BBVA and OpenAI: How ChatGPT Enterprise is Transforming Banking in Canada by 2025

BBVA and OpenAI: How ChatGPT Enterprise is Transforming Banking in Canada by 2025

OpenAI

ChatGPT

Dec 11, 2025

Not sure what to do next with AI?

Assess readiness, risk, and priorities in under an hour.

Not sure what to do next with AI?

Assess readiness, risk, and priorities in under an hour.

➔ Schedule a Consultation

BBVA and OpenAI are expanding a multi-year collaboration to implement ChatGPT Enterprise for about 120,000 employees. After an initial test phase that saved roughly three hours per week on routine tasks, BBVA is scaling AI from productivity to workflows and customer channels, including prototypes for a ChatGPT-based banking app and its “Blue” assistant.

Why it matters now: BBVA is broadening its partnership with OpenAI and deploying ChatGPT Enterprise to ~120,000 employees following a pilot that reportedly saved staff approximately three hours per week on routine tasks. This marks one of the largest enterprise AI rollouts in global banking.

What’s new

Global rollout to ~120k people. BBVA is expanding ChatGPT Enterprise across the group as part of a multi-year AI transformation. Bloomberg+1

From pilots to production. Following an initial deployment (about 11,000 users) and documented time savings, BBVA is transitioning from productivity applications to workflow automation and customer-facing channels. Bloomberg+1

Beyond the back office. BBVA has been prototyping a conversational banking app within ChatGPT and advancing Blue, its AI assistant for customers—signalling future, natively conversational banking experiences. Finextra Research+1

How it works (at a glance)

