération

Numérique

Bureau au Royaume-Uni

33 rue Queen,

Londres

EC4R 1AP

Royaume-Uni

Bureau au Canada

1 University Ave,

Toronto,

ON M5J 1T1,

Canada

Bureau NAMER

77 Sands St,

Brooklyn,

NY 11201,

États-Unis

Bureau EMEA

Rue Charlemont, Saint Kevin's, Dublin,

D02 VN88,

Irlande

Bureau du Moyen-Orient

6994 Alsharq 3890,

An Narjis,

Riyad 13343,

Arabie Saoudite

Numéro d'entreprise : 256 9431 77

Conditions générales

Politique de confidentialité

Droit d'auteur 2026