AI for QSRs: Faster Drive-Thrus, Lower Costs, Happier Guests

AI for QSRs: Faster Drive-Thrus, Lower Costs, Happier Guests

AI

Featured List

Dec 22, 2025

Not sure where to start with AI?

Assess readiness, risk, and priorities in under an hour.

Not sure where to start with AI?

Assess readiness, risk, and priorities in under an hour.

➔ Download Our Free AI Readiness Pack

AI Boosts QSR Operations: Streamline and Save Costs

QSR margins are tight and customer patience is tighter. AI is moving from “pilot” to platform: drive-thru voice bots, predictive inventory, and labour optimisation are delivering measurable seconds saved, higher accuracy, and less waste across large brands.

What’s new (2026)

Voice AI at scale. Wendy’s “FreshAI”, built with Google Cloud, reports faster service and accuracy gains; the chain is expanding to hundreds of restaurants.

Platform shift at McDonald’s. After ending an IBM drive-thru voice test in 2024, McDonald’s is deepening a broader Google Cloud partnership to modernise restaurant tech and AI across thousands of stores.

Yum!’s in-house stack. Taco Bell, KFC and Pizza Hut are standardising on “Byte by Yum!” and partnering with Nvidia to roll out AI voice ordering and computer vision from 2025.

Independent proof points. White Castle is expanding SoundHound’s drive-thru AI to 100+ lanes; Jersey Mike’s is using AI to answer phone orders.

How AI improves QSR operations

Voice ordering (drive-thru & phone).

Handles routine orders, upsells consistently, and frees crew for speed-of-service. Major chains report seconds saved and accuracy improvements as staff focus on hand-off and quality checks.

Deploy patterns range from third-party (SoundHound, Presto) to cloud + in-house platforms (Google Cloud, Nvidia).

Predictive inventory & waste reduction.

Forecasts demand from sales history, weather, local events and time-of-day; auto-replenishes or alerts managers before stockouts; reduces over-prep and shrink.

Labour and scheduling optimisation.

Predicts staffing by hour and station; automates rota suggestions; helps managers reassign in real time as demand changes—an approach popularised by Starbucks’ Deep Brew.

Kitchen and quality control (computer vision).

Checks makeline steps, hold times, and hand-off accuracy; flags anomalies to protect order quality at peak. Yum! highlights this in its platform roadmap.

Menu and pricing intelligence.

Uses basket patterns to recommend bundles and limited-time offers, and supports dynamic messaging on digital menu boards.

Practical steps to get started (90-day playbook)

Phase 1 — Identify high-leverage use cases (Weeks 1–3)

Pick one line-of-business KPI per lane: seconds saved at drive-thru, order accuracy, waste %, or labour hours per transaction.

Document constraints: accents/noise at your sites, menu complexity, peak windows, data coverage.

Phase 2 — Foundations (Weeks 2–6)

Data plumbing: unify POS, kitchen display, inventory, and staffing data; capture audio transcripts for training (with signage/consent as appropriate).

Governance: set red-lines (no debit/credit capture via bots), retention, and human-in-the-loop escalation.

Vendor lane: shortlist by maturity and route (platform vs. point solution). White-label voice (SoundHound/Presto) vs. cloud stack (Google Cloud, Nvidia-accelerated) vs. in-house hybrid.

Phase 3 — Pilot (Weeks 6–10)

Voice AI: start at 1–3 high-volume drive-thrus or phone lines; benchmark speed-of-service, order accuracy, upsell attach rate, agent take-over rate. Use a human barista/cashier “safety net” for edge cases. Wendy’s reported ~22 seconds faster service in trials.

Inventory forecasting: run AI side-by-side with manager forecasts; adopt if it reduces waste and stockouts for at least two consecutive weeks.

Phase 4 — Rollout (Weeks 10–13)

Create a playbook for site surveys (acoustic tests), Wi-Fi/edge compute readiness, mic/speaker hardware, and staff training.

Integrate KPI dashboards into the GM’s daily routine; set weekly “exception reviews” (bot escalation, complaints, refunds) to continuously tune models.

Cost levers & ROI narrative

Labour reallocation: voice bots offload order-taking; staff move to production and hospitality during peaks. Yum! reports AI products already in 25k+ restaurants with continued expansion planned, signalling operating leverage at scale.

Fewer remakes: accuracy gains from consistent capture and CV checks reduce waste and refunds.

Waste reduction: demand-aware prep and smarter replenishment cut shrink and emergency purchases.