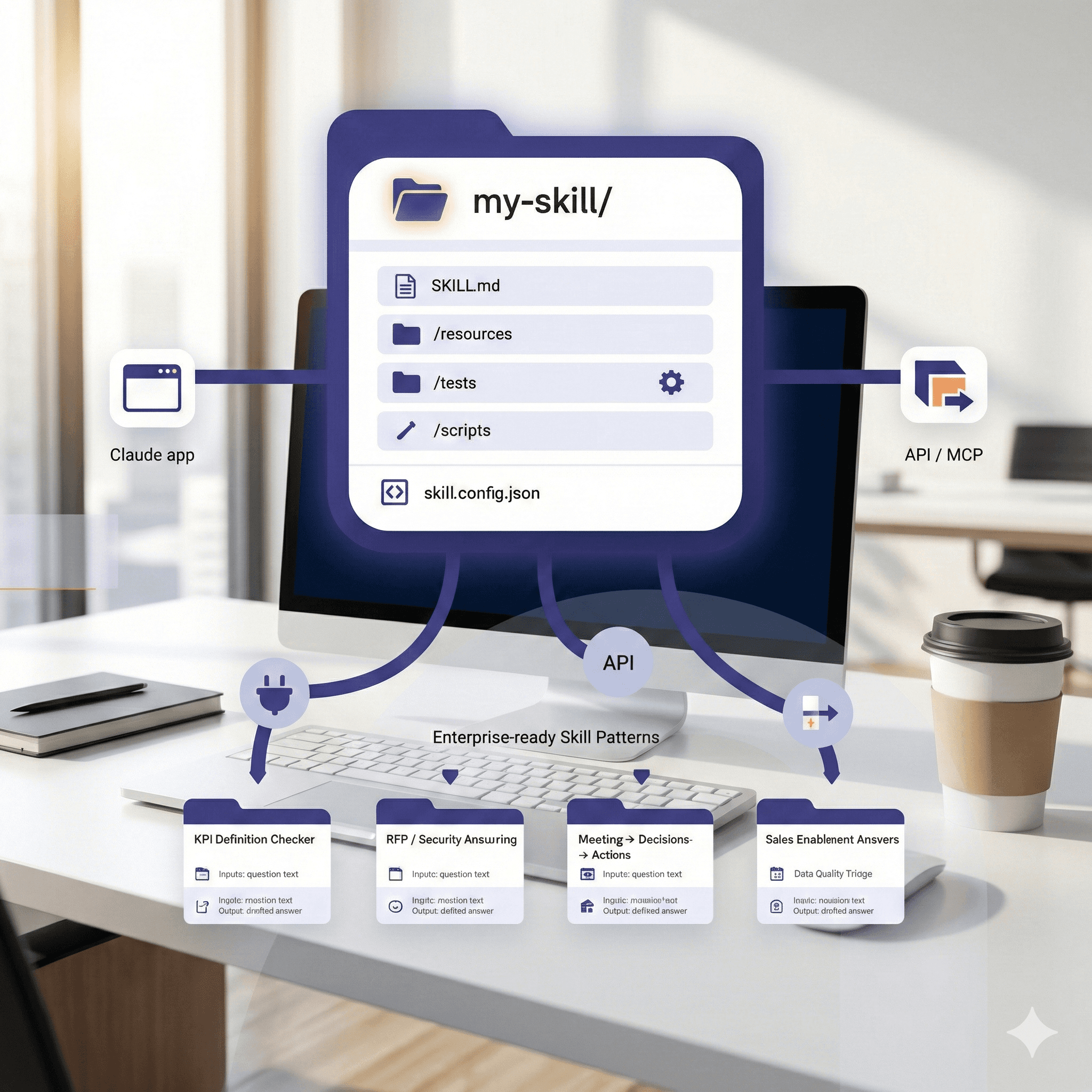

ChatGPT Enterprise provides a corporate-grade AI assistant with administrative controls, data privacy, and higher limits suitable for regulated workloads. BBVA is integrating it into daily work and selected processes (legal, operations, customer support), with OpenAI offering strategic support on scaling patterns.

Practical use cases

Front-line knowledge at speed

Drafting answers to complex policy or product inquiries; BBVA built a Retail Banking Legal Assistant to manage around 40,000 questions per year from branches.Operations & middle-office

Summarizing cases, generating initial drafts, and pulling policy excerpts, freeing people for critical decision-making. Time-savings from the pilot suggest significant weekly hours regained.Customer experience

Advancing from web/app chat to conversational journeys via Blue and potential ChatGPT-native banking experiences (discovery, FAQs, next-best action).Risk & compliance enablement

Structured prompts that reference policies, maintain audit trails, and route exceptional cases to specialists (pattern informed by OpenAI’s BBVA case notes).

Benefits BBVA is targeting

Employee empowerment at scale: secure AI access for ~120,000 people.

Efficiency & speed: early savings of ~3 hours/week observed during the pilot phase.

AI-native ways of working: transitioning from individual use to workflow and customer channels.

Innovation signals to market: prototypes like ChatGPT-native banking apps.

Guardrails: what banks must get right

Data governance & privacy: enforce bank-grade DLP, logging, and redaction; use enterprise instances and allow-listing to control integrations. (Refer to the emphasis by BBVA and OpenAI on enterprise deployment.)

Prompt & model risk management: establish approved prompts, review outputs, and incorporate escalation patterns; treat prompts like code.

Compliance & auditability: ensure model use is documented and explainable; align with regional regulations.

Change management: training, prompt playbooks, and measurable adoption are crucial to achieving BBVA-like scale.

