Build Success by Following Signals: Selin Kocalar’s Playbook

Build Success by Following Signals: Selin Kocalar’s Playbook

Notion

Dec 15, 2025

Not sure what to do next with AI?

Assess readiness, risk, and priorities in under an hour.

Not sure what to do next with AI?

Assess readiness, risk, and priorities in under an hour.

➔ Download Our Free AI Readiness Pack

Why “follow the signals” matters now

In fast-moving markets, static playbooks go stale. Selin Kocalar argues that signals—repeated customer asks, pull from specific channels, conversion spikes—should steer decisions, not legacy tactics. This mindset helped Delve evolve from early ideas into an AI-native compliance platform used by hundreds of companies.

Selin’s journey in brief

Kocalar co-founded Delve out of an MIT dorm, later raising a $32M Series A at a ~$300M valuation and serving 500+ fast-growing customers. The crucial insight: the market kept asking the same question about getting HIPAA/SOC 2 compliant—a persistent signal that justified a decisive pivot into compliance automation.

Signals vs playbooks (what’s different)

Signals: patterns in the wild—e.g., the same buyer question appearing in calls, DMs and comments; a channel that books demos disproportionately well; a segment that closes faster.

Playbooks: inherited tactics that may not fit your audience or timing. Selin’s point: use playbooks as references, but let signals override them when the data and momentum disagree.

Concrete signals Selin highlights

Customer pain repeating across channels (the HIPAA/“how did you get compliant?” thread that ultimately drove Delve’s pivot).

Scrappy, high-signal GTM (creative campaigns and quick experiments that show measurable pull, not vanity metrics).

Operational traction, not opinions (e.g., demos booked and revenue impact trumping top-of-funnel noise).

Practical steps: operationalise signals in Notion (this week)