Pitfalls (and how to avoid them)

Noisy lanes & accents → mishears. Use dual-mic arrays, acoustic models trained on local accents, and clear fallback to a human. McDonald’s 2024 wind-down shows the importance of staged rollouts and rapid iteration.

Menu complexity. Start with simplified phrasing and canonical product names; add long-tail items later.

Change management. Train crews on “bot co-pilot” etiquette; celebrate seconds saved, not jobs threatened.

Vendor lock-in. Keep transcripts, labels and prompts portable; favour standards-based APIs.

Tools & partners to consider

Voice AI: Google Cloud-based solutions (e.g., FreshAI at Wendy’s), SoundHound (drive-thru and phone), Presto.

Inventory forecasting: built-in modules from POS vendors or a light data science layer using historical sales + weather/events.

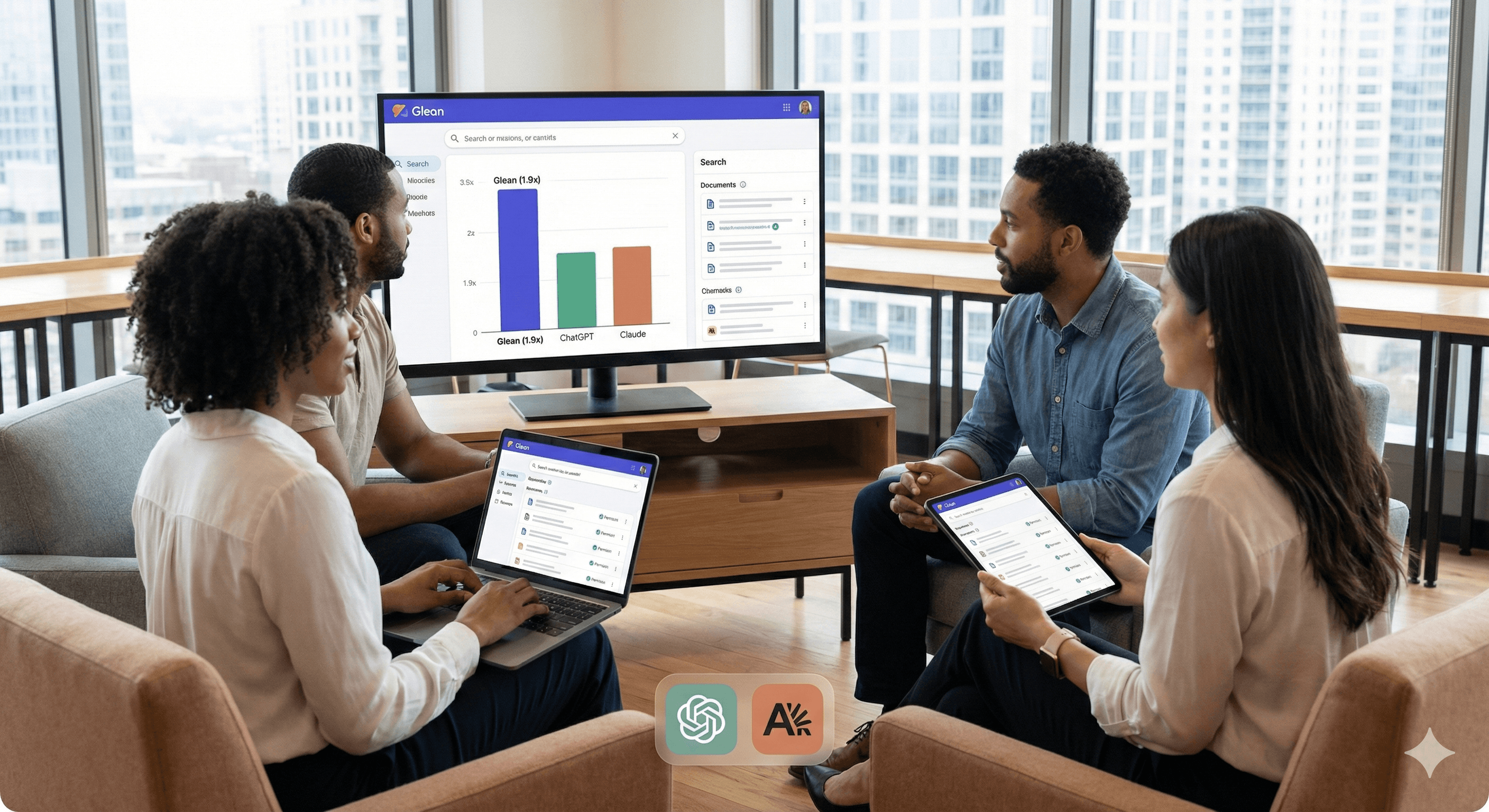

Enterprise search/knowledge: Glean for policy-aware SOPs, training, and store-level knowledge retrieval.

