Scale Digital Health with Public–Private Partnerships (McKinsey)

Scale Digital Health with Public–Private Partnerships (McKinsey)

Dec 17, 2025

Not sure where to start with AI?

Assess readiness, risk, and priorities in under an hour.

Not sure where to start with AI?

Assess readiness, risk, and priorities in under an hour.

➔ Download Our Free AI Readiness Pack

McKinsey’s new research outlines how public–private partnerships (PPPs) actually scale digital health: start with a clear rationale (capability, scale, or financing), choose the right private actor, and design ownership, procurement, data privacy, and sustainability up front. Lessons from Canada, Estonia, Mexico, Tanzania and Togo show what works—and why.

Key points

Capability, scale, finance: Governments most often engage private partners for unique technical capabilities (100% of cases), scale (83% in mature ecosystems) or financing (48% in constrained settings).

Proven economic upside: Digital tools can unlock up to 15% efficiency in LMIC health systems by 2030 when deployed at scale.

Real mechanisms, not slogans: Direct procurement, innovation hubs, equity stakes, and phased ownership help align incentives and sustain solutions.

Five lessons that show up again and again

Guide where to invest. Use a national digital-health roadmap and clarify ownership to reduce fragmentation (e.g., Alberta’s Connect Care with Epic).

Engage the right actor. Tanzania’s Afya-tek blended CHW tools and pharma workflows by partnering with D-tree/AHAI for expertise and funding.

Create incentives. Tax breaks, grants, and innovation hubs (e.g., Estonia’s HealthTech community; CAN Health in Canada) accelerate quality and procurement.

Build trust with guardrails. Enforce GDPR-aligned rules (Estonia PDPA) and require oversight to access sensitive datasets (e.g., FINBB biobank).

Plan for sustainability. Use non-public financing where needed, equity stakes to align incentives (Unity Health Toronto × Signal 1), and phased ownership transitions (e.g., m-mama, Togo CHIS).

McKinsey also notes: private sector spend accounts for 40–60% of health spending in many LMICs, and private investment in digital health hit $25.1bn in 2024—underscoring why PPPs matter. McKinsey & Company

Practical steps or examples (a playbook you can use)

Start with the “why.” Are you buying capability (AI triage, EHR implementation), scale (national roll-out), or financing (blended/donor capital)? Write it down; this drives model selection.

Pick the model.

Direct procurement for critical, standardised systems.

Innovation hubs and sandboxes for rapid testing.

Equity/fee models to align incentives for co-developed AI or analytics.

Decide ownership & oversight early. Separate solution ownership from IP, define joint or sole oversight, and set a transition path (private→joint→public) to build public capacity.

De-risk data from day one. Codify privacy, access, and audit; link procurement eligibility to compliance with national laws/standards.

Finance for durability. Combine budget lines with donor/private capital; use deferred payments or volume-based fees to smooth cashflow.

Measure what matters. Track adoption (patients/HCPs), cost-to-serve, wait-time reductions, and equity impacts; McKinsey’s adoption playbook shows setup → scale-up → enhance benefits phases that improve stickiness.

Live examples to make it tangible

Estonia e-Prescription: nationwide, integrated with EHR and national systems—near-universal digital prescriptions.

Unity Health Toronto × Signal 1 (Canada): hospital takes a minor equity stake; acts as a “living lab” for AI monitoring (CHARTWatch).

Mexico City COVID360: public–foundation partnership to stand up a treatment platform quickly during COVID-19.

Tanzania Afya-tek: connects community health workers, facilities, and dispensaries—procured via roadmap; built for interoperability.

McKinsey’s latest guidance shows that public–private partnerships scale digital health when governments define the “why,” pick the right private actor, hard-wire financing/ownership, enforce data guardrails, and plan for sustainability—using roadmaps, incentives, and phased ownership to reach national scale. McKinsey & Company

FAQs

What are public–private partnerships in digital health?

Structured collaborations where government and private actors (for-profit and not-for-profit) co-design, build or operate digital health solutions—often with mixed financing and shared oversight. McKinsey & Company

Why are these partnerships important now?

Because capability, scale, and financing gaps persist—especially in LMICs where private spend is 40–60% of health spending and digital investment is rising. McKinsey & Company

How do the partnerships work in practice?

Common models include direct procurement, innovation hubs, equity or fee-based structures, and phased ownership; success depends on data privacy, transparent procurement, and clear roadmaps. McKinsey & Company

What’s the potential value?