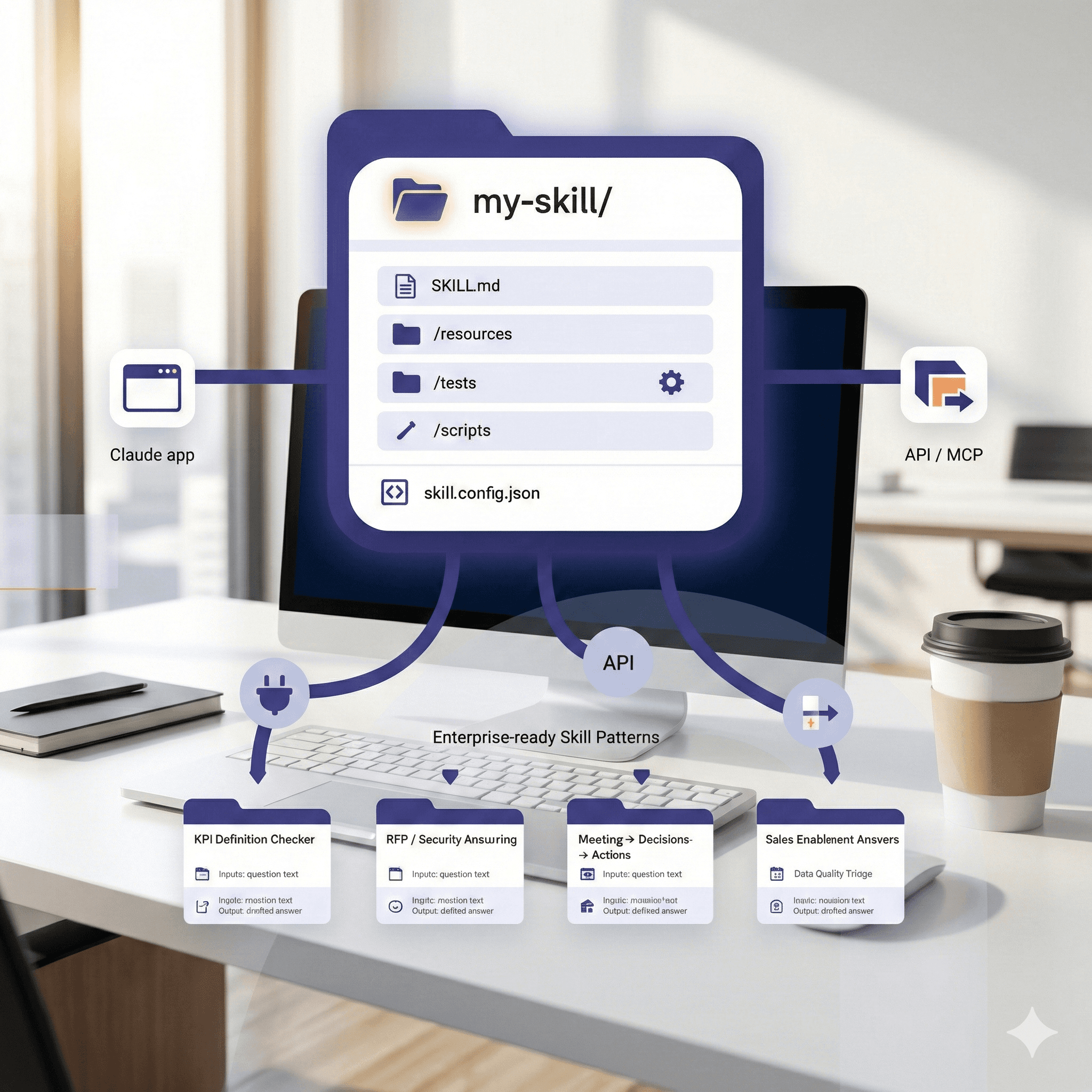

Create a “Signal Board” (Notion database) with fields for Signal type (customer ask, channel, segment), Source link, Frequency count, Severity, and Next action. Review weekly.

Stand up a GTM experiment log with hypotheses, small budgets, and success criteria tied to demos booked—Delve treats demos as the lead indicator.

Tag repeat pains across support tickets, sales notes, and social comments; promote any signal that crosses a threshold (e.g., 10+ mentions/month) to a product/GTM test.

Run a weekly “Signals Stand-up”: decide one build and one GTM test based on the strongest signal. Archive “nice ideas” unless backed by data.

Instrument the metric that matters (for many, demos booked). Pipe it into your dashboard and annotate with experiments for clear attribution.

Examples (inspired by Selin’s approach)

Pivot validation: If 60% of inbound questions ask about a compliance feature, ship a minimal workflow and measure demo lift with that keyword.

Channel pruning: If a newsletter drives 5× demo rate vs paid social (same spend), divert budget for two weeks and re-measure.

Message testing: Turn the most repeated customer phrasing into your headline; keep if demo conversion improves week-over-week.

The principle: Speed over certainty. Small, reversible bets against clear signals compound faster than months of planning against stale playbooks.

Results to aim for

Selin frames progress around booked demos, time to learning, and cost per validated signal. Delve’s case study shows how tightening instrumentation turned a two-person GTM team into a measurable growth engine—cutting manual reporting hours and clarifying what actually drives pipeline.

FAQs

What are “market signals”?

Observed patterns (e.g., repeated buyer pain, a channel that books more demos, faster close rates) that indicate where to focus next. LinkedIn

Why can playbooks be less effective?

They’re generic and often lag reality; if your signals contradict the playbook, prioritise signals. YouTube

How do we implement this approach?

Track signals in a shared system (e.g., a Notion board), run small, time-boxed experiments, and tie success to a concrete metric like demos booked. Review weekly. HockeyStack

What’s the evidence it works?

Delve attributes momentum to acting on repeated compliance pain, creative GTM experiments, and rigorous tracking—culminating in a recent $32M Series A and a large customer base. LinkedIn

Why “follow the signals” matters now

In fast-moving markets, static playbooks go stale. Selin Kocalar argues that signals—repeated customer asks, pull from specific channels, conversion spikes—should steer decisions, not legacy tactics. This mindset helped Delve evolve from early ideas into an AI-native compliance platform used by hundreds of companies.

Selin’s journey in brief

Kocalar co-founded Delve out of an MIT dorm, later raising a $32M Series A at a ~$300M valuation and serving 500+ fast-growing customers. The crucial insight: the market kept asking the same question about getting HIPAA/SOC 2 compliant—a persistent signal that justified a decisive pivot into compliance automation.