Next Steps?

Want a pragmatic QSR pilot—voice at one lane and predictive inventory in two stores—delivered in 90 days? Talk to Generation Digital.

FAQs

How does AI improve QSR operations?

By automating order taking, forecasting inventory, and guiding staffing, AI reduces seconds per order and errors while keeping teams focused on production and guest experience. Yahoo Finance

What are the cost benefits?

Labour is reallocated from order capture to fulfilment; fewer remakes and better prep planning reduce waste and overtime. Large groups (e.g., Yum!) are scaling platform approaches to capture these efficiencies. MarketWatch

Is voice AI ready for noisy drive-thrus?

Yes—with the right acoustic setup and human-in-the-loop. Deploy gradually, monitor hand-off rates, and tune for local accents. Learn from the mixed results of early tests before scaling. AP News

Can smaller brands adopt AI without huge teams?

Yes—phone bots and forecasting modules can start store-by-store. Chains like White Castle and Jersey Mike’s show pragmatic rollouts. SoundHound AI

AI Boosts QSR Operations: Streamline and Save Costs

QSR margins are tight and customer patience is tighter. AI is moving from “pilot” to platform: drive-thru voice bots, predictive inventory, and labour optimisation are delivering measurable seconds saved, higher accuracy, and less waste across large brands.

What’s new (2026)

Voice AI at scale. Wendy’s “FreshAI”, built with Google Cloud, reports faster service and accuracy gains; the chain is expanding to hundreds of restaurants.

Platform shift at McDonald’s. After ending an IBM drive-thru voice test in 2024, McDonald’s is deepening a broader Google Cloud partnership to modernise restaurant tech and AI across thousands of stores.

Yum!’s in-house stack. Taco Bell, KFC and Pizza Hut are standardising on “Byte by Yum!” and partnering with Nvidia to roll out AI voice ordering and computer vision from 2025.

Independent proof points. White Castle is expanding SoundHound’s drive-thru AI to 100+ lanes; Jersey Mike’s is using AI to answer phone orders.

How AI improves QSR operations

Voice ordering (drive-thru & phone).

Handles routine orders, upsells consistently, and frees crew for speed-of-service. Major chains report seconds saved and accuracy improvements as staff focus on hand-off and quality checks.

Deploy patterns range from third-party (SoundHound, Presto) to cloud + in-house platforms (Google Cloud, Nvidia).

Predictive inventory & waste reduction.

Forecasts demand from sales history, weather, local events and time-of-day; auto-replenishes or alerts managers before stockouts; reduces over-prep and shrink.

Labour and scheduling optimisation.

Predicts staffing by hour and station; automates rota suggestions; helps managers reassign in real time as demand changes—an approach popularised by Starbucks’ Deep Brew.

Kitchen and quality control (computer vision).

Checks makeline steps, hold times, and hand-off accuracy; flags anomalies to protect order quality at peak. Yum! highlights this in its platform roadmap.

Menu and pricing intelligence.

Uses basket patterns to recommend bundles and limited-time offers, and supports dynamic messaging on digital menu boards.

Practical steps to get started (90-day playbook)

Phase 1 — Identify high-leverage use cases (Weeks 1–3)

Pick one line-of-business KPI per lane: seconds saved at drive-thru, order accuracy, waste %, or labour hours per transaction.

Document constraints: accents/noise at your sites, menu complexity, peak windows, data coverage.

Phase 2 — Foundations (Weeks 2–6)

Data plumbing: unify POS, kitchen display, inventory, and staffing data; capture audio transcripts for training (with signage/consent as appropriate).

Governance: set red-lines (no debit/credit capture via bots), retention, and human-in-the-loop escalation.

Vendor lane: shortlist by maturity and route (platform vs. point solution). White-label voice (SoundHound/Presto) vs. cloud stack (Google Cloud, Nvidia-accelerated) vs. in-house hybrid.

Phase 3 — Pilot (Weeks 6–10)

Voice AI: start at 1–3 high-volume drive-thrus or phone lines; benchmark speed-of-service, order accuracy, upsell attach rate, agent take-over rate. Use a human barista/cashier “safety net” for edge cases. Wendy’s reported ~22 seconds faster service in trials.