In LMICs, scaled digital tools could unlock up to 15% system-efficiency gains; WHO estimates even modest per-patient digital investment can save >2 million lives from NCDs over time. McKinsey & Company

Summary

McKinsey’s message is pragmatic: treat PPPs as design problems. Choose the model that matches your “why”, bake in governance and privacy, finance for the long haul, and set an adoption roadmap (setup → scale-up → enhance). That’s how digital health moves from pilots to population-level impact. McKinsey & Company

McKinsey’s new research outlines how public–private partnerships (PPPs) actually scale digital health: start with a clear rationale (capability, scale, or financing), choose the right private actor, and design ownership, procurement, data privacy, and sustainability up front. Lessons from Canada, Estonia, Mexico, Tanzania and Togo show what works—and why.

Key points

Capability, scale, finance: Governments most often engage private partners for unique technical capabilities (100% of cases), scale (83% in mature ecosystems) or financing (48% in constrained settings).

Proven economic upside: Digital tools can unlock up to 15% efficiency in LMIC health systems by 2030 when deployed at scale.

Real mechanisms, not slogans: Direct procurement, innovation hubs, equity stakes, and phased ownership help align incentives and sustain solutions.

Five lessons that show up again and again

Guide where to invest. Use a national digital-health roadmap and clarify ownership to reduce fragmentation (e.g., Alberta’s Connect Care with Epic).

Engage the right actor. Tanzania’s Afya-tek blended CHW tools and pharma workflows by partnering with D-tree/AHAI for expertise and funding.

Create incentives. Tax breaks, grants, and innovation hubs (e.g., Estonia’s HealthTech community; CAN Health in Canada) accelerate quality and procurement.

Build trust with guardrails. Enforce GDPR-aligned rules (Estonia PDPA) and require oversight to access sensitive datasets (e.g., FINBB biobank).

Plan for sustainability. Use non-public financing where needed, equity stakes to align incentives (Unity Health Toronto × Signal 1), and phased ownership transitions (e.g., m-mama, Togo CHIS).

McKinsey also notes: private sector spend accounts for 40–60% of health spending in many LMICs, and private investment in digital health hit $25.1bn in 2024—underscoring why PPPs matter. McKinsey & Company

Practical steps or examples (a playbook you can use)

Start with the “why.” Are you buying capability (AI triage, EHR implementation), scale (national roll-out), or financing (blended/donor capital)? Write it down; this drives model selection.

Pick the model.

Direct procurement for critical, standardised systems.

Innovation hubs and sandboxes for rapid testing.

Equity/fee models to align incentives for co-developed AI or analytics.

Decide ownership & oversight early. Separate solution ownership from IP, define joint or sole oversight, and set a transition path (private→joint→public) to build public capacity.

De-risk data from day one. Codify privacy, access, and audit; link procurement eligibility to compliance with national laws/standards.

Finance for durability. Combine budget lines with donor/private capital; use deferred payments or volume-based fees to smooth cashflow.

Measure what matters. Track adoption (patients/HCPs), cost-to-serve, wait-time reductions, and equity impacts; McKinsey’s adoption playbook shows setup → scale-up → enhance benefits phases that improve stickiness.

Live examples to make it tangible

Estonia e-Prescription: nationwide, integrated with EHR and national systems—near-universal digital prescriptions.

Unity Health Toronto × Signal 1 (Canada): hospital takes a minor equity stake; acts as a “living lab” for AI monitoring (CHARTWatch).

Mexico City COVID360: public–foundation partnership to stand up a treatment platform quickly during COVID-19.

Tanzania Afya-tek: connects community health workers, facilities, and dispensaries—procured via roadmap; built for interoperability.

McKinsey’s latest guidance shows that public–private partnerships scale digital health when governments define the “why,” pick the right private actor, hard-wire financing/ownership, enforce data guardrails, and plan for sustainability—using roadmaps, incentives, and phased ownership to reach national scale. McKinsey & Company

FAQs

What are public–private partnerships in digital health?

Structured collaborations where government and private actors (for-profit and not-for-profit) co-design, build or operate digital health solutions—often with mixed financing and shared oversight. McKinsey & Company

Why are these partnerships important now?

Because capability, scale, and financing gaps persist—especially in LMICs where private spend is 40–60% of health spending and digital investment is rising. McKinsey & Company

How do the partnerships work in practice?

Common models include direct procurement, innovation hubs, equity or fee-based structures, and phased ownership; success depends on data privacy, transparent procurement, and clear roadmaps. McKinsey & Company

What’s the potential value?

In LMICs, scaled digital tools could unlock up to 15% system-efficiency gains; WHO estimates even modest per-patient digital investment can save >2 million lives from NCDs over time. McKinsey & Company

Summary

McKinsey’s message is pragmatic: treat PPPs as design problems. Choose the model that matches your “why”, bake in governance and privacy, finance for the long haul, and set an adoption roadmap (setup → scale-up → enhance). That’s how digital health moves from pilots to population-level impact. McKinsey & Company

Get weekly AI news and advice delivered to your inbox

By subscribing you consent to Generation Digital storing and processing your details in line with our privacy policy. You can read the full policy at gend.co/privacy.