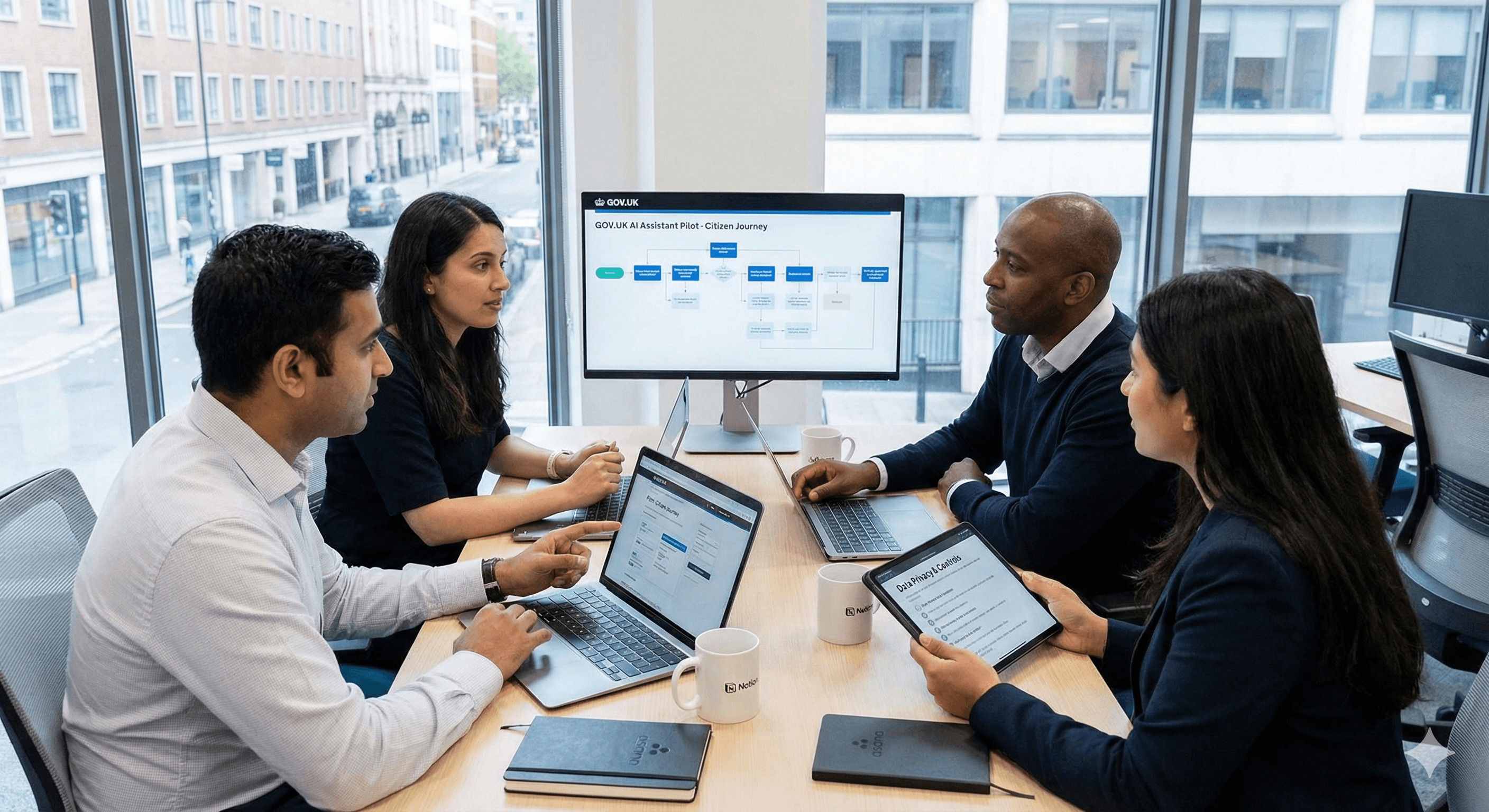

What this means for Canadian & North American banks

BBVA’s initiative indicates that scaling is feasible now—with privacy-preserving enterprise AI delivering tangible ROI signals. If you operate in a regulated market, the strategy is clear: begin with knowledge workflows, measure time saved, then expand to controlled customer-facing journeys.

FAQs

Q1: How many BBVA employees will get ChatGPT Enterprise?

Around 120,000, as BBVA expands its OpenAI partnership across the group. Bloomberg

Q2: What results did BBVA see in pilots?

A reported ~3 hours/week saved on routine tasks for early users, which supported the broader rollout. Bloomberg

Q3: Will AI reach customer channels?

Yes—BBVA is advancing Blue (its AI assistant) and has showcased a ChatGPT-native conversational banking app concept. Cinco Días+1

Q4: Is this secure for a bank?