Inventory forecasting: run AI side-by-side with manager forecasts; adopt if it reduces waste and stockouts for at least two consecutive weeks.

Phase 4 — Rollout (Weeks 10–13)

Create a playbook for site surveys (acoustic tests), Wi-Fi/edge compute readiness, mic/speaker hardware, and staff training.

Integrate KPI dashboards into the GM’s daily routine; set weekly “exception reviews” (bot escalation, complaints, refunds) to continuously tune models.

Cost levers & ROI narrative

Labour reallocation: voice bots offload order-taking; staff move to production and hospitality during peaks. Yum! reports AI products already in 25k+ restaurants with continued expansion planned, signalling operating leverage at scale.

Fewer remakes: accuracy gains from consistent capture and CV checks reduce waste and refunds.

Waste reduction: demand-aware prep and smarter replenishment cut shrink and emergency purchases.

Pitfalls (and how to avoid them)

Noisy lanes & accents → mishears. Use dual-mic arrays, acoustic models trained on local accents, and clear fallback to a human. McDonald’s 2024 wind-down shows the importance of staged rollouts and rapid iteration.

Menu complexity. Start with simplified phrasing and canonical product names; add long-tail items later.

Change management. Train crews on “bot co-pilot” etiquette; celebrate seconds saved, not jobs threatened.

Vendor lock-in. Keep transcripts, labels and prompts portable; favour standards-based APIs.

Tools & partners to consider

Voice AI: Google Cloud-based solutions (e.g., FreshAI at Wendy’s), SoundHound (drive-thru and phone), Presto.

Inventory forecasting: built-in modules from POS vendors or a light data science layer using historical sales + weather/events.

Enterprise search/knowledge: Glean for policy-aware SOPs, training, and store-level knowledge retrieval.

Next Steps?

Want a pragmatic QSR pilot—voice at one lane and predictive inventory in two stores—delivered in 90 days? Talk to Generation Digital.

FAQs

How does AI improve QSR operations?

By automating order taking, forecasting inventory, and guiding staffing, AI reduces seconds per order and errors while keeping teams focused on production and guest experience. Yahoo Finance

What are the cost benefits?

Labour is reallocated from order capture to fulfilment; fewer remakes and better prep planning reduce waste and overtime. Large groups (e.g., Yum!) are scaling platform approaches to capture these efficiencies. MarketWatch

Is voice AI ready for noisy drive-thrus?

Yes—with the right acoustic setup and human-in-the-loop. Deploy gradually, monitor hand-off rates, and tune for local accents. Learn from the mixed results of early tests before scaling. AP News

Can smaller brands adopt AI without huge teams?

Yes—phone bots and forecasting modules can start store-by-store. Chains like White Castle and Jersey Mike’s show pragmatic rollouts. SoundHound AI

Get weekly AI news and advice delivered to your inbox

By subscribing you consent to Generation Digital storing and processing your details in line with our privacy policy. You can read the full policy at gend.co/privacy.

Upcoming Workshops and Webinars

Operational Clarity at Scale - Asana

Virtual Webinar

Weds 25th February 2026

Online

Work With AI Teammates - Asana

In-Person Workshop

Thurs 26th February 2026

London, UK

From Idea to Prototype - AI in Miro

Virtual Webinar

Weds 18th February 2026

Online

Generation

Digital

UK Office

Generation Digital Ltd

33 Queen St,

London

EC4R 1AP

United Kingdom

Canada Office

Generation Digital Americas Inc

181 Bay St., Suite 1800

Toronto, ON, M5J 2T9

Canada

USA Office

Generation Digital Americas Inc

77 Sands St,

Brooklyn, NY 11201,

United States

EU Office

Generation Digital Software

Elgee Building

Dundalk

A91 X2R3

Ireland

Middle East Office

6994 Alsharq 3890,

An Narjis,

Riyadh 13343,

Saudi Arabia

Company No: 256 9431 77 | Copyright 2026 | Terms and Conditions | Privacy Policy

Generation

Digital

UK Office

Generation Digital Ltd

33 Queen St,

London

EC4R 1AP

United Kingdom

Canada Office

Generation Digital Americas Inc

181 Bay St., Suite 1800

Toronto, ON, M5J 2T9

Canada

USA Office

Generation Digital Americas Inc

77 Sands St,

Brooklyn, NY 11201,

United States

EU Office

Generation Digital Software

Elgee Building

Dundalk

A91 X2R3

Ireland

Middle East Office

6994 Alsharq 3890,

An Narjis,

Riyadh 13343,

Saudi Arabia