Upcoming Workshops and Webinars

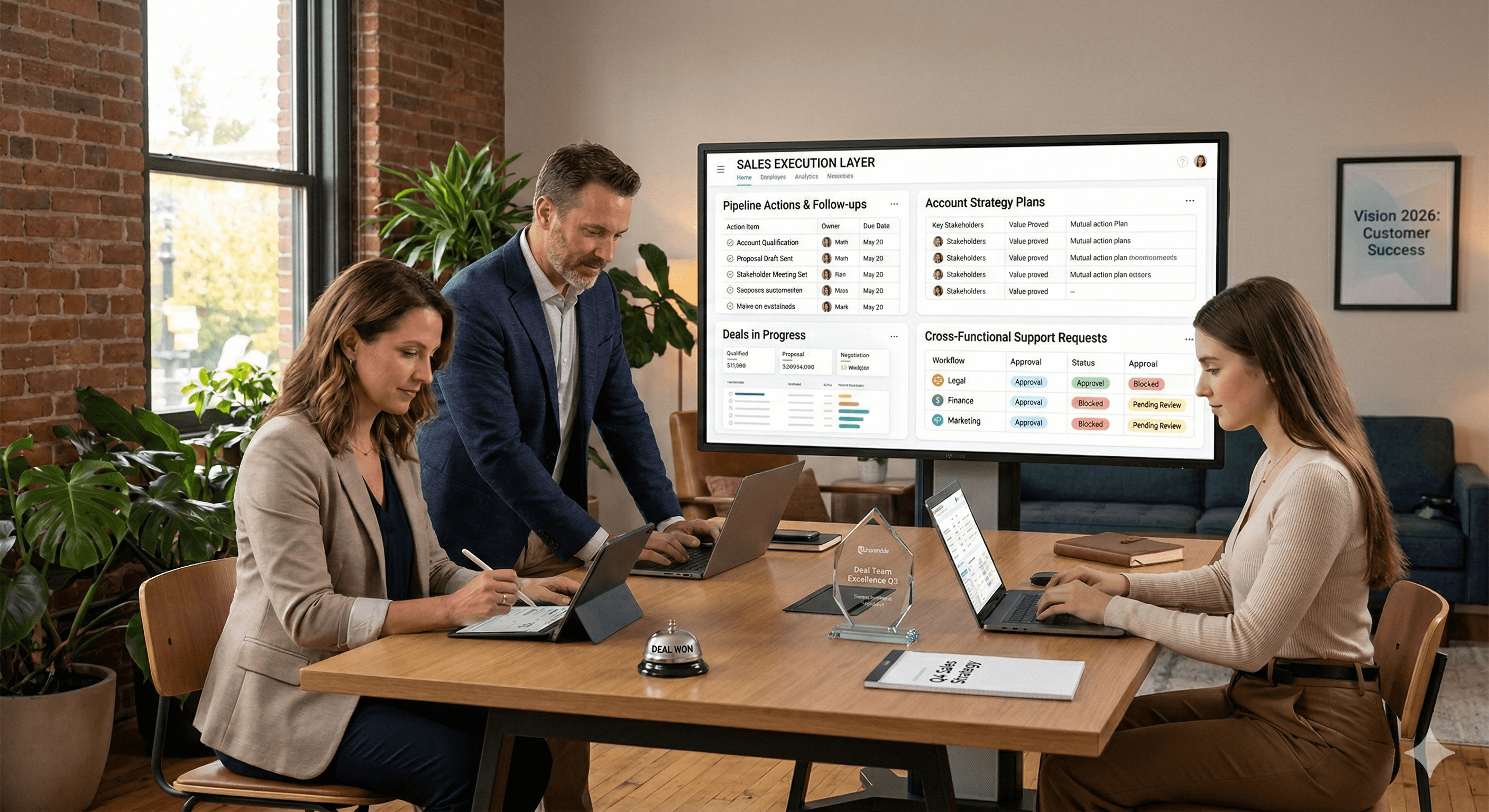

Operational Clarity at Scale - Asana

Virtual Webinar

Weds 25th February 2026

Online

Work With AI Teammates - Asana

In-Person Workshop

Thurs 26th February 2026

London, UK

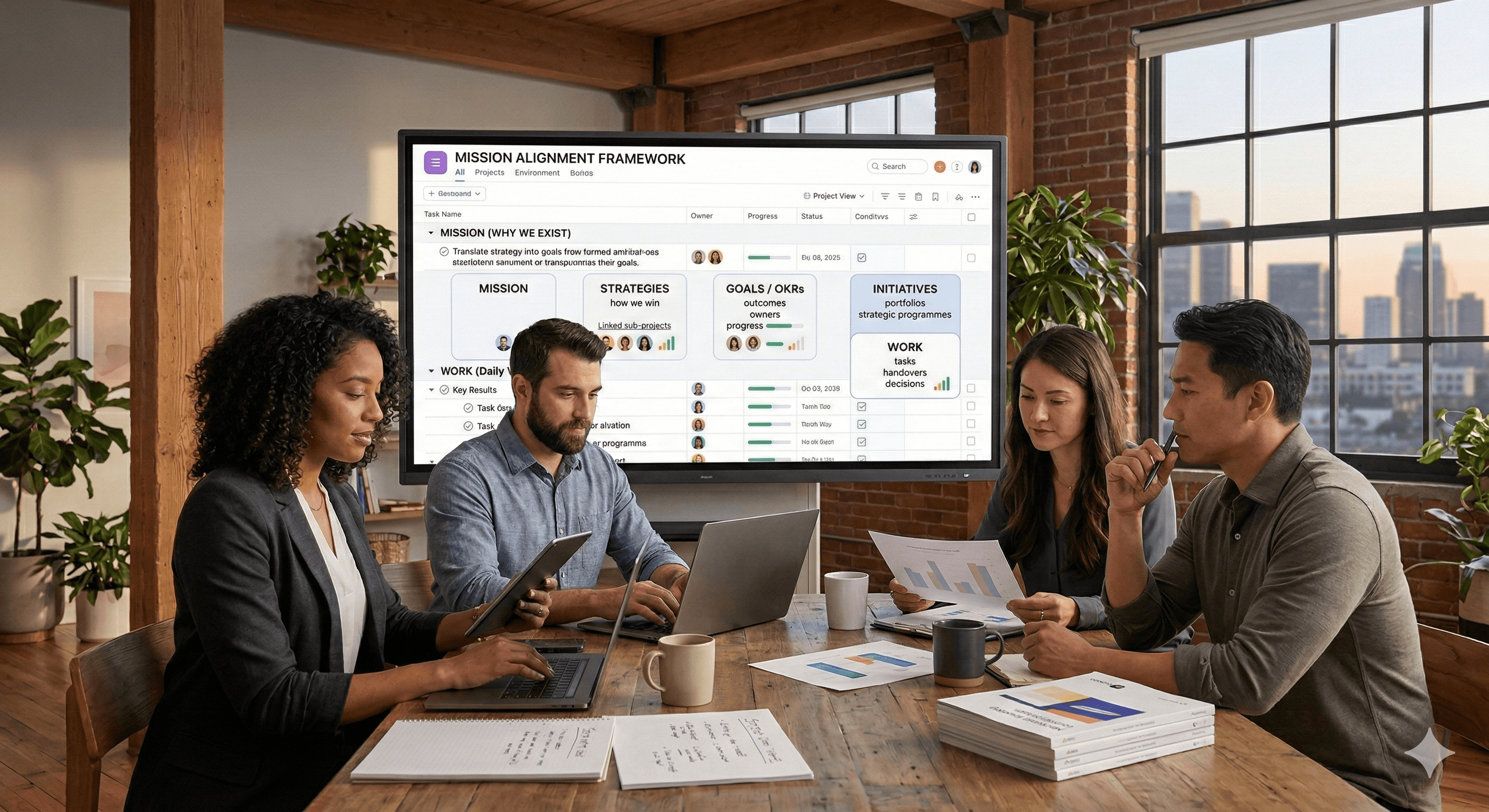

From Idea to Prototype - AI in Miro

Virtual Webinar

Weds 18th February 2026

Online

Generation

Digital

UK Office

Generation Digital Ltd

33 Queen St,

London

EC4R 1AP

United Kingdom

Canada Office

Generation Digital Americas Inc

181 Bay St., Suite 1800

Toronto, ON, M5J 2T9

Canada

USA Office

Generation Digital Americas Inc

77 Sands St,

Brooklyn, NY 11201,

United States

EU Office

Generation Digital Software

Elgee Building

Dundalk

A91 X2R3

Ireland

Middle East Office

6994 Alsharq 3890,

An Narjis,

Riyadh 13343,

Saudi Arabia

Company No: 256 9431 77 | Copyright 2026 | Terms and Conditions | Privacy Policy

Generation

Digital

UK Office

Generation Digital Ltd

33 Queen St,

London

EC4R 1AP

United Kingdom

Canada Office

Generation Digital Americas Inc

181 Bay St., Suite 1800

Toronto, ON, M5J 2T9

Canada

USA Office

Generation Digital Americas Inc

77 Sands St,

Brooklyn, NY 11201,

United States

EU Office

Generation Digital Software

Elgee Building

Dundalk

A91 X2R3

Ireland

Middle East Office

6994 Alsharq 3890,

An Narjis,

Riyadh 13343,

Saudi Arabia