Signals vs playbooks (what’s different)

Signals: patterns in the wild—e.g., the same buyer question appearing in calls, DMs and comments; a channel that books demos disproportionately well; a segment that closes faster.

Playbooks: inherited tactics that may not fit your audience or timing. Selin’s point: use playbooks as references, but let signals override them when the data and momentum disagree.

Concrete signals Selin highlights

Customer pain repeating across channels (the HIPAA/“how did you get compliant?” thread that ultimately drove Delve’s pivot).

Scrappy, high-signal GTM (creative campaigns and quick experiments that show measurable pull, not vanity metrics).

Operational traction, not opinions (e.g., demos booked and revenue impact trumping top-of-funnel noise).

Practical steps: operationalise signals in Notion (this week)

Create a “Signal Board” (Notion database) with fields for Signal type (customer ask, channel, segment), Source link, Frequency count, Severity, and Next action. Review weekly.

Stand up a GTM experiment log with hypotheses, small budgets, and success criteria tied to demos booked—Delve treats demos as the lead indicator.

Tag repeat pains across support tickets, sales notes, and social comments; promote any signal that crosses a threshold (e.g., 10+ mentions/month) to a product/GTM test.

Run a weekly “Signals Stand-up”: decide one build and one GTM test based on the strongest signal. Archive “nice ideas” unless backed by data.

Instrument the metric that matters (for many, demos booked). Pipe it into your dashboard and annotate with experiments for clear attribution.

Examples (inspired by Selin’s approach)

Pivot validation: If 60% of inbound questions ask about a compliance feature, ship a minimal workflow and measure demo lift with that keyword.

Channel pruning: If a newsletter drives 5× demo rate vs paid social (same spend), divert budget for two weeks and re-measure.

Message testing: Turn the most repeated customer phrasing into your headline; keep if demo conversion improves week-over-week.

The principle: Speed over certainty. Small, reversible bets against clear signals compound faster than months of planning against stale playbooks.

Results to aim for

Selin frames progress around booked demos, time to learning, and cost per validated signal. Delve’s case study shows how tightening instrumentation turned a two-person GTM team into a measurable growth engine—cutting manual reporting hours and clarifying what actually drives pipeline.

FAQs

What are “market signals”?

Observed patterns (e.g., repeated buyer pain, a channel that books more demos, faster close rates) that indicate where to focus next. LinkedIn

Why can playbooks be less effective?

They’re generic and often lag reality; if your signals contradict the playbook, prioritise signals. YouTube

How do we implement this approach?

Track signals in a shared system (e.g., a Notion board), run small, time-boxed experiments, and tie success to a concrete metric like demos booked. Review weekly. HockeyStack

What’s the evidence it works?

Delve attributes momentum to acting on repeated compliance pain, creative GTM experiments, and rigorous tracking—culminating in a recent $32M Series A and a large customer base. LinkedIn

Get weekly AI news and advice delivered to your inbox

By subscribing you consent to Generation Digital storing and processing your details in line with our privacy policy. You can read the full policy at gend.co/privacy.

Generation

Digital

UK Office

Generation Digital Ltd

33 Queen St,

London

EC4R 1AP

United Kingdom

Canada Office

Generation Digital Americas Inc

181 Bay St., Suite 1800

Toronto, ON, M5J 2T9

Canada

USA Office

Generation Digital Americas Inc

77 Sands St,

Brooklyn, NY 11201,

United States

EU Office

Generation Digital Software

Elgee Building

Dundalk

A91 X2R3

Ireland

Middle East Office

6994 Alsharq 3890,

An Narjis,

Riyadh 13343,

Saudi Arabia

Company No: 256 9431 77 | Copyright 2026 | Terms and Conditions | Privacy Policy

Generation

Digital

UK Office

Generation Digital Ltd

33 Queen St,

London

EC4R 1AP

United Kingdom

Canada Office

Generation Digital Americas Inc

181 Bay St., Suite 1800

Toronto, ON, M5J 2T9

Canada

USA Office

Generation Digital Americas Inc

77 Sands St,

Brooklyn, NY 11201,

United States

EU Office

Generation Digital Software

Elgee Building

Dundalk

A91 X2R3

Ireland

Middle East Office

6994 Alsharq 3890,

An Narjis,

Riyadh 13343,

Saudi Arabia