BBVA utilizes ChatGPT Enterprise with enterprise controls and is embedding AI within a structured, scalable governance framework. OpenAI

BBVA and OpenAI are expanding a multi-year collaboration to implement ChatGPT Enterprise for about 120,000 employees. After an initial test phase that saved roughly three hours per week on routine tasks, BBVA is scaling AI from productivity to workflows and customer channels, including prototypes for a ChatGPT-based banking app and its “Blue” assistant.

Why it matters now: BBVA is broadening its partnership with OpenAI and deploying ChatGPT Enterprise to ~120,000 employees following a pilot that reportedly saved staff approximately three hours per week on routine tasks. This marks one of the largest enterprise AI rollouts in global banking.

What’s new

Global rollout to ~120k people. BBVA is expanding ChatGPT Enterprise across the group as part of a multi-year AI transformation. Bloomberg+1

From pilots to production. Following an initial deployment (about 11,000 users) and documented time savings, BBVA is transitioning from productivity applications to workflow automation and customer-facing channels. Bloomberg+1

Beyond the back office. BBVA has been prototyping a conversational banking app within ChatGPT and advancing Blue, its AI assistant for customers—signalling future, natively conversational banking experiences. Finextra Research+1

How it works (at a glance)

ChatGPT Enterprise provides a corporate-grade AI assistant with administrative controls, data privacy, and higher limits suitable for regulated workloads. BBVA is integrating it into daily work and selected processes (legal, operations, customer support), with OpenAI offering strategic support on scaling patterns.

Practical use cases

Front-line knowledge at speed

Drafting answers to complex policy or product inquiries; BBVA built a Retail Banking Legal Assistant to manage around 40,000 questions per year from branches.Operations & middle-office

Summarizing cases, generating initial drafts, and pulling policy excerpts, freeing people for critical decision-making. Time-savings from the pilot suggest significant weekly hours regained.Customer experience

Advancing from web/app chat to conversational journeys via Blue and potential ChatGPT-native banking experiences (discovery, FAQs, next-best action).Risk & compliance enablement

Structured prompts that reference policies, maintain audit trails, and route exceptional cases to specialists (pattern informed by OpenAI’s BBVA case notes).

Benefits BBVA is targeting

Employee empowerment at scale: secure AI access for ~120,000 people.

Efficiency & speed: early savings of ~3 hours/week observed during the pilot phase.

AI-native ways of working: transitioning from individual use to workflow and customer channels.

Innovation signals to market: prototypes like ChatGPT-native banking apps.

Guardrails: what banks must get right

Data governance & privacy: enforce bank-grade DLP, logging, and redaction; use enterprise instances and allow-listing to control integrations. (Refer to the emphasis by BBVA and OpenAI on enterprise deployment.)

Prompt & model risk management: establish approved prompts, review outputs, and incorporate escalation patterns; treat prompts like code.

Compliance & auditability: ensure model use is documented and explainable; align with regional regulations.

Change management: training, prompt playbooks, and measurable adoption are crucial to achieving BBVA-like scale.

What this means for Canadian & North American banks

BBVA’s initiative indicates that scaling is feasible now—with privacy-preserving enterprise AI delivering tangible ROI signals. If you operate in a regulated market, the strategy is clear: begin with knowledge workflows, measure time saved, then expand to controlled customer-facing journeys.

FAQs

Q1: How many BBVA employees will get ChatGPT Enterprise?

Around 120,000, as BBVA expands its OpenAI partnership across the group. Bloomberg

Q2: What results did BBVA see in pilots?

A reported ~3 hours/week saved on routine tasks for early users, which supported the broader rollout. Bloomberg

Q3: Will AI reach customer channels?

Yes—BBVA is advancing Blue (its AI assistant) and has showcased a ChatGPT-native conversational banking app concept. Cinco Días+1

Q4: Is this secure for a bank?

BBVA utilizes ChatGPT Enterprise with enterprise controls and is embedding AI within a structured, scalable governance framework. OpenAI

Receive practical advice directly in your inbox

By subscribing, you agree to allow Generation Digital to store and process your information according to our privacy policy. You can review the full policy at gend.co/privacy.

Generation

Digital

Business Number: 256 9431 77 | Copyright 2026 | Terms and Conditions | Privacy Policy

Generation

Digital